User login

Trump administration floats 18% budget cut to HHS

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

The five-to-one return on fraud and abuse investigation in this program is controversial, because of the incentives for those conducting the investigations. Health care providers should not fear that an auditor trying to make his/her quota is being overly severe in reviewing their charts. There is heightened concern about the effects of the program given the changes coming with MACRA.

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

The budget process is a long one and the President’s recommendations are just the beginning. AGA is on Capitol Hill daily coordinating with our champions in Congress to ensure that the concerns of GIs are being heard regarding issues that affect our members and our patients. We will continue to work diligently as an organization as well as in coordination with other organizations and as a member of many coalitions to reach out to Capitol Hill, regulators, and payors to ensure that the future

of GI practice and research remains viable. Contact AGA to learn more about how to get involved in your community at advocacy@gastro.org, and learn more about AGA PAC at www.gastro.org/agapac.

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

The five-to-one return on fraud and abuse investigation in this program is controversial, because of the incentives for those conducting the investigations. Health care providers should not fear that an auditor trying to make his/her quota is being overly severe in reviewing their charts. There is heightened concern about the effects of the program given the changes coming with MACRA.

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

The budget process is a long one and the President’s recommendations are just the beginning. AGA is on Capitol Hill daily coordinating with our champions in Congress to ensure that the concerns of GIs are being heard regarding issues that affect our members and our patients. We will continue to work diligently as an organization as well as in coordination with other organizations and as a member of many coalitions to reach out to Capitol Hill, regulators, and payors to ensure that the future

of GI practice and research remains viable. Contact AGA to learn more about how to get involved in your community at advocacy@gastro.org, and learn more about AGA PAC at www.gastro.org/agapac.

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

The five-to-one return on fraud and abuse investigation in this program is controversial, because of the incentives for those conducting the investigations. Health care providers should not fear that an auditor trying to make his/her quota is being overly severe in reviewing their charts. There is heightened concern about the effects of the program given the changes coming with MACRA.

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

The budget process is a long one and the President’s recommendations are just the beginning. AGA is on Capitol Hill daily coordinating with our champions in Congress to ensure that the concerns of GIs are being heard regarding issues that affect our members and our patients. We will continue to work diligently as an organization as well as in coordination with other organizations and as a member of many coalitions to reach out to Capitol Hill, regulators, and payors to ensure that the future

of GI practice and research remains viable. Contact AGA to learn more about how to get involved in your community at advocacy@gastro.org, and learn more about AGA PAC at www.gastro.org/agapac.

Resident Match Day 2017: Record number of applicants and matches

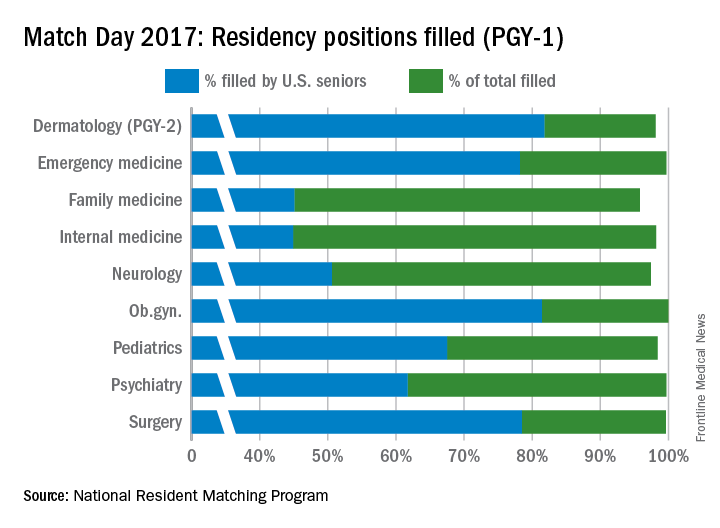

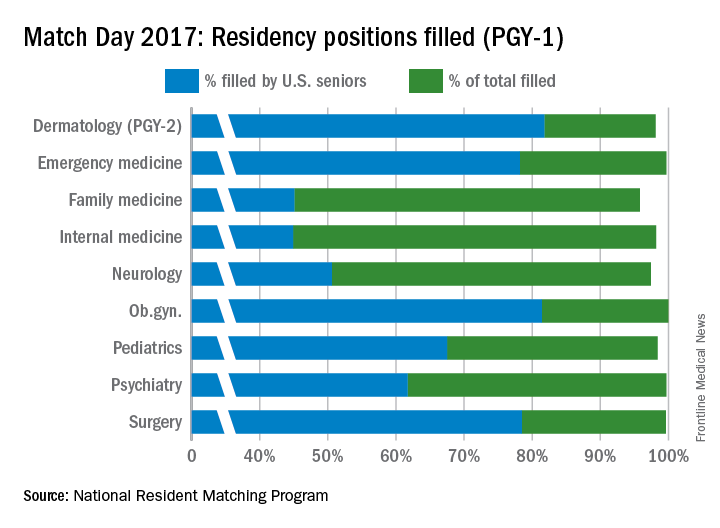

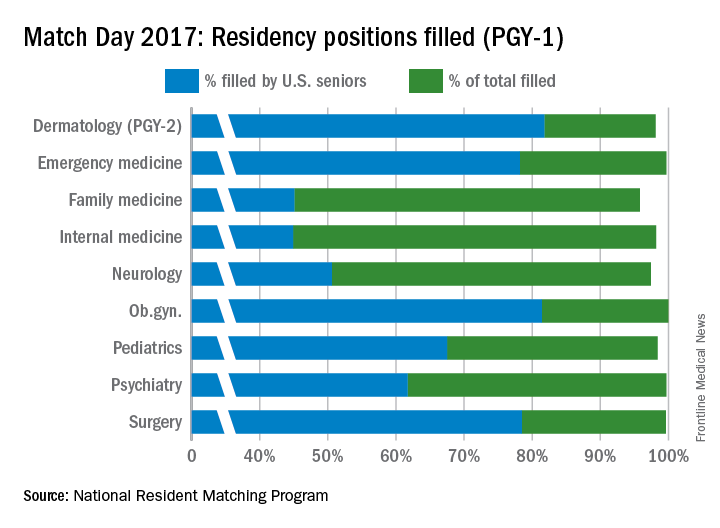

Once again, a record was set for both the number of slots available for residency programs and the number of positions filled during the 2017 Main Residency Match.

This is the fifth straight year the National Resident Matching Program (NRMP) has reported growth, with 35,969 applicants submitting their program choices, up 1.4% from the previous year, and 27,688 positions matched to postgraduate year 1 (PGY-1) applicants, up 3.2% from 2016.

One factor driving the increase is the “all-in” policy that required programs registering for the Match to offer all their available positions in the Match or another national matching program. The policy, which began with the 2013 Match, has resulted in significant increases for internal medicine, family medicine, and pediatrics.

The year-over-year increase in internal medicine was tracking similar to the increase in overall positions, something seen as a good thing by the American College of Physicians (ACP).

Family medicine, the next largest offering, accounted for 11.6% of all positions. In 2017, there 3,356 residency slots offered, up from 3,238 in 2016. U.S. graduates accounted for 45.1% of the 3,215 positions filled this year, roughly the same rate as last year.

Pediatrics ranked third in positions offered (2,738, or 9.5% of all positions offered) and had 98.4% of those slots fill this year. Of the 2,693 spots that were filled, 67.5% were filled by U.S. medical school graduates, about the same rate as in 2016.

Other specialties that made up a smaller percentage of the overall Match positions but boasted high total fill rates for PGY-1 positions in 2017 were emergency medicine (99.7%), neurology (97.4%), ob.gyn. (100%), psychiatry (99.7%), and surgery (99.6%).

A record-high 18,539 allopathic medical school seniors submitted program choices and 17,480 (94.3%) were matched to first-year resident programs, a rate that has been consistent for a number of years according to NRMP data.

Of the 1,279 unfilled slots, 1,177 were offered in the Match Week Supplemental Offer and Acceptance Program, the results of which will be available in May.

“I was surprised that the number of U.S.-citizen and non-U.S.-citizen IMGs declined this year, but on the other hand, the good news is their match rates went up,” Ms. Signer said in an interview.

U.S.-citizen IMGs declined by 254 to 5,069, but 54.8% were matched to first-year residency positions, the highest match rate since 2004. The number of non-U.S.-citizen IMGs declined by 176 to 7,284, but 52.4% were matched to first-year positions, the highest match rate since 2005.

Ms. Signer declined to speculate what caused the decline, noting that NRMP does not collect demographic data.

Dr. Masters of the ACP noted that IMGs are filling a significant portion of internal medicine positions, now at around 45%.

Dr. Masters noted that this trend is important in light of the White House’s continued attempts to curb immigration from certain parts of the world.

“That really accentuates the concerns that ACP has with the executive orders that could potentially disrupt the movement of international medical graduates here for training,” he said.

Once again, a record was set for both the number of slots available for residency programs and the number of positions filled during the 2017 Main Residency Match.

This is the fifth straight year the National Resident Matching Program (NRMP) has reported growth, with 35,969 applicants submitting their program choices, up 1.4% from the previous year, and 27,688 positions matched to postgraduate year 1 (PGY-1) applicants, up 3.2% from 2016.

One factor driving the increase is the “all-in” policy that required programs registering for the Match to offer all their available positions in the Match or another national matching program. The policy, which began with the 2013 Match, has resulted in significant increases for internal medicine, family medicine, and pediatrics.

The year-over-year increase in internal medicine was tracking similar to the increase in overall positions, something seen as a good thing by the American College of Physicians (ACP).

Family medicine, the next largest offering, accounted for 11.6% of all positions. In 2017, there 3,356 residency slots offered, up from 3,238 in 2016. U.S. graduates accounted for 45.1% of the 3,215 positions filled this year, roughly the same rate as last year.

Pediatrics ranked third in positions offered (2,738, or 9.5% of all positions offered) and had 98.4% of those slots fill this year. Of the 2,693 spots that were filled, 67.5% were filled by U.S. medical school graduates, about the same rate as in 2016.

Other specialties that made up a smaller percentage of the overall Match positions but boasted high total fill rates for PGY-1 positions in 2017 were emergency medicine (99.7%), neurology (97.4%), ob.gyn. (100%), psychiatry (99.7%), and surgery (99.6%).

A record-high 18,539 allopathic medical school seniors submitted program choices and 17,480 (94.3%) were matched to first-year resident programs, a rate that has been consistent for a number of years according to NRMP data.

Of the 1,279 unfilled slots, 1,177 were offered in the Match Week Supplemental Offer and Acceptance Program, the results of which will be available in May.

“I was surprised that the number of U.S.-citizen and non-U.S.-citizen IMGs declined this year, but on the other hand, the good news is their match rates went up,” Ms. Signer said in an interview.

U.S.-citizen IMGs declined by 254 to 5,069, but 54.8% were matched to first-year residency positions, the highest match rate since 2004. The number of non-U.S.-citizen IMGs declined by 176 to 7,284, but 52.4% were matched to first-year positions, the highest match rate since 2005.

Ms. Signer declined to speculate what caused the decline, noting that NRMP does not collect demographic data.

Dr. Masters of the ACP noted that IMGs are filling a significant portion of internal medicine positions, now at around 45%.

Dr. Masters noted that this trend is important in light of the White House’s continued attempts to curb immigration from certain parts of the world.

“That really accentuates the concerns that ACP has with the executive orders that could potentially disrupt the movement of international medical graduates here for training,” he said.

Once again, a record was set for both the number of slots available for residency programs and the number of positions filled during the 2017 Main Residency Match.

This is the fifth straight year the National Resident Matching Program (NRMP) has reported growth, with 35,969 applicants submitting their program choices, up 1.4% from the previous year, and 27,688 positions matched to postgraduate year 1 (PGY-1) applicants, up 3.2% from 2016.

One factor driving the increase is the “all-in” policy that required programs registering for the Match to offer all their available positions in the Match or another national matching program. The policy, which began with the 2013 Match, has resulted in significant increases for internal medicine, family medicine, and pediatrics.

The year-over-year increase in internal medicine was tracking similar to the increase in overall positions, something seen as a good thing by the American College of Physicians (ACP).

Family medicine, the next largest offering, accounted for 11.6% of all positions. In 2017, there 3,356 residency slots offered, up from 3,238 in 2016. U.S. graduates accounted for 45.1% of the 3,215 positions filled this year, roughly the same rate as last year.

Pediatrics ranked third in positions offered (2,738, or 9.5% of all positions offered) and had 98.4% of those slots fill this year. Of the 2,693 spots that were filled, 67.5% were filled by U.S. medical school graduates, about the same rate as in 2016.

Other specialties that made up a smaller percentage of the overall Match positions but boasted high total fill rates for PGY-1 positions in 2017 were emergency medicine (99.7%), neurology (97.4%), ob.gyn. (100%), psychiatry (99.7%), and surgery (99.6%).

A record-high 18,539 allopathic medical school seniors submitted program choices and 17,480 (94.3%) were matched to first-year resident programs, a rate that has been consistent for a number of years according to NRMP data.

Of the 1,279 unfilled slots, 1,177 were offered in the Match Week Supplemental Offer and Acceptance Program, the results of which will be available in May.

“I was surprised that the number of U.S.-citizen and non-U.S.-citizen IMGs declined this year, but on the other hand, the good news is their match rates went up,” Ms. Signer said in an interview.

U.S.-citizen IMGs declined by 254 to 5,069, but 54.8% were matched to first-year residency positions, the highest match rate since 2004. The number of non-U.S.-citizen IMGs declined by 176 to 7,284, but 52.4% were matched to first-year positions, the highest match rate since 2005.

Ms. Signer declined to speculate what caused the decline, noting that NRMP does not collect demographic data.

Dr. Masters of the ACP noted that IMGs are filling a significant portion of internal medicine positions, now at around 45%.

Dr. Masters noted that this trend is important in light of the White House’s continued attempts to curb immigration from certain parts of the world.

“That really accentuates the concerns that ACP has with the executive orders that could potentially disrupt the movement of international medical graduates here for training,” he said.

Trump administration floats 18% budget cut to HHS

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

The Department of Health & Human Services would see an 18% funding cut under the first budget proposal from the Trump administration.

The proposal, submitted to Congress March 16, would cut $15.1 billion from fiscal 2017 levels, funding the agency at $69 billion for fiscal year 2018. More than a third of the cuts come from the National Institutes of Health.

The NIH’s overall budget would drop to $25.9 billion in FY 2018, down $5.8 billion from this year (fiscal 2017). The proposal includes “a major reorganization of NIH’s institutes and centers to help focus resources on the highest priority research and training activities, including: eliminating the Fogarty International Center, consolidating the Agency for Healthcare Research and Quality within the NIH, and other consolidations and structural changes across NIH organizations and activities,” according to summary documents from the Office of Management and Budget.

The proposed cuts also account for the funds that are to be appropriated for the 21st Century Cures Act, which was supposed to add $4.8 billion in new appropriated funding, including funds dedicated to the Cancer Moonshot and the BRAIN Initiative.

The Centers for Disease Control and Prevention also would be reformed, getting a new $500 million block grant “to increase state flexibility and focus on the leading public health challenges specific to each state.” It also creates a new Federal Emergency Response Fund to respond to public health outbreaks such as the Zika virus.

Another area receiving a boost under the proposal is the funding for the Health Care Fraud and Abuse Control program at the CMS, which would receive $751 million in fiscal 2018, about 10% more than it did in fiscal 2017. The budget document notes that the “return on investment for the HCFAC account was $5 returned for every $1 expended from 2014-2016.”

Other cuts highlighted by the proposal include elimination of $403 million in health professions and nursing training programs, “which lack evidence that they significantly improve the nation’s health workforce,” and a $4.2 billion cut from the elimination of discretionary programs within the Office of Community Services.

More pushback from docs after CBO scores GOP health care plan

Physician groups continue to push back against a Republican plan to repeal and replace the Affordable Care Act following a Congressional Budget Office analysis that showed up to 24 million patients would not be insured under the plan.

According to the CBO analysis, 14 million more patients would become uninsured in the first year of the American Health Care Act than under current law, with most dropping coverage because of the repeal of the ACA’s individual health insurance mandate.

By 2020, an additional 7 million patients would lose coverage largely because of the bill’s rollback of expansion in favor of a per capita allotment to states to cover their Medicaid population.

“In 2026, an estimated 52 million would be uninsured, compared with 28 million who would lack insurance that year under current law,” according to the CBO analysis.

American Medical Association President Andrew Gurman, MD, called the uptick in uninsured “unacceptable.”

“While the Affordable Care Act was an imperfect law, it was a significant improvement on the status quo at the time, and the AMA believes we need continued progress to expand coverage for the uninsured. Unfortunately, the current proposal – as the CBO analysis shows – would result in the most vulnerable population losing their coverage,” Dr. Gurman said in a statement.

Likewise, the American Osteopathic Association voiced its objections to the GOP proposal.

“The AOA urges Congress to halt any further progression of the American Health Care Act as written and take a more comprehensive approach that addresses such systemic issues while providing stability for the insurance marketplace and the millions of Americans who rely on it for coverage,” President Boyd Buser, DO, said in a statement.

According to the CBO analysis, the individual health insurance market “would probably be stable in most areas under either current law or the legislation.” However, there could be large premium increases for some patients, based on age group.

Tom Price, MD, secretary of the Department of Health & Human Services, criticized the CBO projections.

“The CBO report’s coverage numbers defy logic,” he said in a statement. “They project that zeroing out the individual mandate – allowing Americans to choose whether to have insurance – will result in 14 million Americans opting out of coverage in 1 year. For there to be the reductions in coverage they project in just the first year, they assume 5 million Americans on Medicaid will drop off of health insurance for which they pay very little, and another 9 million will stop participating in the individual and employer markets. These types of assumptions do not translate to the real world, and they do not accurately estimate the effects of this bill.”

Rep. Kevin Brady (R-Texas), chairman of the House Ways & Means Committee, also disputed the increase in the uninsured population.

“The American Health Care Act is a dramatic departure from Obamacare, which forced Americans to buy expensive, one-size-fits-all health insurance,” Chairman Brady said in a statement. “Our legislation gives individuals and families the freedom to access health care options that are tailored to the needs, not Washington’s.”

Rep. Brady and Dr. Price also pointed out that the AHCA is just the first step of a three-step process, which will include a review of ACA regulations as well as passage of further legislation aimed at providing high quality care at lower costs. However, those cannot be scored by CBO as those details have yet to be released, the GOP leaders pointed out.

The CBO analysis predicts that premiums for those buying insurance in the individual marketplace would increase of 15%-20% from 2018 to 2019, but starting in 2020, average premiums are expected to decrease from states using federal government funds to help offset costs from high users of health care and more younger people coming into the health insurance market.

“By 2026, average premiums for single policyholders in the nongroup market under the legislation would be roughly 10% lower than under current law,” according to the analysis, although since the law allows for higher premiums for older individuals, the congressional budget watchdog sees the provisions of the AHCA as “substantially reducing premiums for young adults and substantially raising premiums for older people.”

The CBO estimates that enacting this legislation would reduce federal deficits by $337 billion over the 2017-2026 period, mainly from reductions in Medicaid spending and the elimination of the current premium subsidies, though the deficit reduction is somewhat offset by the refundable premium tax credits that replace the ACA’s subsidies.

Physician groups continue to push back against a Republican plan to repeal and replace the Affordable Care Act following a Congressional Budget Office analysis that showed up to 24 million patients would not be insured under the plan.

According to the CBO analysis, 14 million more patients would become uninsured in the first year of the American Health Care Act than under current law, with most dropping coverage because of the repeal of the ACA’s individual health insurance mandate.

By 2020, an additional 7 million patients would lose coverage largely because of the bill’s rollback of expansion in favor of a per capita allotment to states to cover their Medicaid population.

“In 2026, an estimated 52 million would be uninsured, compared with 28 million who would lack insurance that year under current law,” according to the CBO analysis.

American Medical Association President Andrew Gurman, MD, called the uptick in uninsured “unacceptable.”

“While the Affordable Care Act was an imperfect law, it was a significant improvement on the status quo at the time, and the AMA believes we need continued progress to expand coverage for the uninsured. Unfortunately, the current proposal – as the CBO analysis shows – would result in the most vulnerable population losing their coverage,” Dr. Gurman said in a statement.

Likewise, the American Osteopathic Association voiced its objections to the GOP proposal.

“The AOA urges Congress to halt any further progression of the American Health Care Act as written and take a more comprehensive approach that addresses such systemic issues while providing stability for the insurance marketplace and the millions of Americans who rely on it for coverage,” President Boyd Buser, DO, said in a statement.

According to the CBO analysis, the individual health insurance market “would probably be stable in most areas under either current law or the legislation.” However, there could be large premium increases for some patients, based on age group.

Tom Price, MD, secretary of the Department of Health & Human Services, criticized the CBO projections.

“The CBO report’s coverage numbers defy logic,” he said in a statement. “They project that zeroing out the individual mandate – allowing Americans to choose whether to have insurance – will result in 14 million Americans opting out of coverage in 1 year. For there to be the reductions in coverage they project in just the first year, they assume 5 million Americans on Medicaid will drop off of health insurance for which they pay very little, and another 9 million will stop participating in the individual and employer markets. These types of assumptions do not translate to the real world, and they do not accurately estimate the effects of this bill.”

Rep. Kevin Brady (R-Texas), chairman of the House Ways & Means Committee, also disputed the increase in the uninsured population.

“The American Health Care Act is a dramatic departure from Obamacare, which forced Americans to buy expensive, one-size-fits-all health insurance,” Chairman Brady said in a statement. “Our legislation gives individuals and families the freedom to access health care options that are tailored to the needs, not Washington’s.”

Rep. Brady and Dr. Price also pointed out that the AHCA is just the first step of a three-step process, which will include a review of ACA regulations as well as passage of further legislation aimed at providing high quality care at lower costs. However, those cannot be scored by CBO as those details have yet to be released, the GOP leaders pointed out.

The CBO analysis predicts that premiums for those buying insurance in the individual marketplace would increase of 15%-20% from 2018 to 2019, but starting in 2020, average premiums are expected to decrease from states using federal government funds to help offset costs from high users of health care and more younger people coming into the health insurance market.

“By 2026, average premiums for single policyholders in the nongroup market under the legislation would be roughly 10% lower than under current law,” according to the analysis, although since the law allows for higher premiums for older individuals, the congressional budget watchdog sees the provisions of the AHCA as “substantially reducing premiums for young adults and substantially raising premiums for older people.”

The CBO estimates that enacting this legislation would reduce federal deficits by $337 billion over the 2017-2026 period, mainly from reductions in Medicaid spending and the elimination of the current premium subsidies, though the deficit reduction is somewhat offset by the refundable premium tax credits that replace the ACA’s subsidies.

Physician groups continue to push back against a Republican plan to repeal and replace the Affordable Care Act following a Congressional Budget Office analysis that showed up to 24 million patients would not be insured under the plan.

According to the CBO analysis, 14 million more patients would become uninsured in the first year of the American Health Care Act than under current law, with most dropping coverage because of the repeal of the ACA’s individual health insurance mandate.

By 2020, an additional 7 million patients would lose coverage largely because of the bill’s rollback of expansion in favor of a per capita allotment to states to cover their Medicaid population.

“In 2026, an estimated 52 million would be uninsured, compared with 28 million who would lack insurance that year under current law,” according to the CBO analysis.

American Medical Association President Andrew Gurman, MD, called the uptick in uninsured “unacceptable.”

“While the Affordable Care Act was an imperfect law, it was a significant improvement on the status quo at the time, and the AMA believes we need continued progress to expand coverage for the uninsured. Unfortunately, the current proposal – as the CBO analysis shows – would result in the most vulnerable population losing their coverage,” Dr. Gurman said in a statement.

Likewise, the American Osteopathic Association voiced its objections to the GOP proposal.

“The AOA urges Congress to halt any further progression of the American Health Care Act as written and take a more comprehensive approach that addresses such systemic issues while providing stability for the insurance marketplace and the millions of Americans who rely on it for coverage,” President Boyd Buser, DO, said in a statement.

According to the CBO analysis, the individual health insurance market “would probably be stable in most areas under either current law or the legislation.” However, there could be large premium increases for some patients, based on age group.

Tom Price, MD, secretary of the Department of Health & Human Services, criticized the CBO projections.

“The CBO report’s coverage numbers defy logic,” he said in a statement. “They project that zeroing out the individual mandate – allowing Americans to choose whether to have insurance – will result in 14 million Americans opting out of coverage in 1 year. For there to be the reductions in coverage they project in just the first year, they assume 5 million Americans on Medicaid will drop off of health insurance for which they pay very little, and another 9 million will stop participating in the individual and employer markets. These types of assumptions do not translate to the real world, and they do not accurately estimate the effects of this bill.”

Rep. Kevin Brady (R-Texas), chairman of the House Ways & Means Committee, also disputed the increase in the uninsured population.

“The American Health Care Act is a dramatic departure from Obamacare, which forced Americans to buy expensive, one-size-fits-all health insurance,” Chairman Brady said in a statement. “Our legislation gives individuals and families the freedom to access health care options that are tailored to the needs, not Washington’s.”

Rep. Brady and Dr. Price also pointed out that the AHCA is just the first step of a three-step process, which will include a review of ACA regulations as well as passage of further legislation aimed at providing high quality care at lower costs. However, those cannot be scored by CBO as those details have yet to be released, the GOP leaders pointed out.

The CBO analysis predicts that premiums for those buying insurance in the individual marketplace would increase of 15%-20% from 2018 to 2019, but starting in 2020, average premiums are expected to decrease from states using federal government funds to help offset costs from high users of health care and more younger people coming into the health insurance market.

“By 2026, average premiums for single policyholders in the nongroup market under the legislation would be roughly 10% lower than under current law,” according to the analysis, although since the law allows for higher premiums for older individuals, the congressional budget watchdog sees the provisions of the AHCA as “substantially reducing premiums for young adults and substantially raising premiums for older people.”

The CBO estimates that enacting this legislation would reduce federal deficits by $337 billion over the 2017-2026 period, mainly from reductions in Medicaid spending and the elimination of the current premium subsidies, though the deficit reduction is somewhat offset by the refundable premium tax credits that replace the ACA’s subsidies.

GOP health plan clears first hurdle as opposition lines up

The Republican plan to replace the Affordable Care Act cleared the first legislative hurdle when two house committees passed language that would repeal revenue provisions of the Affordable Care Act and lay the foundation for replacing the health care reform law.

The House Ways and Means Committee–approved legislation would eliminate the individual mandate in favor of allowing insurance companies to penalize individuals by up to 30% of premiums for lapses in coverage and would repeal taxes on high-cost health plans (Cadillac tax), over-the-counter and prescription medications, health savings accounts, tanning, investment, and on health insurers.

The language passed with a party-line vote March 9 with 23 Republicans voting for and 16 Democrats voting against after nearly 18 hours of debate and amendments.

The House Energy and Commerce Committee, after 27 hours of debate that started March 8, also passed its language along party lines with 31 Republicans voting for and 23 Democrats voting against. Their bill would end Medicaid expansion and reset the program’s funding to a per capita allotment based on population indicators, along with block grants, to provide states more flexibility to better manage its population.

A key concern raised in both committee debates was the brief window between the public unveiling of the legislation and the committees’ efforts, especially the lack of financial impact analysis or “score” from the Congressional Budget Office. Democrats efforts in both committees to hold action for a CBO score were voted down on across party lines.

In both committees, Democrats introduced a wide range of amendments, including guarantees there would be no impact from the reduction of Medicaid expansion and on funding to support coverage for mental health, women, children, seniors, and veterans, all of which were voted down. Ways and Means members also offered an amendment to require President Trump to release his income tax filings.

Rep. Frank Pallone (D-N.J.), lead Democrat in the Energy and Commerce Committee, voiced his colleagues’ objections to the bill and the process.

The bill “would rip health care away from millions of Americans, raise costs for working families and seniors, and lead to the rationing of care for 76 million Americans who receive Medicaid. … This has not been a transparent process. We did not go through regular order. The bill was posted less than 2 days before markup. No hearings were held, and we don’t have a CBO score,” Rep. Pallone said during committee debate.

A CBO score of the budget and coverage impacts of the Republican health care proposal could come as early as March 13.

The pace of action in the House even drew criticism from some in the GOP. Sen. Tom Cotton (R-Ark.) took to Twitter with a stern warning to the House.

“House health-care bill can’t pass w/o major changes,” Sen. Cotton tweeted. “To my friends in House: pause, start over. Get it right, don’t get it fast.”

He followed up with two more tweets: “GOP shouldn’t act like Dems did in O’care. No excuse to release bill Mon night, start voting Wed. With no budget estimate!” He added: “What matters in long run is better, more affordable health care for Americans, NOT house leaders’ arbitrary legislative calendar.”

Four Republican senators – Rob Portman (Ohio), Shelley Moore Capito (W.Va.), Cory Gardner (Colo.), and Lisa Murkowski (Alaska) – also expressed concerns regarding how Medicaid will be changed under the repeal/replace effort and vowed not to support any plan “that does not include stability for Medicaid expansion populations or flexibility for states.”

Republicans hold a slim 52-seat majority in the Senate and need only 50 votes to pass any legislation that uses the budget reconciliation process. If those four senators voted with Democrats, who are expected to vote as a party against the repeal effort, the current House Republican legislation would not clear the Senate.

Physicians’ groups also have voiced their opposition. American Medical Association President Andrew Gurman, MD, said in a statement that it is “not legislation we can support. The replacement bill, as written, would reverse the coverage gains of the ACA, causing many Americans to lose the health coverage they have come to depend on.” He added that the proposed changes to Medicaid “would limit states’ ability to respond to changes in service demands and threaten coverage for people with low incomes.”

Likewise, a joint statement issued by the American Academy of Family Physicians, American Academy of Pediatricians, American College of Physicians, American Congress of Obstetricians and Gynecologists and the American Osteopathic Association, expressed concern that the proposal “will likely result in less access to coverage and higher costs for millions of patients.”

The Republican plan to replace the Affordable Care Act cleared the first legislative hurdle when two house committees passed language that would repeal revenue provisions of the Affordable Care Act and lay the foundation for replacing the health care reform law.

The House Ways and Means Committee–approved legislation would eliminate the individual mandate in favor of allowing insurance companies to penalize individuals by up to 30% of premiums for lapses in coverage and would repeal taxes on high-cost health plans (Cadillac tax), over-the-counter and prescription medications, health savings accounts, tanning, investment, and on health insurers.

The language passed with a party-line vote March 9 with 23 Republicans voting for and 16 Democrats voting against after nearly 18 hours of debate and amendments.

The House Energy and Commerce Committee, after 27 hours of debate that started March 8, also passed its language along party lines with 31 Republicans voting for and 23 Democrats voting against. Their bill would end Medicaid expansion and reset the program’s funding to a per capita allotment based on population indicators, along with block grants, to provide states more flexibility to better manage its population.

A key concern raised in both committee debates was the brief window between the public unveiling of the legislation and the committees’ efforts, especially the lack of financial impact analysis or “score” from the Congressional Budget Office. Democrats efforts in both committees to hold action for a CBO score were voted down on across party lines.

In both committees, Democrats introduced a wide range of amendments, including guarantees there would be no impact from the reduction of Medicaid expansion and on funding to support coverage for mental health, women, children, seniors, and veterans, all of which were voted down. Ways and Means members also offered an amendment to require President Trump to release his income tax filings.

Rep. Frank Pallone (D-N.J.), lead Democrat in the Energy and Commerce Committee, voiced his colleagues’ objections to the bill and the process.

The bill “would rip health care away from millions of Americans, raise costs for working families and seniors, and lead to the rationing of care for 76 million Americans who receive Medicaid. … This has not been a transparent process. We did not go through regular order. The bill was posted less than 2 days before markup. No hearings were held, and we don’t have a CBO score,” Rep. Pallone said during committee debate.

A CBO score of the budget and coverage impacts of the Republican health care proposal could come as early as March 13.

The pace of action in the House even drew criticism from some in the GOP. Sen. Tom Cotton (R-Ark.) took to Twitter with a stern warning to the House.

“House health-care bill can’t pass w/o major changes,” Sen. Cotton tweeted. “To my friends in House: pause, start over. Get it right, don’t get it fast.”

He followed up with two more tweets: “GOP shouldn’t act like Dems did in O’care. No excuse to release bill Mon night, start voting Wed. With no budget estimate!” He added: “What matters in long run is better, more affordable health care for Americans, NOT house leaders’ arbitrary legislative calendar.”

Four Republican senators – Rob Portman (Ohio), Shelley Moore Capito (W.Va.), Cory Gardner (Colo.), and Lisa Murkowski (Alaska) – also expressed concerns regarding how Medicaid will be changed under the repeal/replace effort and vowed not to support any plan “that does not include stability for Medicaid expansion populations or flexibility for states.”

Republicans hold a slim 52-seat majority in the Senate and need only 50 votes to pass any legislation that uses the budget reconciliation process. If those four senators voted with Democrats, who are expected to vote as a party against the repeal effort, the current House Republican legislation would not clear the Senate.

Physicians’ groups also have voiced their opposition. American Medical Association President Andrew Gurman, MD, said in a statement that it is “not legislation we can support. The replacement bill, as written, would reverse the coverage gains of the ACA, causing many Americans to lose the health coverage they have come to depend on.” He added that the proposed changes to Medicaid “would limit states’ ability to respond to changes in service demands and threaten coverage for people with low incomes.”

Likewise, a joint statement issued by the American Academy of Family Physicians, American Academy of Pediatricians, American College of Physicians, American Congress of Obstetricians and Gynecologists and the American Osteopathic Association, expressed concern that the proposal “will likely result in less access to coverage and higher costs for millions of patients.”

The Republican plan to replace the Affordable Care Act cleared the first legislative hurdle when two house committees passed language that would repeal revenue provisions of the Affordable Care Act and lay the foundation for replacing the health care reform law.

The House Ways and Means Committee–approved legislation would eliminate the individual mandate in favor of allowing insurance companies to penalize individuals by up to 30% of premiums for lapses in coverage and would repeal taxes on high-cost health plans (Cadillac tax), over-the-counter and prescription medications, health savings accounts, tanning, investment, and on health insurers.

The language passed with a party-line vote March 9 with 23 Republicans voting for and 16 Democrats voting against after nearly 18 hours of debate and amendments.

The House Energy and Commerce Committee, after 27 hours of debate that started March 8, also passed its language along party lines with 31 Republicans voting for and 23 Democrats voting against. Their bill would end Medicaid expansion and reset the program’s funding to a per capita allotment based on population indicators, along with block grants, to provide states more flexibility to better manage its population.

A key concern raised in both committee debates was the brief window between the public unveiling of the legislation and the committees’ efforts, especially the lack of financial impact analysis or “score” from the Congressional Budget Office. Democrats efforts in both committees to hold action for a CBO score were voted down on across party lines.

In both committees, Democrats introduced a wide range of amendments, including guarantees there would be no impact from the reduction of Medicaid expansion and on funding to support coverage for mental health, women, children, seniors, and veterans, all of which were voted down. Ways and Means members also offered an amendment to require President Trump to release his income tax filings.

Rep. Frank Pallone (D-N.J.), lead Democrat in the Energy and Commerce Committee, voiced his colleagues’ objections to the bill and the process.

The bill “would rip health care away from millions of Americans, raise costs for working families and seniors, and lead to the rationing of care for 76 million Americans who receive Medicaid. … This has not been a transparent process. We did not go through regular order. The bill was posted less than 2 days before markup. No hearings were held, and we don’t have a CBO score,” Rep. Pallone said during committee debate.

A CBO score of the budget and coverage impacts of the Republican health care proposal could come as early as March 13.

The pace of action in the House even drew criticism from some in the GOP. Sen. Tom Cotton (R-Ark.) took to Twitter with a stern warning to the House.

“House health-care bill can’t pass w/o major changes,” Sen. Cotton tweeted. “To my friends in House: pause, start over. Get it right, don’t get it fast.”

He followed up with two more tweets: “GOP shouldn’t act like Dems did in O’care. No excuse to release bill Mon night, start voting Wed. With no budget estimate!” He added: “What matters in long run is better, more affordable health care for Americans, NOT house leaders’ arbitrary legislative calendar.”

Four Republican senators – Rob Portman (Ohio), Shelley Moore Capito (W.Va.), Cory Gardner (Colo.), and Lisa Murkowski (Alaska) – also expressed concerns regarding how Medicaid will be changed under the repeal/replace effort and vowed not to support any plan “that does not include stability for Medicaid expansion populations or flexibility for states.”

Republicans hold a slim 52-seat majority in the Senate and need only 50 votes to pass any legislation that uses the budget reconciliation process. If those four senators voted with Democrats, who are expected to vote as a party against the repeal effort, the current House Republican legislation would not clear the Senate.

Physicians’ groups also have voiced their opposition. American Medical Association President Andrew Gurman, MD, said in a statement that it is “not legislation we can support. The replacement bill, as written, would reverse the coverage gains of the ACA, causing many Americans to lose the health coverage they have come to depend on.” He added that the proposed changes to Medicaid “would limit states’ ability to respond to changes in service demands and threaten coverage for people with low incomes.”

Likewise, a joint statement issued by the American Academy of Family Physicians, American Academy of Pediatricians, American College of Physicians, American Congress of Obstetricians and Gynecologists and the American Osteopathic Association, expressed concern that the proposal “will likely result in less access to coverage and higher costs for millions of patients.”

House Republicans start work on ACA repeal/replace

House Republicans have formally begun their efforts to repeal and replace the Affordable Care Act, but a group of four GOP senators could present a significant hurdle to getting the budget reconciliation package to the president’s desk.

The budget reconciliation language – introduced March 6 – represents the first of three phases in their planned effort to quash the ACA.

“Second are all the regulatory modifications and changes that can be put into place,” Dr. Price said, noting that the Obama administration made 192 specific rules related to the ACA and published more than 5,000 letters of guidance. “We are going to go through every single one of those and ... if they help patients, we need to continue them. If they harm patients or increase costs, they need to be addressed.”

He added that additional legislation could be needed to address changes that cannot be made through the reconciliation process, such as addressing prescription drug costs and allowing health insurance to be sold across state lines.

Sections of the reconciliation package were introduced in the House Energy and Commerce and House Ways and Means Committees, covering areas relative to each committee’s jurisdiction. Taken together, they put forth the plan to repeal and replace certain revenue aspects of the ACA.

Provisions to repeal Medicaid expansion likely will prove the most problematic. The Energy and Commerce language calls for the repeal of Medicaid expansion provisions by 2020. It also repeals a requirement that state Medicaid plans offer the same minimum essential health benefits that are required by plans on the exchanges.

Starting in fiscal 2020, states would begin to receive a per capita allotment to fund their Medicaid programs, a fixed amount per Medicaid enrollee that will adjust over time for inflation using the consumer price index. States spending more than their annual allotment per beneficiary would be penalized with reduced funding in the following year.

That provision has run afoul of certain Republican senators whose votes are needed to gain a simple majority and pass the budget reconciliation package. Because of the slim nature of the Republican majority, any defection from the party line could endanger passage.

“We are concerned that any poorly implemented or poorly timed change in the current funding structure in Medicaid could result in a reduction in access to life-saving health care services,” Sen. Rob Portman (R-Ohio), Sen. Shelley Moore Capito (R-W.Va.), Sen. Cory Gardner (R-Colo.), and Sen. Lisa Murkowski (R-Alaska) said in a letter to Senate Majority Leader Mitch McConnell (R-Ky.). The letter was based on an earlier draft of the legislative language but remains valid as little substantive change has occurred in the formal, introduced language.

“We believe Medicaid needs to be reformed, but reform should not come at the cost of disruption in access to health care for our country’s most vulnerable and sickest individuals,” the senators continued. “Any changes made to how Medicaid is financed through the state and federal governments should be coupled with significant new flexibility so they can efficiently and effectively manage their Medicaid programs to best meet their own needs. ... [The House proposal] does not meet the test of stability for individuals currently enrolled in the program, and we will not support a plan that does not include stability for Medicaid expansion populations or flexibility for states.”

The Energy and Commerce language also includes provisions for block grants to states that would allow them to be used in a manner they see fit within a defined list, including providing financial assistance to high-risk individuals; arrangements that help stabilize premiums in the individual market; reduce the cost of providing insurance in the small group and individual markets; promoting participation in the small group and individual markets; and promoting access to preventive, dental, and vision services as well as treatment for mental and substance abuse disorders. Funds could also be used to provide payments for care or assistance to reduce out-of-pocket costs.

The House proposal also would repeal the premium cost sharing subsidies in the ACA, which would be replaced with refundable tax credits, according to the language released by the Ways and Means Committee.

The credit can be used to purchase a state-approved, major health insurance or unsubsidized COBRA (the Consolidated Omnibus Budget Reconciliation Act) coverage and increases based on age. Individuals younger than age 30 years would get $2,000, and the credit increases in $500 increments per 10-year age block, plateauing at $4,000 for those aged 60 years and older. The caps will adjust over time, based on inflation, and are available to those making up to $75,000 ($150,000 for joint filers); the credit phases out by $100 for every $1,000 over those thresholds.

The Ways and Means language also repeals a number of revenue provisions, including the individual mandate and associated penalties; the employer mandate and associated penalties; taxes on high-cost health plans (Cadillac tax); over-the-counter and prescription medications; health savings accounts; tanning; investment; and on health insurers.

In place of the individual mandate, the language will allow insurers to raise premiums by up to 30%.

The bill does not repeal the provisions regarding young adults being able to stay on their parents’ policies to the age of 26 years, nor does it allow insurers to deny coverage for preexisting conditions.

The House committees will begin consideration of their respective languages on March 8.

House Republicans have formally begun their efforts to repeal and replace the Affordable Care Act, but a group of four GOP senators could present a significant hurdle to getting the budget reconciliation package to the president’s desk.

The budget reconciliation language – introduced March 6 – represents the first of three phases in their planned effort to quash the ACA.

“Second are all the regulatory modifications and changes that can be put into place,” Dr. Price said, noting that the Obama administration made 192 specific rules related to the ACA and published more than 5,000 letters of guidance. “We are going to go through every single one of those and ... if they help patients, we need to continue them. If they harm patients or increase costs, they need to be addressed.”

He added that additional legislation could be needed to address changes that cannot be made through the reconciliation process, such as addressing prescription drug costs and allowing health insurance to be sold across state lines.

Sections of the reconciliation package were introduced in the House Energy and Commerce and House Ways and Means Committees, covering areas relative to each committee’s jurisdiction. Taken together, they put forth the plan to repeal and replace certain revenue aspects of the ACA.

Provisions to repeal Medicaid expansion likely will prove the most problematic. The Energy and Commerce language calls for the repeal of Medicaid expansion provisions by 2020. It also repeals a requirement that state Medicaid plans offer the same minimum essential health benefits that are required by plans on the exchanges.

Starting in fiscal 2020, states would begin to receive a per capita allotment to fund their Medicaid programs, a fixed amount per Medicaid enrollee that will adjust over time for inflation using the consumer price index. States spending more than their annual allotment per beneficiary would be penalized with reduced funding in the following year.

That provision has run afoul of certain Republican senators whose votes are needed to gain a simple majority and pass the budget reconciliation package. Because of the slim nature of the Republican majority, any defection from the party line could endanger passage.

“We are concerned that any poorly implemented or poorly timed change in the current funding structure in Medicaid could result in a reduction in access to life-saving health care services,” Sen. Rob Portman (R-Ohio), Sen. Shelley Moore Capito (R-W.Va.), Sen. Cory Gardner (R-Colo.), and Sen. Lisa Murkowski (R-Alaska) said in a letter to Senate Majority Leader Mitch McConnell (R-Ky.). The letter was based on an earlier draft of the legislative language but remains valid as little substantive change has occurred in the formal, introduced language.

“We believe Medicaid needs to be reformed, but reform should not come at the cost of disruption in access to health care for our country’s most vulnerable and sickest individuals,” the senators continued. “Any changes made to how Medicaid is financed through the state and federal governments should be coupled with significant new flexibility so they can efficiently and effectively manage their Medicaid programs to best meet their own needs. ... [The House proposal] does not meet the test of stability for individuals currently enrolled in the program, and we will not support a plan that does not include stability for Medicaid expansion populations or flexibility for states.”

The Energy and Commerce language also includes provisions for block grants to states that would allow them to be used in a manner they see fit within a defined list, including providing financial assistance to high-risk individuals; arrangements that help stabilize premiums in the individual market; reduce the cost of providing insurance in the small group and individual markets; promoting participation in the small group and individual markets; and promoting access to preventive, dental, and vision services as well as treatment for mental and substance abuse disorders. Funds could also be used to provide payments for care or assistance to reduce out-of-pocket costs.

The House proposal also would repeal the premium cost sharing subsidies in the ACA, which would be replaced with refundable tax credits, according to the language released by the Ways and Means Committee.

The credit can be used to purchase a state-approved, major health insurance or unsubsidized COBRA (the Consolidated Omnibus Budget Reconciliation Act) coverage and increases based on age. Individuals younger than age 30 years would get $2,000, and the credit increases in $500 increments per 10-year age block, plateauing at $4,000 for those aged 60 years and older. The caps will adjust over time, based on inflation, and are available to those making up to $75,000 ($150,000 for joint filers); the credit phases out by $100 for every $1,000 over those thresholds.

The Ways and Means language also repeals a number of revenue provisions, including the individual mandate and associated penalties; the employer mandate and associated penalties; taxes on high-cost health plans (Cadillac tax); over-the-counter and prescription medications; health savings accounts; tanning; investment; and on health insurers.

In place of the individual mandate, the language will allow insurers to raise premiums by up to 30%.

The bill does not repeal the provisions regarding young adults being able to stay on their parents’ policies to the age of 26 years, nor does it allow insurers to deny coverage for preexisting conditions.

The House committees will begin consideration of their respective languages on March 8.

House Republicans have formally begun their efforts to repeal and replace the Affordable Care Act, but a group of four GOP senators could present a significant hurdle to getting the budget reconciliation package to the president’s desk.

The budget reconciliation language – introduced March 6 – represents the first of three phases in their planned effort to quash the ACA.

“Second are all the regulatory modifications and changes that can be put into place,” Dr. Price said, noting that the Obama administration made 192 specific rules related to the ACA and published more than 5,000 letters of guidance. “We are going to go through every single one of those and ... if they help patients, we need to continue them. If they harm patients or increase costs, they need to be addressed.”

He added that additional legislation could be needed to address changes that cannot be made through the reconciliation process, such as addressing prescription drug costs and allowing health insurance to be sold across state lines.

Sections of the reconciliation package were introduced in the House Energy and Commerce and House Ways and Means Committees, covering areas relative to each committee’s jurisdiction. Taken together, they put forth the plan to repeal and replace certain revenue aspects of the ACA.

Provisions to repeal Medicaid expansion likely will prove the most problematic. The Energy and Commerce language calls for the repeal of Medicaid expansion provisions by 2020. It also repeals a requirement that state Medicaid plans offer the same minimum essential health benefits that are required by plans on the exchanges.

Starting in fiscal 2020, states would begin to receive a per capita allotment to fund their Medicaid programs, a fixed amount per Medicaid enrollee that will adjust over time for inflation using the consumer price index. States spending more than their annual allotment per beneficiary would be penalized with reduced funding in the following year.

That provision has run afoul of certain Republican senators whose votes are needed to gain a simple majority and pass the budget reconciliation package. Because of the slim nature of the Republican majority, any defection from the party line could endanger passage.

“We are concerned that any poorly implemented or poorly timed change in the current funding structure in Medicaid could result in a reduction in access to life-saving health care services,” Sen. Rob Portman (R-Ohio), Sen. Shelley Moore Capito (R-W.Va.), Sen. Cory Gardner (R-Colo.), and Sen. Lisa Murkowski (R-Alaska) said in a letter to Senate Majority Leader Mitch McConnell (R-Ky.). The letter was based on an earlier draft of the legislative language but remains valid as little substantive change has occurred in the formal, introduced language.

“We believe Medicaid needs to be reformed, but reform should not come at the cost of disruption in access to health care for our country’s most vulnerable and sickest individuals,” the senators continued. “Any changes made to how Medicaid is financed through the state and federal governments should be coupled with significant new flexibility so they can efficiently and effectively manage their Medicaid programs to best meet their own needs. ... [The House proposal] does not meet the test of stability for individuals currently enrolled in the program, and we will not support a plan that does not include stability for Medicaid expansion populations or flexibility for states.”

The Energy and Commerce language also includes provisions for block grants to states that would allow them to be used in a manner they see fit within a defined list, including providing financial assistance to high-risk individuals; arrangements that help stabilize premiums in the individual market; reduce the cost of providing insurance in the small group and individual markets; promoting participation in the small group and individual markets; and promoting access to preventive, dental, and vision services as well as treatment for mental and substance abuse disorders. Funds could also be used to provide payments for care or assistance to reduce out-of-pocket costs.

The House proposal also would repeal the premium cost sharing subsidies in the ACA, which would be replaced with refundable tax credits, according to the language released by the Ways and Means Committee.

The credit can be used to purchase a state-approved, major health insurance or unsubsidized COBRA (the Consolidated Omnibus Budget Reconciliation Act) coverage and increases based on age. Individuals younger than age 30 years would get $2,000, and the credit increases in $500 increments per 10-year age block, plateauing at $4,000 for those aged 60 years and older. The caps will adjust over time, based on inflation, and are available to those making up to $75,000 ($150,000 for joint filers); the credit phases out by $100 for every $1,000 over those thresholds.

The Ways and Means language also repeals a number of revenue provisions, including the individual mandate and associated penalties; the employer mandate and associated penalties; taxes on high-cost health plans (Cadillac tax); over-the-counter and prescription medications; health savings accounts; tanning; investment; and on health insurers.

In place of the individual mandate, the language will allow insurers to raise premiums by up to 30%.

The bill does not repeal the provisions regarding young adults being able to stay on their parents’ policies to the age of 26 years, nor does it allow insurers to deny coverage for preexisting conditions.

The House committees will begin consideration of their respective languages on March 8.

Trump lays out principles for ACA replacement

Flexibility and choice were key themes in the health care reform vision President Trump outlined in his first speech to a joint session of Congress on Feb. 28.

Specifically, Americans should be able to “purchase their own coverage through the use of tax credits and expanded health savings accounts, but it must be the plan they want, not the plan forced on them by our government,” Mr. Trump said. They also should be able to purchase insurance across state lines, which “will create a truly competitive national marketplace that will bring costs way down and provide far better care.”

He also advocated providing more flexibility to states to improve Medicaid but did not provide any specifics on how that would be accomplished.

Finally, Mr. Trump called for “legal reforms that protect patients and doctors from unnecessary costs that drive up the price of insurance and work to bring down the artificially high price of drugs and bring them down immediately,” he said, adding that the Food and Drug Administration needs to slash the time to approval for drugs and other medical treatments.

Some of these concepts were mirrored in a talking-points memo from the House Republican leadership earlier in February.

According to the memo, Republican efforts to repeal and replace the ACA will focus on the following areas:

• Repealing the ACA’s Medicaid expansion and allowing states to choose between block grands or per capita grants for Medicaid funding. States could choose to use those grants and per capita grants to keep expansion.

• Rebranding high-risk pools as “state innovation grants” to provide states with flexibility to design coverage that meets the needs of their populations. States could use the innovation grants to reduce patient out-of-pocket costs, lower the cost of providing care, stabilize the individual and small-group markets, provide access to preventive care, and promote participation in private health care plans.

• Promoting health savings accounts tied to high-deductible plans through increasing maximum contribution limits and other administrative fixes to allow for greater flexibility in their use.

• Replacing ACA premium subsides with refundable flat tax credits. Credit would be age-based, with younger recipients receiving smaller credits and older taxpayers being eligible for more. Tax credits would be available to those who are not eligible to receive coverage through other sources, such as an employer or government program.

Many of these provisions were included in a health reform plan known as A Better Way, which was announced in June 2016 by House Speaker Paul Ryan (R-Wis.).

Like Mr. Trump’s outline to Congress, the GOP talking-points memo was light on specifics, including how the bill will be paid for, how much money will be distributed to states for Medicaid, and how these provisions would alter current insurance coverage rates, which government actuaries project would reach 91.5% by 2025 under current law.

The GOP talking-points memo followed a Feb. 10 discussion draft that included the legislative language required to implement these concepts and allowed insurers to charge higher premiums to people with coverage lapses; repealed a number of taxes imposed on insurers, pharmaceutical companies, and device manufacturers; eliminated many of the ACA’s essential benefits; and ended tax penalties on companies that do not provide coverage to their employees.

This proposal, however, is already running into opposition from House Republicans, with reports stating that blocks of Republicans would not approve of the provisions.

It also could run aground in the Senate, where Sen. Lamar Alexander (R-Tenn.), chairman of the Committee on Health, Education, Labor, and Pensions, has expressed his intent to tackle heath care reform in pieces (public programs, the individual market, and employer market) to avoid getting bogged down in one overarching piece of legislation.

Getting Republicans on the same page is going to be a huge hurdle to get any legislation passed long before it comes down to trying to secure any Democratic votes to help pass any replacement legislation.

As former House Speaker John Boehner told physicians and health care IT leaders at the HIMSS annual conference on Feb. 23, “In the 25 years that I served in the Unites States Congress, Republicans never ever one time agreed on what a health care proposal should look like. Not once. … If you repeal without replace, anything that happens is your fault. You broke it. … If you pass repeal without replace, you’ll never pass replace because they will never ever agree on what the [replacement] bill should be.”

Flexibility and choice were key themes in the health care reform vision President Trump outlined in his first speech to a joint session of Congress on Feb. 28.

Specifically, Americans should be able to “purchase their own coverage through the use of tax credits and expanded health savings accounts, but it must be the plan they want, not the plan forced on them by our government,” Mr. Trump said. They also should be able to purchase insurance across state lines, which “will create a truly competitive national marketplace that will bring costs way down and provide far better care.”

He also advocated providing more flexibility to states to improve Medicaid but did not provide any specifics on how that would be accomplished.

Finally, Mr. Trump called for “legal reforms that protect patients and doctors from unnecessary costs that drive up the price of insurance and work to bring down the artificially high price of drugs and bring them down immediately,” he said, adding that the Food and Drug Administration needs to slash the time to approval for drugs and other medical treatments.

Some of these concepts were mirrored in a talking-points memo from the House Republican leadership earlier in February.

According to the memo, Republican efforts to repeal and replace the ACA will focus on the following areas:

• Repealing the ACA’s Medicaid expansion and allowing states to choose between block grands or per capita grants for Medicaid funding. States could choose to use those grants and per capita grants to keep expansion.

• Rebranding high-risk pools as “state innovation grants” to provide states with flexibility to design coverage that meets the needs of their populations. States could use the innovation grants to reduce patient out-of-pocket costs, lower the cost of providing care, stabilize the individual and small-group markets, provide access to preventive care, and promote participation in private health care plans.