User login

CMS alerts physicians of payment reductions for PQRS noncompliance

Doctors who did not adequately meet Physician Quality Reporting System (PQRS) requirements in 2016 will soon be receiving notification letters alerting them that their Medicare Part B physician fee schedule payments will be reduced by 2%.

Officials from the Centers for Medicare & Medicaid Services said in a statement that “the majority” of eligible professionals “successfully reported to PQRS and avoided the downward payment adjustment,” but did not state how many doctors are expected to receive letters.

The CMS noted that there are no hardship exemptions to avoid the payment reduction for 2018.

Doctors who did not adequately meet Physician Quality Reporting System (PQRS) requirements in 2016 will soon be receiving notification letters alerting them that their Medicare Part B physician fee schedule payments will be reduced by 2%.

Officials from the Centers for Medicare & Medicaid Services said in a statement that “the majority” of eligible professionals “successfully reported to PQRS and avoided the downward payment adjustment,” but did not state how many doctors are expected to receive letters.

The CMS noted that there are no hardship exemptions to avoid the payment reduction for 2018.

Doctors who did not adequately meet Physician Quality Reporting System (PQRS) requirements in 2016 will soon be receiving notification letters alerting them that their Medicare Part B physician fee schedule payments will be reduced by 2%.

Officials from the Centers for Medicare & Medicaid Services said in a statement that “the majority” of eligible professionals “successfully reported to PQRS and avoided the downward payment adjustment,” but did not state how many doctors are expected to receive letters.

The CMS noted that there are no hardship exemptions to avoid the payment reduction for 2018.

Doctors testify on health insurance stabilization

WASHINGTON – Physicians testifying before the Senate Health, Education, Labor & Pensions Committee offered recommendations that are generally in line with the narrow, focused legislation to stabilize the individual health insurance markets that Chairman Lamar Alexander (R-Tenn.) is hoping to introduce early in the week of Sept. 17.

Two key provisions of Chairman Alexander’s plan are extending the cost-sharing reduction (CSR) payments to insurers through the end of 2018 and providing additional flexibility to the process that allows states to come up with alternatives to the Affordable Care Act mandates.

Manny Sethi, MD, president of Healthy Tennessee, said he favored repealing and replacing the ACA but offered suggestions to fit the current legislative landscape.

“We must take three steps immediately,” Dr. Sethi, an orthopedic trauma surgeon, testified. “First, in order to stabilize the insurance markets, we must continue the cost-sharing reduction program. Premiums are rapidly rising as insurers fear they will be left bearing the cost. These soaring costs are forcing young members out, saturating the market with higher-need and higher-cost patients and further escalating prices in a troublesome cycle.

“Second, we must quickly create risk pools for those individuals with serious chronic conditions, allowing more affordable coverage options for young, healthy citizens,” Dr. Sethi continued. “Third, I believe a one-size-fits-all plan from Washington, D.C., doesn’t meet the needs of Tennesseans. Open the door for innovation, and allow more flexibility for states to create their own insurance products. For example, a catastrophic plan should be available regardless of age or income status, which is currently not the case.”

Opening the catastrophic plans to all would help bring people into the individual market, even if they don’t have access to any government subsidies, he said.

“Meeting with patients ... I do believe that creating a catastrophic plan open to all ages, all incomes, I think would bring younger folks, and people in general, into the insurance market because I think that’s the problem,” Dr. Sethi said. “You don’t want to pay more for your insurance than you do for your home mortgage. When you do that, something’s wrong.”

Susan Turney, MD, CEO of Marshfield (Wisc.) Clinic Health System, offered similar suggestions. She called for fully funding CSR payments for 2018 and beyond and also recommended creating a reinsurance program, establishing continuous coverage rules that encourage people to get and maintain coverage, enhancing risk adjustment for payments to carriers, and reinstating federal funding for outreach that was recently cut by the Trump administration.

But she also stressed a longer-term goal of how care is delivered, especially in rural areas.

“As we look at this short-term fix to a relatively small group of insured, we have to start thinking differently about how we provide care. The care delivery model needs to be above the payment system, and, once we figure out how to take care of our communities, we can then look differently at the way we support the practices who provide those services,” Dr. Turney said. “Most people don’t ask to get sick. We need to take care of them, and we need to figure out the best way to do that.”

Physicians’ organizations including the American Academy of Family Physicians, American Academy of Pediatrics, American College of Physicians, American Congress of Obstetricians and Gynecologists, American Osteopathic Association, and American Psychiatric Association, submitted a joint statement to the committee that advocated ensuring CSR funding through at least 2019, continuing reinsurance programs, continuing community outreach programs, and expanding public choice through a public option in all exchanges markets.

Chairman Alexander stressed that, in order for this narrowly focused bill to have a chance at passing, it will require a little compromise from both sides of the aisle.

“To get a result, Republicans will have to agree to something – additional funding through the Affordable Care Act – that some are reluctant to support,” he said. “And Democrats will have to agree to something – more flexibility for states – that some may be reluctant to support. I simply won’t be able to persuade the Republican majority in the Senate, the Republican majority in the House, and the Republican president to extend the cost-sharing payments without giving states meaningful flexibility.”

He stressed that the flexibility he is looking for in the 1332 waiver program will not alter consumer protections that are in place, including the ban on charging more for preexisting conditions, guaranteed issue, no annual or lifetime caps on benefits, and allowing those under 26 years of age to remain on their parent’s policy.

“Our goal is to see if we can come to a consensus by early next week so we can hand [Senate Majority Leader Mitch] McConnell and [Senate Minority Leader Chuck] Schumer an agreement that Congress can pass by the end of the month that would help limit premium increases for 18 million Americans next year and begin to lower premiums after that, and to prevent insurers from leaving the markets where those 18 million Americans buy insurance.”

WASHINGTON – Physicians testifying before the Senate Health, Education, Labor & Pensions Committee offered recommendations that are generally in line with the narrow, focused legislation to stabilize the individual health insurance markets that Chairman Lamar Alexander (R-Tenn.) is hoping to introduce early in the week of Sept. 17.

Two key provisions of Chairman Alexander’s plan are extending the cost-sharing reduction (CSR) payments to insurers through the end of 2018 and providing additional flexibility to the process that allows states to come up with alternatives to the Affordable Care Act mandates.

Manny Sethi, MD, president of Healthy Tennessee, said he favored repealing and replacing the ACA but offered suggestions to fit the current legislative landscape.

“We must take three steps immediately,” Dr. Sethi, an orthopedic trauma surgeon, testified. “First, in order to stabilize the insurance markets, we must continue the cost-sharing reduction program. Premiums are rapidly rising as insurers fear they will be left bearing the cost. These soaring costs are forcing young members out, saturating the market with higher-need and higher-cost patients and further escalating prices in a troublesome cycle.

“Second, we must quickly create risk pools for those individuals with serious chronic conditions, allowing more affordable coverage options for young, healthy citizens,” Dr. Sethi continued. “Third, I believe a one-size-fits-all plan from Washington, D.C., doesn’t meet the needs of Tennesseans. Open the door for innovation, and allow more flexibility for states to create their own insurance products. For example, a catastrophic plan should be available regardless of age or income status, which is currently not the case.”

Opening the catastrophic plans to all would help bring people into the individual market, even if they don’t have access to any government subsidies, he said.

“Meeting with patients ... I do believe that creating a catastrophic plan open to all ages, all incomes, I think would bring younger folks, and people in general, into the insurance market because I think that’s the problem,” Dr. Sethi said. “You don’t want to pay more for your insurance than you do for your home mortgage. When you do that, something’s wrong.”

Susan Turney, MD, CEO of Marshfield (Wisc.) Clinic Health System, offered similar suggestions. She called for fully funding CSR payments for 2018 and beyond and also recommended creating a reinsurance program, establishing continuous coverage rules that encourage people to get and maintain coverage, enhancing risk adjustment for payments to carriers, and reinstating federal funding for outreach that was recently cut by the Trump administration.

But she also stressed a longer-term goal of how care is delivered, especially in rural areas.

“As we look at this short-term fix to a relatively small group of insured, we have to start thinking differently about how we provide care. The care delivery model needs to be above the payment system, and, once we figure out how to take care of our communities, we can then look differently at the way we support the practices who provide those services,” Dr. Turney said. “Most people don’t ask to get sick. We need to take care of them, and we need to figure out the best way to do that.”

Physicians’ organizations including the American Academy of Family Physicians, American Academy of Pediatrics, American College of Physicians, American Congress of Obstetricians and Gynecologists, American Osteopathic Association, and American Psychiatric Association, submitted a joint statement to the committee that advocated ensuring CSR funding through at least 2019, continuing reinsurance programs, continuing community outreach programs, and expanding public choice through a public option in all exchanges markets.

Chairman Alexander stressed that, in order for this narrowly focused bill to have a chance at passing, it will require a little compromise from both sides of the aisle.

“To get a result, Republicans will have to agree to something – additional funding through the Affordable Care Act – that some are reluctant to support,” he said. “And Democrats will have to agree to something – more flexibility for states – that some may be reluctant to support. I simply won’t be able to persuade the Republican majority in the Senate, the Republican majority in the House, and the Republican president to extend the cost-sharing payments without giving states meaningful flexibility.”

He stressed that the flexibility he is looking for in the 1332 waiver program will not alter consumer protections that are in place, including the ban on charging more for preexisting conditions, guaranteed issue, no annual or lifetime caps on benefits, and allowing those under 26 years of age to remain on their parent’s policy.

“Our goal is to see if we can come to a consensus by early next week so we can hand [Senate Majority Leader Mitch] McConnell and [Senate Minority Leader Chuck] Schumer an agreement that Congress can pass by the end of the month that would help limit premium increases for 18 million Americans next year and begin to lower premiums after that, and to prevent insurers from leaving the markets where those 18 million Americans buy insurance.”

WASHINGTON – Physicians testifying before the Senate Health, Education, Labor & Pensions Committee offered recommendations that are generally in line with the narrow, focused legislation to stabilize the individual health insurance markets that Chairman Lamar Alexander (R-Tenn.) is hoping to introduce early in the week of Sept. 17.

Two key provisions of Chairman Alexander’s plan are extending the cost-sharing reduction (CSR) payments to insurers through the end of 2018 and providing additional flexibility to the process that allows states to come up with alternatives to the Affordable Care Act mandates.

Manny Sethi, MD, president of Healthy Tennessee, said he favored repealing and replacing the ACA but offered suggestions to fit the current legislative landscape.

“We must take three steps immediately,” Dr. Sethi, an orthopedic trauma surgeon, testified. “First, in order to stabilize the insurance markets, we must continue the cost-sharing reduction program. Premiums are rapidly rising as insurers fear they will be left bearing the cost. These soaring costs are forcing young members out, saturating the market with higher-need and higher-cost patients and further escalating prices in a troublesome cycle.

“Second, we must quickly create risk pools for those individuals with serious chronic conditions, allowing more affordable coverage options for young, healthy citizens,” Dr. Sethi continued. “Third, I believe a one-size-fits-all plan from Washington, D.C., doesn’t meet the needs of Tennesseans. Open the door for innovation, and allow more flexibility for states to create their own insurance products. For example, a catastrophic plan should be available regardless of age or income status, which is currently not the case.”

Opening the catastrophic plans to all would help bring people into the individual market, even if they don’t have access to any government subsidies, he said.

“Meeting with patients ... I do believe that creating a catastrophic plan open to all ages, all incomes, I think would bring younger folks, and people in general, into the insurance market because I think that’s the problem,” Dr. Sethi said. “You don’t want to pay more for your insurance than you do for your home mortgage. When you do that, something’s wrong.”

Susan Turney, MD, CEO of Marshfield (Wisc.) Clinic Health System, offered similar suggestions. She called for fully funding CSR payments for 2018 and beyond and also recommended creating a reinsurance program, establishing continuous coverage rules that encourage people to get and maintain coverage, enhancing risk adjustment for payments to carriers, and reinstating federal funding for outreach that was recently cut by the Trump administration.

But she also stressed a longer-term goal of how care is delivered, especially in rural areas.

“As we look at this short-term fix to a relatively small group of insured, we have to start thinking differently about how we provide care. The care delivery model needs to be above the payment system, and, once we figure out how to take care of our communities, we can then look differently at the way we support the practices who provide those services,” Dr. Turney said. “Most people don’t ask to get sick. We need to take care of them, and we need to figure out the best way to do that.”

Physicians’ organizations including the American Academy of Family Physicians, American Academy of Pediatrics, American College of Physicians, American Congress of Obstetricians and Gynecologists, American Osteopathic Association, and American Psychiatric Association, submitted a joint statement to the committee that advocated ensuring CSR funding through at least 2019, continuing reinsurance programs, continuing community outreach programs, and expanding public choice through a public option in all exchanges markets.

Chairman Alexander stressed that, in order for this narrowly focused bill to have a chance at passing, it will require a little compromise from both sides of the aisle.

“To get a result, Republicans will have to agree to something – additional funding through the Affordable Care Act – that some are reluctant to support,” he said. “And Democrats will have to agree to something – more flexibility for states – that some may be reluctant to support. I simply won’t be able to persuade the Republican majority in the Senate, the Republican majority in the House, and the Republican president to extend the cost-sharing payments without giving states meaningful flexibility.”

He stressed that the flexibility he is looking for in the 1332 waiver program will not alter consumer protections that are in place, including the ban on charging more for preexisting conditions, guaranteed issue, no annual or lifetime caps on benefits, and allowing those under 26 years of age to remain on their parent’s policy.

“Our goal is to see if we can come to a consensus by early next week so we can hand [Senate Majority Leader Mitch] McConnell and [Senate Minority Leader Chuck] Schumer an agreement that Congress can pass by the end of the month that would help limit premium increases for 18 million Americans next year and begin to lower premiums after that, and to prevent insurers from leaving the markets where those 18 million Americans buy insurance.”

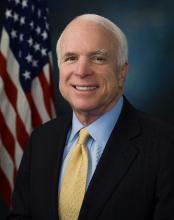

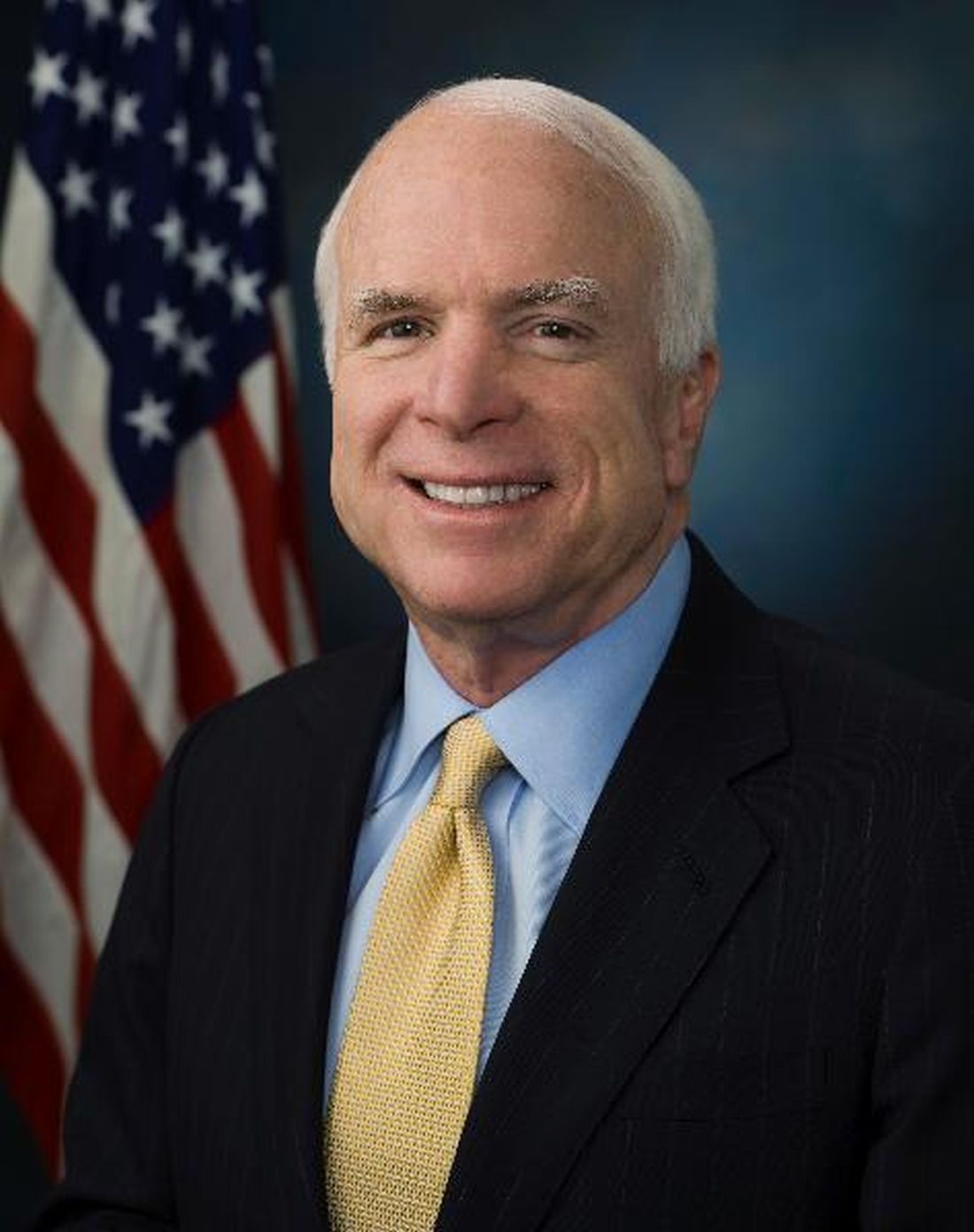

AT A SENATE HELP COMMITTEE HEARING

Sen. Alexander seeks quick, passable steps to stabilize individual markets

WASHINGTON – Sen. Lamar Alexander (R-Tenn.) wants two quick fixes to stabilize the individual health insurance market so that Congress can come together to craft a long-term solution.

There seems to be “general consensus that we should see what can we do, No. 1, on the cost-sharing payments and, No. 2, on amending 1332 [waiver program] to provide flexibility to the states,” Sen. Alexander*, chairman of the Senate Health, Education, Labor, and Pensions Committee said Sept. 6 after the first of four hearings the committee is holding on creating stability for the individual health insurance market.

Chairman Alexander said that he hopes to have a small, passable legislative proposal ready by Sept. 14, in time to allow insurers to make last-minute adjustments to their individual market bids, which are due to state insurance commissioners by Sept. 20.

Sen. Patty Murray (D-Wash.), the committee’s ranking member, stressed the urgent need to pass a quick fix, noting that insurance premiums could rise as much as 20% higher than they would have, if there is no guarantee on the cost-sharing reduction (CSR) payments.

A panel of state insurance commissioners all agreed with the two proposals, though there were suggestions that the CSR payments should be guaranteed for at least a year, if not longer, beyond 2018, which was when Chairman Alexander suggested the guarantee should sunset.

“The CSR funding issue is the single most critical issue you can address to help stabilize insurance markets in 2018,” Julie Mix McPeak, commissioner of the Tennessee Department of Commerce and Insurance, testified at the hearing. She emphasized that it is not an insurance bailout. “CSR funding ensures that some of our most vulnerable consumers receive assistance for copays and deductibles that are required to be paid under federal law and has the effect of reducing proposed premium increases and has a direct impact on the amount of subsidy assistance provided by the federal government.”

“You must permanently fund the cost-sharing reduction payments,” Mike Kreidler, insurance commissioner for the state of Washington, testified during the hearing. “That is something that is going help a great deal in our marketplace.”

The commissioners also advocated for a reinsurance program.

Ms. McPeak called for Congress to “establish a reinsurance mechanism that would stop losses for individual claims at a specified amount to increase market participation by carriers. For the most immediate impact, this backstop mechanism must be federal, as it would be impossible for many states to develop such a program for the 2018 plan year.”

“I urge you to create a federal reinsurance program this year,” Mr. Kreidler said. “Doing this would show your commitment to stabilizing the market. They worked very well in the state of Washington for the first 3 years we had a reinsurance program. We would like to see it continue and go forward.”

In talking about fixing 1332 waivers, which allow states to develop a specific proposal that works within the parameters of the Affordable Care Act but offers flexibility to create programs that are unique to a state’s needs, Lori Wing-Heier, director of the Alaska Division of Insurance talked about her state’s successful efforts to get a wavier for its reinsurance program.

“The waiver process is somewhat onerous in the fact that there is not a defined application to submit,” Ms. Wing-Heier said, leaving it up to states to make sure they are providing all the requested information. “After that, the part that is stifling states right now is the 6-month waiting period before they receive final approval.”

Other issues were raised by both panelists and senators, including the cost of delivering health care, the cost of prescription drugs, and cuts to marketing budgets, but Chairman Alexander said that he did not want to expand a proposal beyond his two points.

“My whole focus right now is: What can we do to take a couple of steps to stabilize the individual market?” he said, although he suggested that if there were clear consensus on other aspects, they could be considered.

The archived hearing can be viewed on the committee’s website.

gtwachtman@frontlinemedcom.com

CORRECTION, 9/8/17: An earlier version of this story misidentified the HELP Committee chairman.

WASHINGTON – Sen. Lamar Alexander (R-Tenn.) wants two quick fixes to stabilize the individual health insurance market so that Congress can come together to craft a long-term solution.

There seems to be “general consensus that we should see what can we do, No. 1, on the cost-sharing payments and, No. 2, on amending 1332 [waiver program] to provide flexibility to the states,” Sen. Alexander*, chairman of the Senate Health, Education, Labor, and Pensions Committee said Sept. 6 after the first of four hearings the committee is holding on creating stability for the individual health insurance market.

Chairman Alexander said that he hopes to have a small, passable legislative proposal ready by Sept. 14, in time to allow insurers to make last-minute adjustments to their individual market bids, which are due to state insurance commissioners by Sept. 20.

Sen. Patty Murray (D-Wash.), the committee’s ranking member, stressed the urgent need to pass a quick fix, noting that insurance premiums could rise as much as 20% higher than they would have, if there is no guarantee on the cost-sharing reduction (CSR) payments.

A panel of state insurance commissioners all agreed with the two proposals, though there were suggestions that the CSR payments should be guaranteed for at least a year, if not longer, beyond 2018, which was when Chairman Alexander suggested the guarantee should sunset.

“The CSR funding issue is the single most critical issue you can address to help stabilize insurance markets in 2018,” Julie Mix McPeak, commissioner of the Tennessee Department of Commerce and Insurance, testified at the hearing. She emphasized that it is not an insurance bailout. “CSR funding ensures that some of our most vulnerable consumers receive assistance for copays and deductibles that are required to be paid under federal law and has the effect of reducing proposed premium increases and has a direct impact on the amount of subsidy assistance provided by the federal government.”

“You must permanently fund the cost-sharing reduction payments,” Mike Kreidler, insurance commissioner for the state of Washington, testified during the hearing. “That is something that is going help a great deal in our marketplace.”

The commissioners also advocated for a reinsurance program.

Ms. McPeak called for Congress to “establish a reinsurance mechanism that would stop losses for individual claims at a specified amount to increase market participation by carriers. For the most immediate impact, this backstop mechanism must be federal, as it would be impossible for many states to develop such a program for the 2018 plan year.”

“I urge you to create a federal reinsurance program this year,” Mr. Kreidler said. “Doing this would show your commitment to stabilizing the market. They worked very well in the state of Washington for the first 3 years we had a reinsurance program. We would like to see it continue and go forward.”

In talking about fixing 1332 waivers, which allow states to develop a specific proposal that works within the parameters of the Affordable Care Act but offers flexibility to create programs that are unique to a state’s needs, Lori Wing-Heier, director of the Alaska Division of Insurance talked about her state’s successful efforts to get a wavier for its reinsurance program.

“The waiver process is somewhat onerous in the fact that there is not a defined application to submit,” Ms. Wing-Heier said, leaving it up to states to make sure they are providing all the requested information. “After that, the part that is stifling states right now is the 6-month waiting period before they receive final approval.”

Other issues were raised by both panelists and senators, including the cost of delivering health care, the cost of prescription drugs, and cuts to marketing budgets, but Chairman Alexander said that he did not want to expand a proposal beyond his two points.

“My whole focus right now is: What can we do to take a couple of steps to stabilize the individual market?” he said, although he suggested that if there were clear consensus on other aspects, they could be considered.

The archived hearing can be viewed on the committee’s website.

gtwachtman@frontlinemedcom.com

CORRECTION, 9/8/17: An earlier version of this story misidentified the HELP Committee chairman.

WASHINGTON – Sen. Lamar Alexander (R-Tenn.) wants two quick fixes to stabilize the individual health insurance market so that Congress can come together to craft a long-term solution.

There seems to be “general consensus that we should see what can we do, No. 1, on the cost-sharing payments and, No. 2, on amending 1332 [waiver program] to provide flexibility to the states,” Sen. Alexander*, chairman of the Senate Health, Education, Labor, and Pensions Committee said Sept. 6 after the first of four hearings the committee is holding on creating stability for the individual health insurance market.

Chairman Alexander said that he hopes to have a small, passable legislative proposal ready by Sept. 14, in time to allow insurers to make last-minute adjustments to their individual market bids, which are due to state insurance commissioners by Sept. 20.

Sen. Patty Murray (D-Wash.), the committee’s ranking member, stressed the urgent need to pass a quick fix, noting that insurance premiums could rise as much as 20% higher than they would have, if there is no guarantee on the cost-sharing reduction (CSR) payments.

A panel of state insurance commissioners all agreed with the two proposals, though there were suggestions that the CSR payments should be guaranteed for at least a year, if not longer, beyond 2018, which was when Chairman Alexander suggested the guarantee should sunset.

“The CSR funding issue is the single most critical issue you can address to help stabilize insurance markets in 2018,” Julie Mix McPeak, commissioner of the Tennessee Department of Commerce and Insurance, testified at the hearing. She emphasized that it is not an insurance bailout. “CSR funding ensures that some of our most vulnerable consumers receive assistance for copays and deductibles that are required to be paid under federal law and has the effect of reducing proposed premium increases and has a direct impact on the amount of subsidy assistance provided by the federal government.”

“You must permanently fund the cost-sharing reduction payments,” Mike Kreidler, insurance commissioner for the state of Washington, testified during the hearing. “That is something that is going help a great deal in our marketplace.”

The commissioners also advocated for a reinsurance program.

Ms. McPeak called for Congress to “establish a reinsurance mechanism that would stop losses for individual claims at a specified amount to increase market participation by carriers. For the most immediate impact, this backstop mechanism must be federal, as it would be impossible for many states to develop such a program for the 2018 plan year.”

“I urge you to create a federal reinsurance program this year,” Mr. Kreidler said. “Doing this would show your commitment to stabilizing the market. They worked very well in the state of Washington for the first 3 years we had a reinsurance program. We would like to see it continue and go forward.”

In talking about fixing 1332 waivers, which allow states to develop a specific proposal that works within the parameters of the Affordable Care Act but offers flexibility to create programs that are unique to a state’s needs, Lori Wing-Heier, director of the Alaska Division of Insurance talked about her state’s successful efforts to get a wavier for its reinsurance program.

“The waiver process is somewhat onerous in the fact that there is not a defined application to submit,” Ms. Wing-Heier said, leaving it up to states to make sure they are providing all the requested information. “After that, the part that is stifling states right now is the 6-month waiting period before they receive final approval.”

Other issues were raised by both panelists and senators, including the cost of delivering health care, the cost of prescription drugs, and cuts to marketing budgets, but Chairman Alexander said that he did not want to expand a proposal beyond his two points.

“My whole focus right now is: What can we do to take a couple of steps to stabilize the individual market?” he said, although he suggested that if there were clear consensus on other aspects, they could be considered.

The archived hearing can be viewed on the committee’s website.

gtwachtman@frontlinemedcom.com

CORRECTION, 9/8/17: An earlier version of this story misidentified the HELP Committee chairman.

AT A SENATE HELP COMMITTEE HEARING

Midyear formulary changes wreak havoc on diabetes care

Instability of formulary coverage for drug and insulin can make it tough to treat patients with diabetes, and the problem is getting worse.

Just one example: CVS Caremark removed 22 insulin products and drugs to treat diabetes in its July 2017 formulary update.

“This is a real problem,” Philip Levy, MD, an endocrinologist at Banner University Medical Group in Phoenix, said in an interview. “We have people that are doing well on one medication and then all of a sudden, their insurance carrier says you have to use a different medication and they don’t tolerate it. It’s a real problem.”

Claresa Levetan, MD, with Chestnut Hill Endocrinology, Diabetes & Metabolic Associates of Philadelphia, agreed. “It’s a very big problem. ... In my practice, it’s a nightmare because I cannot choose to put them on the insulin or the medications that would be best for them.”

The American Diabetes Association also is concerned. The association is “deeply concerned with recent trends in prescription drug formulary designs that result in frequent changes in drug coverage for individuals with diabetes,” according to a statement.

The situation is made more challenging by the sheer volume of money spent on insulins and diabetes drugs.

Diabetes prescription ranked first among therapeutic classes in terms of total spend (13%), ahead of autoimmune (11.9%) and multiple sclerosis and HIV treatments (both tied at 4.7% each) for its commercial clients, according to pharmacy benefit manager (PBM) Prime Therapeutics. Three of the top 10 drugs by drug spend are diabetes medication (No. 4: Lantus; No. 7: NovoLog; and No. 8: Victoza). For its Medicare Part D clients, diabetes drugs also topped the list in terms of total spend per therapeutic class (14.2%), ahead of oral cancer therapies (11.3%) and respiratory (6.5%). Three of the top 10 drugs by drug spend among Medicare Part D clients are diabetes drugs (No. 4: Lantus; No. 6: Januvia; and No. 10: Humalog KwikPen).

Express Scripts reports similar trends. Diabetes prescriptions were the second highest therapeutic class in terms of per member per year spending in 2016 at $108.80, behind inflammatory conditions ($118.21) and ahead of oncology ($60.70).

Utilization of diabetes drugs increased 5.3%, according to the PBM, while unit costs for these treatments rose 14.1%. Express Scripts identified the top five most costly medications as Lantus, Humalog KwikPen, metformin, Januvia, and Invokana.

“Formulary changes made during the year are particularly troubling because most individuals do not have the option of changing to a different insurance plan that would cover his/her prescription medication,” the ADA said in its statement. “Therefore, the association is strongly opposed to formulary changes such as removing medications from formularies or moving medications to a higher tier during the plan year.”

Beyond cost, Dr. Levetan suggested that another issue is the lack of clinician input at the PBM level.

“I think the problem is not only just companies switching to a cheaper bid mid-year between [manufacturers], but there is really no input from physicians, especially the endocrinologists and the specialists,” she said. “This is potentially life threatening.”

Finding alternatives can also have adverse effects on outcomes and can also be time consuming.

“If somebody is doing well, there is no real reason to change that or to stop it,” Dr. Levy said. “There are some medications that are pretty interchangeable, but others, they all have slightly different side effects and we try to use what we think is the best medication for that patient based on the patient’s characteristics.”

ADA is recommending that PBMs, insurance plans, and employers “provide an expedited and standard process for gaining access to medications not included in the plan’s formulary. Responses to exception requests must be timely to ensure no delay in obtaining a needed medication, thereby preventing a gap in treatment. In addition, the association recommends PBMs, plans, and employers temporarily cover nonformulary drugs as if they are on formulary during the first 30 days after a formulary list is changed.”

Instability of formulary coverage for drug and insulin can make it tough to treat patients with diabetes, and the problem is getting worse.

Just one example: CVS Caremark removed 22 insulin products and drugs to treat diabetes in its July 2017 formulary update.

“This is a real problem,” Philip Levy, MD, an endocrinologist at Banner University Medical Group in Phoenix, said in an interview. “We have people that are doing well on one medication and then all of a sudden, their insurance carrier says you have to use a different medication and they don’t tolerate it. It’s a real problem.”

Claresa Levetan, MD, with Chestnut Hill Endocrinology, Diabetes & Metabolic Associates of Philadelphia, agreed. “It’s a very big problem. ... In my practice, it’s a nightmare because I cannot choose to put them on the insulin or the medications that would be best for them.”

The American Diabetes Association also is concerned. The association is “deeply concerned with recent trends in prescription drug formulary designs that result in frequent changes in drug coverage for individuals with diabetes,” according to a statement.

The situation is made more challenging by the sheer volume of money spent on insulins and diabetes drugs.

Diabetes prescription ranked first among therapeutic classes in terms of total spend (13%), ahead of autoimmune (11.9%) and multiple sclerosis and HIV treatments (both tied at 4.7% each) for its commercial clients, according to pharmacy benefit manager (PBM) Prime Therapeutics. Three of the top 10 drugs by drug spend are diabetes medication (No. 4: Lantus; No. 7: NovoLog; and No. 8: Victoza). For its Medicare Part D clients, diabetes drugs also topped the list in terms of total spend per therapeutic class (14.2%), ahead of oral cancer therapies (11.3%) and respiratory (6.5%). Three of the top 10 drugs by drug spend among Medicare Part D clients are diabetes drugs (No. 4: Lantus; No. 6: Januvia; and No. 10: Humalog KwikPen).

Express Scripts reports similar trends. Diabetes prescriptions were the second highest therapeutic class in terms of per member per year spending in 2016 at $108.80, behind inflammatory conditions ($118.21) and ahead of oncology ($60.70).

Utilization of diabetes drugs increased 5.3%, according to the PBM, while unit costs for these treatments rose 14.1%. Express Scripts identified the top five most costly medications as Lantus, Humalog KwikPen, metformin, Januvia, and Invokana.

“Formulary changes made during the year are particularly troubling because most individuals do not have the option of changing to a different insurance plan that would cover his/her prescription medication,” the ADA said in its statement. “Therefore, the association is strongly opposed to formulary changes such as removing medications from formularies or moving medications to a higher tier during the plan year.”

Beyond cost, Dr. Levetan suggested that another issue is the lack of clinician input at the PBM level.

“I think the problem is not only just companies switching to a cheaper bid mid-year between [manufacturers], but there is really no input from physicians, especially the endocrinologists and the specialists,” she said. “This is potentially life threatening.”

Finding alternatives can also have adverse effects on outcomes and can also be time consuming.

“If somebody is doing well, there is no real reason to change that or to stop it,” Dr. Levy said. “There are some medications that are pretty interchangeable, but others, they all have slightly different side effects and we try to use what we think is the best medication for that patient based on the patient’s characteristics.”

ADA is recommending that PBMs, insurance plans, and employers “provide an expedited and standard process for gaining access to medications not included in the plan’s formulary. Responses to exception requests must be timely to ensure no delay in obtaining a needed medication, thereby preventing a gap in treatment. In addition, the association recommends PBMs, plans, and employers temporarily cover nonformulary drugs as if they are on formulary during the first 30 days after a formulary list is changed.”

Instability of formulary coverage for drug and insulin can make it tough to treat patients with diabetes, and the problem is getting worse.

Just one example: CVS Caremark removed 22 insulin products and drugs to treat diabetes in its July 2017 formulary update.

“This is a real problem,” Philip Levy, MD, an endocrinologist at Banner University Medical Group in Phoenix, said in an interview. “We have people that are doing well on one medication and then all of a sudden, their insurance carrier says you have to use a different medication and they don’t tolerate it. It’s a real problem.”

Claresa Levetan, MD, with Chestnut Hill Endocrinology, Diabetes & Metabolic Associates of Philadelphia, agreed. “It’s a very big problem. ... In my practice, it’s a nightmare because I cannot choose to put them on the insulin or the medications that would be best for them.”

The American Diabetes Association also is concerned. The association is “deeply concerned with recent trends in prescription drug formulary designs that result in frequent changes in drug coverage for individuals with diabetes,” according to a statement.

The situation is made more challenging by the sheer volume of money spent on insulins and diabetes drugs.

Diabetes prescription ranked first among therapeutic classes in terms of total spend (13%), ahead of autoimmune (11.9%) and multiple sclerosis and HIV treatments (both tied at 4.7% each) for its commercial clients, according to pharmacy benefit manager (PBM) Prime Therapeutics. Three of the top 10 drugs by drug spend are diabetes medication (No. 4: Lantus; No. 7: NovoLog; and No. 8: Victoza). For its Medicare Part D clients, diabetes drugs also topped the list in terms of total spend per therapeutic class (14.2%), ahead of oral cancer therapies (11.3%) and respiratory (6.5%). Three of the top 10 drugs by drug spend among Medicare Part D clients are diabetes drugs (No. 4: Lantus; No. 6: Januvia; and No. 10: Humalog KwikPen).

Express Scripts reports similar trends. Diabetes prescriptions were the second highest therapeutic class in terms of per member per year spending in 2016 at $108.80, behind inflammatory conditions ($118.21) and ahead of oncology ($60.70).

Utilization of diabetes drugs increased 5.3%, according to the PBM, while unit costs for these treatments rose 14.1%. Express Scripts identified the top five most costly medications as Lantus, Humalog KwikPen, metformin, Januvia, and Invokana.

“Formulary changes made during the year are particularly troubling because most individuals do not have the option of changing to a different insurance plan that would cover his/her prescription medication,” the ADA said in its statement. “Therefore, the association is strongly opposed to formulary changes such as removing medications from formularies or moving medications to a higher tier during the plan year.”

Beyond cost, Dr. Levetan suggested that another issue is the lack of clinician input at the PBM level.

“I think the problem is not only just companies switching to a cheaper bid mid-year between [manufacturers], but there is really no input from physicians, especially the endocrinologists and the specialists,” she said. “This is potentially life threatening.”

Finding alternatives can also have adverse effects on outcomes and can also be time consuming.

“If somebody is doing well, there is no real reason to change that or to stop it,” Dr. Levy said. “There are some medications that are pretty interchangeable, but others, they all have slightly different side effects and we try to use what we think is the best medication for that patient based on the patient’s characteristics.”

ADA is recommending that PBMs, insurance plans, and employers “provide an expedited and standard process for gaining access to medications not included in the plan’s formulary. Responses to exception requests must be timely to ensure no delay in obtaining a needed medication, thereby preventing a gap in treatment. In addition, the association recommends PBMs, plans, and employers temporarily cover nonformulary drugs as if they are on formulary during the first 30 days after a formulary list is changed.”

Medicare fee schedule: Proposed pay bump falls short of promise

Physicians will likely see a 0.31% uptick in their Medicare payments in 2018 and not the 0.5% promised in the Medicare Access and CHIP Reauthorization Act.

Officials at the Centers for Medicare and Medicaid Services were not able to find adequate funding in so-called misvalued codes to back the larger increase, as required by law, according to the proposed Medicare physician fee schedule for 2018.

Other provisions in the proposed Medicare physician fee schedule may be more palatable than the petite pay raise.

The proposal would roll back data reporting requirements of the Physician Quality Reporting System (PQRS), to better align them with the new Quality Payment Program (QPP), and will waive half of penalties assessed for not meeting PQRS requirements in 2016.

“We are proposing these changes based on stakeholder feedback and to better align with the MIPS [Merit-based Incentive Payment System track of the QPP] data submission requirements for the quality performance category,” according to a CMS fact sheet on the proposed fee schedule.

“This will allow some physicians who attempted to report for the 2016 performance period to avoid penalties and better align PQRS with MIPS as physicians transition to QPP,” officials from the American College of Physicians said in a statement.

Other physician organizations said they believed the proposal did not go far enough.

“While the reductions in penalties represent a move in the right direction, the [American College of Rheumatology] believes CMS should establish a value modifier adjustment of zero for 2018,” ACR officials said in a statement. “This would align with the agency’s policy to ‘zero out’ the impact of the resource use component of the Merit-based Incentive Payment System in 2019, the successor to the value modifier program. This provides additional time to continue refining the cost measures and gives physicians more time to understand the program.”

The proposed fee schedule also would delay implementation of the appropriate use criteria (AUC) for imaging services, a program that would deny payments for imaging services unless the ordering physician consulted the appropriate use criteria.

The American Medical Association “appreciates CMS’ decision to postpone the implementation of this requirement until 2019 and to make the first year an opportunity for testing and education where consultation would not be required as a condition of payment for imaging services,” according to a statement.

“We also applaud the proposed delay in implementing AUC for diagnostic imaging studies,” ACR said in its statement. “We will be gauging the readiness of our members to use clinical support systems. ... We support simplifying and phasing-in the program requirements. The ACR also strongly supports larger exemptions to the program,” such as physicians in small groups and rural and underserved areas.

The proposed fee schedule also seeks feedback from physicians and organizations on how Medicare Part B pays for biosimilars. Under the 2016 fee schedule, the average sales prices (ASPs) for all biosimilar products assigned to the same reference product are included in the same CPT code, meaning the ASPs for all biosimilars of a common reference product are used to determine a single reimbursement rate.

That CMS is looking deeper at this is being seen as a plus.

Biosimilars “tied to the same reference product may not share all indications with one another or the reference product [and] a blended payment model may cause significant confusion in a multitiered biosimilars market that may include both interchangeable and noninterchangeable products,” the Biosimilars Forum said in a statement. The current situation “may lead to decreased physician confidence in how they are reimbursed and also dramatically reduce the investment in the development of biosimilars and thereby limit treatment options available to patients.”

Both the Biosimilars Forum and the ACR support unique codes for each biosimilar.

“Physicians can better track and monitor their effectiveness and ensure adequate pharmacovigilance in the area of biosimilars” by employing unique codes, according to ACR officials.

The fee schedule proposal also would expand the Medicare Diabetes Prevention Program (DPP), currently a demonstration project, taking it nationwide in 2018. The proposal outlines the payment structure and supplier enrollment requirements and compliance standards, as well as beneficiary engagement incentives.

Physicians would be paid based on performance goals being met by patients, including meeting certain numbers of service and maintenance sessions with the program as well as achieving specific weight loss goals. For beneficiaries who are able to lose at least 5% of body weight, physicians could receive up to $810. If that weight loss goal is not achieved, the most a physician could receive is $125, according to a CMS fact sheet. Currently, DPP can only be employed via office visit; however, the proposal would allow virtual make-up sessions.

“The new proposal provides more flexibility to DPP providers in supporting patient engagement and attendance and by making performance-based payments available if patients meet weight-loss targets over longer periods of time,” according to the AMA.

The fee schedule also proposes more telemedicine coverage, specifically for counseling to discuss the need for lung cancer screening, including eligibility determination and shared decision making, as well psychotherapy for crisis, with codes for the first 60 minutes of intervention and a separate code for each additional 30 minutes. Four add-on codes have been proposed to supplement existing codes that cover interactive complexity, chronic care management services, and health risk assessment.

For clinicians providing behavioral health services, CMS is proposing an increased payment for providing face-to-face office-based services that better reflects overhead expenses.

Comments on the fee schedule update are due Sept. 11 and can be made here. The final rule is expected in early November.

Physicians will likely see a 0.31% uptick in their Medicare payments in 2018 and not the 0.5% promised in the Medicare Access and CHIP Reauthorization Act.

Officials at the Centers for Medicare and Medicaid Services were not able to find adequate funding in so-called misvalued codes to back the larger increase, as required by law, according to the proposed Medicare physician fee schedule for 2018.

Other provisions in the proposed Medicare physician fee schedule may be more palatable than the petite pay raise.

The proposal would roll back data reporting requirements of the Physician Quality Reporting System (PQRS), to better align them with the new Quality Payment Program (QPP), and will waive half of penalties assessed for not meeting PQRS requirements in 2016.

“We are proposing these changes based on stakeholder feedback and to better align with the MIPS [Merit-based Incentive Payment System track of the QPP] data submission requirements for the quality performance category,” according to a CMS fact sheet on the proposed fee schedule.

“This will allow some physicians who attempted to report for the 2016 performance period to avoid penalties and better align PQRS with MIPS as physicians transition to QPP,” officials from the American College of Physicians said in a statement.

Other physician organizations said they believed the proposal did not go far enough.

“While the reductions in penalties represent a move in the right direction, the [American College of Rheumatology] believes CMS should establish a value modifier adjustment of zero for 2018,” ACR officials said in a statement. “This would align with the agency’s policy to ‘zero out’ the impact of the resource use component of the Merit-based Incentive Payment System in 2019, the successor to the value modifier program. This provides additional time to continue refining the cost measures and gives physicians more time to understand the program.”

The proposed fee schedule also would delay implementation of the appropriate use criteria (AUC) for imaging services, a program that would deny payments for imaging services unless the ordering physician consulted the appropriate use criteria.

The American Medical Association “appreciates CMS’ decision to postpone the implementation of this requirement until 2019 and to make the first year an opportunity for testing and education where consultation would not be required as a condition of payment for imaging services,” according to a statement.

“We also applaud the proposed delay in implementing AUC for diagnostic imaging studies,” ACR said in its statement. “We will be gauging the readiness of our members to use clinical support systems. ... We support simplifying and phasing-in the program requirements. The ACR also strongly supports larger exemptions to the program,” such as physicians in small groups and rural and underserved areas.

The proposed fee schedule also seeks feedback from physicians and organizations on how Medicare Part B pays for biosimilars. Under the 2016 fee schedule, the average sales prices (ASPs) for all biosimilar products assigned to the same reference product are included in the same CPT code, meaning the ASPs for all biosimilars of a common reference product are used to determine a single reimbursement rate.

That CMS is looking deeper at this is being seen as a plus.

Biosimilars “tied to the same reference product may not share all indications with one another or the reference product [and] a blended payment model may cause significant confusion in a multitiered biosimilars market that may include both interchangeable and noninterchangeable products,” the Biosimilars Forum said in a statement. The current situation “may lead to decreased physician confidence in how they are reimbursed and also dramatically reduce the investment in the development of biosimilars and thereby limit treatment options available to patients.”

Both the Biosimilars Forum and the ACR support unique codes for each biosimilar.

“Physicians can better track and monitor their effectiveness and ensure adequate pharmacovigilance in the area of biosimilars” by employing unique codes, according to ACR officials.

The fee schedule proposal also would expand the Medicare Diabetes Prevention Program (DPP), currently a demonstration project, taking it nationwide in 2018. The proposal outlines the payment structure and supplier enrollment requirements and compliance standards, as well as beneficiary engagement incentives.

Physicians would be paid based on performance goals being met by patients, including meeting certain numbers of service and maintenance sessions with the program as well as achieving specific weight loss goals. For beneficiaries who are able to lose at least 5% of body weight, physicians could receive up to $810. If that weight loss goal is not achieved, the most a physician could receive is $125, according to a CMS fact sheet. Currently, DPP can only be employed via office visit; however, the proposal would allow virtual make-up sessions.

“The new proposal provides more flexibility to DPP providers in supporting patient engagement and attendance and by making performance-based payments available if patients meet weight-loss targets over longer periods of time,” according to the AMA.

The fee schedule also proposes more telemedicine coverage, specifically for counseling to discuss the need for lung cancer screening, including eligibility determination and shared decision making, as well psychotherapy for crisis, with codes for the first 60 minutes of intervention and a separate code for each additional 30 minutes. Four add-on codes have been proposed to supplement existing codes that cover interactive complexity, chronic care management services, and health risk assessment.

For clinicians providing behavioral health services, CMS is proposing an increased payment for providing face-to-face office-based services that better reflects overhead expenses.

Comments on the fee schedule update are due Sept. 11 and can be made here. The final rule is expected in early November.

Physicians will likely see a 0.31% uptick in their Medicare payments in 2018 and not the 0.5% promised in the Medicare Access and CHIP Reauthorization Act.

Officials at the Centers for Medicare and Medicaid Services were not able to find adequate funding in so-called misvalued codes to back the larger increase, as required by law, according to the proposed Medicare physician fee schedule for 2018.

Other provisions in the proposed Medicare physician fee schedule may be more palatable than the petite pay raise.

The proposal would roll back data reporting requirements of the Physician Quality Reporting System (PQRS), to better align them with the new Quality Payment Program (QPP), and will waive half of penalties assessed for not meeting PQRS requirements in 2016.

“We are proposing these changes based on stakeholder feedback and to better align with the MIPS [Merit-based Incentive Payment System track of the QPP] data submission requirements for the quality performance category,” according to a CMS fact sheet on the proposed fee schedule.

“This will allow some physicians who attempted to report for the 2016 performance period to avoid penalties and better align PQRS with MIPS as physicians transition to QPP,” officials from the American College of Physicians said in a statement.

Other physician organizations said they believed the proposal did not go far enough.

“While the reductions in penalties represent a move in the right direction, the [American College of Rheumatology] believes CMS should establish a value modifier adjustment of zero for 2018,” ACR officials said in a statement. “This would align with the agency’s policy to ‘zero out’ the impact of the resource use component of the Merit-based Incentive Payment System in 2019, the successor to the value modifier program. This provides additional time to continue refining the cost measures and gives physicians more time to understand the program.”

The proposed fee schedule also would delay implementation of the appropriate use criteria (AUC) for imaging services, a program that would deny payments for imaging services unless the ordering physician consulted the appropriate use criteria.

The American Medical Association “appreciates CMS’ decision to postpone the implementation of this requirement until 2019 and to make the first year an opportunity for testing and education where consultation would not be required as a condition of payment for imaging services,” according to a statement.

“We also applaud the proposed delay in implementing AUC for diagnostic imaging studies,” ACR said in its statement. “We will be gauging the readiness of our members to use clinical support systems. ... We support simplifying and phasing-in the program requirements. The ACR also strongly supports larger exemptions to the program,” such as physicians in small groups and rural and underserved areas.

The proposed fee schedule also seeks feedback from physicians and organizations on how Medicare Part B pays for biosimilars. Under the 2016 fee schedule, the average sales prices (ASPs) for all biosimilar products assigned to the same reference product are included in the same CPT code, meaning the ASPs for all biosimilars of a common reference product are used to determine a single reimbursement rate.

That CMS is looking deeper at this is being seen as a plus.

Biosimilars “tied to the same reference product may not share all indications with one another or the reference product [and] a blended payment model may cause significant confusion in a multitiered biosimilars market that may include both interchangeable and noninterchangeable products,” the Biosimilars Forum said in a statement. The current situation “may lead to decreased physician confidence in how they are reimbursed and also dramatically reduce the investment in the development of biosimilars and thereby limit treatment options available to patients.”

Both the Biosimilars Forum and the ACR support unique codes for each biosimilar.

“Physicians can better track and monitor their effectiveness and ensure adequate pharmacovigilance in the area of biosimilars” by employing unique codes, according to ACR officials.

The fee schedule proposal also would expand the Medicare Diabetes Prevention Program (DPP), currently a demonstration project, taking it nationwide in 2018. The proposal outlines the payment structure and supplier enrollment requirements and compliance standards, as well as beneficiary engagement incentives.

Physicians would be paid based on performance goals being met by patients, including meeting certain numbers of service and maintenance sessions with the program as well as achieving specific weight loss goals. For beneficiaries who are able to lose at least 5% of body weight, physicians could receive up to $810. If that weight loss goal is not achieved, the most a physician could receive is $125, according to a CMS fact sheet. Currently, DPP can only be employed via office visit; however, the proposal would allow virtual make-up sessions.

“The new proposal provides more flexibility to DPP providers in supporting patient engagement and attendance and by making performance-based payments available if patients meet weight-loss targets over longer periods of time,” according to the AMA.

The fee schedule also proposes more telemedicine coverage, specifically for counseling to discuss the need for lung cancer screening, including eligibility determination and shared decision making, as well psychotherapy for crisis, with codes for the first 60 minutes of intervention and a separate code for each additional 30 minutes. Four add-on codes have been proposed to supplement existing codes that cover interactive complexity, chronic care management services, and health risk assessment.

For clinicians providing behavioral health services, CMS is proposing an increased payment for providing face-to-face office-based services that better reflects overhead expenses.

Comments on the fee schedule update are due Sept. 11 and can be made here. The final rule is expected in early November.

Antimicrobial development model links financial incentives with public health needs

A new model promoting the development and sustainable use of antimicrobials has been proposed by the Duke University Margolis Center for Health Policy.

Dubbed the “Priority Antimicrobial Value and Entry (PAVE) Award,” the model “provides developers quick access to a significant reward upon market entry of an effective antimicrobial, and provides strong incentives to shift reimbursement from insurance plans to population- and value-based contracts, not payments based on volume of sales,” according to a white paper detailing the proposal.

“This model builds on and reinforces the shift to quality and value in U.S. health care, with payments more directly linked to public health benefits and total costs,” Gregory Daniel, PhD, deputy director of the Margolis Center and lead author of the report, said in a viewpoint published online in JAMA (2017 Aug 3. doi: 10.1001/jama.2017.10164). “Along with strong push mechanisms that remove some of the financial risk associated with initial development of drug candidates, these measures could make a major contribution to the global effort to create and sustain a robust pipeline of antimicrobials that address current and growing public health needs – and would do so through an approach well suited to the reforming U.S. health care system.”

The proposal combines incentives provided from both the public and private sectors.

Payments from public funds would be largest in year 1 and would decrease over the next 5-6 years, with each payment “contingent upon developers demonstrating an increasing share of their revenue from population-based [alternative payment models] linked to value to society through availability, support for sustainable use, and continued data collection,” the report notes, describing a method that emphasizes value and delinks revenues from volume.

Delinking revenues from volume has been a part of two prominent proposals in Europe. One proposed by Chatham House, a London-based public policy institute, also proposed a number of financial incentives, such as public funding and tax credits, to help finance development in addition to MERs. A second being developed in the European Union, expected to be finalized later this year, would provide grants for early stage research, establishment of a nonprofit developer to manage and finance discovery through commercialization, a MER to developers that meet certain criteria, an annual licensing fee to developers for access to their product, and a dual-pricing model that allows for higher prices to be charged for appropriate use.

The Duke paper identifies a number of contracting models, such as a manufacturer contracting with a health plan on a per-member per-month basis to provide the drug as needed, or episode-based payments as needed, for all hospitalized patients identified with specific diagnosis-related groups.

“Successful implementation of the PAVE Award will require cooperation between developers, payers, and providers,” the Duke policy researchers stated. “The contract should encourage short- and long-term savings from reduced inappropriate use, as well as reduced infection-related costs, such as extended hospital stays, treatment complications, and additional infections.”

For infectious diseases physicians, there are a few specific roles in addition to any that are played beyond being a part of the medical research.

“For example, as the clinicians on the front lines seeing the patients, they are able to really identify what are the emerging threats on the horizon and where do we need to be targeting R&D. I think that is useful for helping to inform which antibiotics should be eligible to receive market entry rewards,” Amanda Jezek, senior vice president of public policy and government relations at the Infectious Diseases Society of America, said in an interview. She also noted that physicians will be instrumental in “helping to create the political will to advance proposals like this because they are the ones who can really speak to what the need for patients is on the ground, in communities, and in hospitals.”

Physicians also will play a vital role in ensuring that any new antimicrobial drugs are not overused.

“Once these antibiotics are approved, infectious diseases physicians lead stewardship programs that are essential for ensuring that these drugs are used appropriately, and that is critical because if you start overusing the new antibiotics, resistance to them will develop quickly and you are back to where you started,” said Ms. Jezek, who was part of the advisory group that helped to inform the report.

A new model promoting the development and sustainable use of antimicrobials has been proposed by the Duke University Margolis Center for Health Policy.

Dubbed the “Priority Antimicrobial Value and Entry (PAVE) Award,” the model “provides developers quick access to a significant reward upon market entry of an effective antimicrobial, and provides strong incentives to shift reimbursement from insurance plans to population- and value-based contracts, not payments based on volume of sales,” according to a white paper detailing the proposal.

“This model builds on and reinforces the shift to quality and value in U.S. health care, with payments more directly linked to public health benefits and total costs,” Gregory Daniel, PhD, deputy director of the Margolis Center and lead author of the report, said in a viewpoint published online in JAMA (2017 Aug 3. doi: 10.1001/jama.2017.10164). “Along with strong push mechanisms that remove some of the financial risk associated with initial development of drug candidates, these measures could make a major contribution to the global effort to create and sustain a robust pipeline of antimicrobials that address current and growing public health needs – and would do so through an approach well suited to the reforming U.S. health care system.”

The proposal combines incentives provided from both the public and private sectors.

Payments from public funds would be largest in year 1 and would decrease over the next 5-6 years, with each payment “contingent upon developers demonstrating an increasing share of their revenue from population-based [alternative payment models] linked to value to society through availability, support for sustainable use, and continued data collection,” the report notes, describing a method that emphasizes value and delinks revenues from volume.

Delinking revenues from volume has been a part of two prominent proposals in Europe. One proposed by Chatham House, a London-based public policy institute, also proposed a number of financial incentives, such as public funding and tax credits, to help finance development in addition to MERs. A second being developed in the European Union, expected to be finalized later this year, would provide grants for early stage research, establishment of a nonprofit developer to manage and finance discovery through commercialization, a MER to developers that meet certain criteria, an annual licensing fee to developers for access to their product, and a dual-pricing model that allows for higher prices to be charged for appropriate use.

The Duke paper identifies a number of contracting models, such as a manufacturer contracting with a health plan on a per-member per-month basis to provide the drug as needed, or episode-based payments as needed, for all hospitalized patients identified with specific diagnosis-related groups.

“Successful implementation of the PAVE Award will require cooperation between developers, payers, and providers,” the Duke policy researchers stated. “The contract should encourage short- and long-term savings from reduced inappropriate use, as well as reduced infection-related costs, such as extended hospital stays, treatment complications, and additional infections.”

For infectious diseases physicians, there are a few specific roles in addition to any that are played beyond being a part of the medical research.

“For example, as the clinicians on the front lines seeing the patients, they are able to really identify what are the emerging threats on the horizon and where do we need to be targeting R&D. I think that is useful for helping to inform which antibiotics should be eligible to receive market entry rewards,” Amanda Jezek, senior vice president of public policy and government relations at the Infectious Diseases Society of America, said in an interview. She also noted that physicians will be instrumental in “helping to create the political will to advance proposals like this because they are the ones who can really speak to what the need for patients is on the ground, in communities, and in hospitals.”

Physicians also will play a vital role in ensuring that any new antimicrobial drugs are not overused.

“Once these antibiotics are approved, infectious diseases physicians lead stewardship programs that are essential for ensuring that these drugs are used appropriately, and that is critical because if you start overusing the new antibiotics, resistance to them will develop quickly and you are back to where you started,” said Ms. Jezek, who was part of the advisory group that helped to inform the report.

A new model promoting the development and sustainable use of antimicrobials has been proposed by the Duke University Margolis Center for Health Policy.

Dubbed the “Priority Antimicrobial Value and Entry (PAVE) Award,” the model “provides developers quick access to a significant reward upon market entry of an effective antimicrobial, and provides strong incentives to shift reimbursement from insurance plans to population- and value-based contracts, not payments based on volume of sales,” according to a white paper detailing the proposal.

“This model builds on and reinforces the shift to quality and value in U.S. health care, with payments more directly linked to public health benefits and total costs,” Gregory Daniel, PhD, deputy director of the Margolis Center and lead author of the report, said in a viewpoint published online in JAMA (2017 Aug 3. doi: 10.1001/jama.2017.10164). “Along with strong push mechanisms that remove some of the financial risk associated with initial development of drug candidates, these measures could make a major contribution to the global effort to create and sustain a robust pipeline of antimicrobials that address current and growing public health needs – and would do so through an approach well suited to the reforming U.S. health care system.”

The proposal combines incentives provided from both the public and private sectors.

Payments from public funds would be largest in year 1 and would decrease over the next 5-6 years, with each payment “contingent upon developers demonstrating an increasing share of their revenue from population-based [alternative payment models] linked to value to society through availability, support for sustainable use, and continued data collection,” the report notes, describing a method that emphasizes value and delinks revenues from volume.

Delinking revenues from volume has been a part of two prominent proposals in Europe. One proposed by Chatham House, a London-based public policy institute, also proposed a number of financial incentives, such as public funding and tax credits, to help finance development in addition to MERs. A second being developed in the European Union, expected to be finalized later this year, would provide grants for early stage research, establishment of a nonprofit developer to manage and finance discovery through commercialization, a MER to developers that meet certain criteria, an annual licensing fee to developers for access to their product, and a dual-pricing model that allows for higher prices to be charged for appropriate use.

The Duke paper identifies a number of contracting models, such as a manufacturer contracting with a health plan on a per-member per-month basis to provide the drug as needed, or episode-based payments as needed, for all hospitalized patients identified with specific diagnosis-related groups.

“Successful implementation of the PAVE Award will require cooperation between developers, payers, and providers,” the Duke policy researchers stated. “The contract should encourage short- and long-term savings from reduced inappropriate use, as well as reduced infection-related costs, such as extended hospital stays, treatment complications, and additional infections.”

For infectious diseases physicians, there are a few specific roles in addition to any that are played beyond being a part of the medical research.

“For example, as the clinicians on the front lines seeing the patients, they are able to really identify what are the emerging threats on the horizon and where do we need to be targeting R&D. I think that is useful for helping to inform which antibiotics should be eligible to receive market entry rewards,” Amanda Jezek, senior vice president of public policy and government relations at the Infectious Diseases Society of America, said in an interview. She also noted that physicians will be instrumental in “helping to create the political will to advance proposals like this because they are the ones who can really speak to what the need for patients is on the ground, in communities, and in hospitals.”

Physicians also will play a vital role in ensuring that any new antimicrobial drugs are not overused.

“Once these antibiotics are approved, infectious diseases physicians lead stewardship programs that are essential for ensuring that these drugs are used appropriately, and that is critical because if you start overusing the new antibiotics, resistance to them will develop quickly and you are back to where you started,” said Ms. Jezek, who was part of the advisory group that helped to inform the report.

CBO: End of ACA subsidies would mean short-term exit of insurers

Terminating the Affordable Care Act’s cost-sharing reduction payments to insurers would cause a short-term exit by insurers from the individual insurance marketplaces, but the availability of plans is expected to rebound, according to the Congressional Budget Office.

In a new analysis requested by Democratic leadership in the House of Representatives, CBO and staff from the congressional Joint Committee on Taxation (JCT) examined what would happen if the Trump administration announced by the end of August that it would cease to make cost-sharing reduction payments at the end of 2017.

However, insurers would be on the hook to cover the payments no longer provided by the government, which means that “participating insurers would raise premiums of ‘silver’ plans to recover the costs.”

Gross premiums for silver plans “would be 20% higher in 2018 and 25% by 2020,” pushing higher premium tax credits and increasing the federal deficit by $194 billion from 2017 through 2026,” the report states. “Most people would pay net premiums (after accounting for premium tax credits) for nongroup insurance throughout the next decade that were similar to or less than what they would pay otherwise.”

The percentage of people facing a “slight increases” would be higher during the next 2 years, they pointed out.

The number of uninsured would be slightly higher in 2018 (about 1 million more uninsured) but then would be slightly lower starting in 2020 (about 1 million less each year).

Should the administration end cost-sharing reduction payments in 2017, those eligible for tax credits who have annual incomes 200%-400% of the federal poverty level would use their subsidies to purchase either gold or bronze plans, with silver plans going almost exclusively to people eligible for cost-sharing reductions (100%-200% of the poverty line).

Terminating the Affordable Care Act’s cost-sharing reduction payments to insurers would cause a short-term exit by insurers from the individual insurance marketplaces, but the availability of plans is expected to rebound, according to the Congressional Budget Office.

In a new analysis requested by Democratic leadership in the House of Representatives, CBO and staff from the congressional Joint Committee on Taxation (JCT) examined what would happen if the Trump administration announced by the end of August that it would cease to make cost-sharing reduction payments at the end of 2017.

However, insurers would be on the hook to cover the payments no longer provided by the government, which means that “participating insurers would raise premiums of ‘silver’ plans to recover the costs.”