User login

Policy & Practice : Want more health reform news? Subscribe to our podcast – search 'Policy & Practice' in the iTunes store

Mortality Trends Diverge

While pregnancy-related deaths dropped around the world, the official number increased early in this decade among U.S. women, according to two reports. Worldwide pregnancy-related deaths dropped by a third during 1990–2008, from 546,000 to 358,000, according to the latest maternal mortality report from the United Nations and the World Bank. “Countries where women are facing a high risk of death during pregnancy or childbirth are taking measures that are proving effective; they are training more midwives, and strengthening hospitals and health [centers] to assist pregnant women,” Dr. Margaret Chan, Director-General of the U.N.'s World Health Organization, said in a statement. In the United States, increased reporting of pregnancy deaths put the number of women dying of maternal causes at 495 in 2003 and 540 in 2004, the Centers for Disease Control and Prevention reported. The U.S. figures translate to 12 deaths per 100,000 live births in 2003 and 13 deaths per 100,000 in 2004. In contrast, the worldwide report said that the 2008 rate of maternal death was 290 per 100,000 live births in developing parts of the world. The U.S. increase “largely reflects the use by an increasing number of states of a separate item on the death certificate indicating pregnancy status of the decedent,” according to the CDC report. It acknowledged that an increasing number of cesarean sections and maternal obesity could be partly to blame.

Pregnancy Prevention Funded

The Department of Health and Human Services has granted $155 million to states, nonprofit organizations, schools, and universities to support teen pregnancy prevention programs that have been tested and proved effective, the agency said. “This investment will help bring evidence-based initiatives to more communities across the country while also testing new approaches so we can expand our toolkit of effective interventions,” HHS Secretary Kathleen Sebelius said in a statement. About $100 million will come from the existing Teen Pregnancy Prevention program, and the rest is from the new Affordable Care Act and the Personal Responsibility Education Program it created.

Planned Parenthood Case Moves On

A criminal case against a Kansas City, Kan., Planned Parenthood clinic is moving forward, after the state's Supreme Court refused to dismiss charges that the clinic conducted illegal late-term abortions and falsified records. The criminal complaint, filed in 2007 by the state's district attorney, includes 23 felonies and 84 misdemeanors, the Kansas City Star reported. The clinic is alleged to have done late-term abortions without finding that they were medically necessary. Planned Parenthood has denied all charges. The district attorney at the time, Phill Kline, had earlier as the state's attorney general launched an investigation into Wichita abortion provider Dr. George Tiller as well as the Kansas City Planned Parenthood clinic. Dr. Tiller went on trial in March 2009 and was acquitted of all charges. He was shot to death 2 months later by an antiabortion activist.

Productivity, Ownership Linked

Billable work per patient appears to be increasing only at physician groups under the “private practice model,” but expenses have also grown, according to a Medical Group Management Association study. Over the past 5 years, relative value units per patient rose by 13% at private medical practices but declined nearly 18% at practices owned by hospitals or integrated delivery systems, analysts found. Meanwhile, operating costs for private practices increased by nearly 2% last year, in contrast to a slight decline for practices owned by the larger entities. MGMA attributed part of the increase in expenses for private practices to the cost of implementing electronic health record systems. “In the private practice model, EHR incentives have provided a catalyst for practices to purchase systems and deploy electronic health records, therefore increasing the practice's information technology expenditures,” Kenneth Hertz, a principal with MGMA Health Care Consulting Group, said in a statement.

Nursing Expansion Called For

Nurses' roles and responsibilities should change significantly to meet the increased demand for care created by health care reform, according to an Institute of Medicine report that immediately drew criticism from the American Medical Association. The report urged removal of regulatory and institutional obstacles to nurses taking on additional patient-care duties. To handle these new responsibilities, nurses should receive higher levels of training through an improved education system, including a new residency program and additional opportunities for lifelong learning, the institute report said. The AMA took issue with the report's call to expand nurses' scope of practice, saying that nurse practitioners don't have nearly the amount of training and clinical experience that doctors do. “With a shortage of both nurses and physicians, increasing the responsibility of nurses is not the answer to the physician shortage,” AMA board member Dr. Rebecca J. Patchin said in a statement.

Mortality Trends Diverge

While pregnancy-related deaths dropped around the world, the official number increased early in this decade among U.S. women, according to two reports. Worldwide pregnancy-related deaths dropped by a third during 1990–2008, from 546,000 to 358,000, according to the latest maternal mortality report from the United Nations and the World Bank. “Countries where women are facing a high risk of death during pregnancy or childbirth are taking measures that are proving effective; they are training more midwives, and strengthening hospitals and health [centers] to assist pregnant women,” Dr. Margaret Chan, Director-General of the U.N.'s World Health Organization, said in a statement. In the United States, increased reporting of pregnancy deaths put the number of women dying of maternal causes at 495 in 2003 and 540 in 2004, the Centers for Disease Control and Prevention reported. The U.S. figures translate to 12 deaths per 100,000 live births in 2003 and 13 deaths per 100,000 in 2004. In contrast, the worldwide report said that the 2008 rate of maternal death was 290 per 100,000 live births in developing parts of the world. The U.S. increase “largely reflects the use by an increasing number of states of a separate item on the death certificate indicating pregnancy status of the decedent,” according to the CDC report. It acknowledged that an increasing number of cesarean sections and maternal obesity could be partly to blame.

Pregnancy Prevention Funded

The Department of Health and Human Services has granted $155 million to states, nonprofit organizations, schools, and universities to support teen pregnancy prevention programs that have been tested and proved effective, the agency said. “This investment will help bring evidence-based initiatives to more communities across the country while also testing new approaches so we can expand our toolkit of effective interventions,” HHS Secretary Kathleen Sebelius said in a statement. About $100 million will come from the existing Teen Pregnancy Prevention program, and the rest is from the new Affordable Care Act and the Personal Responsibility Education Program it created.

Planned Parenthood Case Moves On

A criminal case against a Kansas City, Kan., Planned Parenthood clinic is moving forward, after the state's Supreme Court refused to dismiss charges that the clinic conducted illegal late-term abortions and falsified records. The criminal complaint, filed in 2007 by the state's district attorney, includes 23 felonies and 84 misdemeanors, the Kansas City Star reported. The clinic is alleged to have done late-term abortions without finding that they were medically necessary. Planned Parenthood has denied all charges. The district attorney at the time, Phill Kline, had earlier as the state's attorney general launched an investigation into Wichita abortion provider Dr. George Tiller as well as the Kansas City Planned Parenthood clinic. Dr. Tiller went on trial in March 2009 and was acquitted of all charges. He was shot to death 2 months later by an antiabortion activist.

Productivity, Ownership Linked

Billable work per patient appears to be increasing only at physician groups under the “private practice model,” but expenses have also grown, according to a Medical Group Management Association study. Over the past 5 years, relative value units per patient rose by 13% at private medical practices but declined nearly 18% at practices owned by hospitals or integrated delivery systems, analysts found. Meanwhile, operating costs for private practices increased by nearly 2% last year, in contrast to a slight decline for practices owned by the larger entities. MGMA attributed part of the increase in expenses for private practices to the cost of implementing electronic health record systems. “In the private practice model, EHR incentives have provided a catalyst for practices to purchase systems and deploy electronic health records, therefore increasing the practice's information technology expenditures,” Kenneth Hertz, a principal with MGMA Health Care Consulting Group, said in a statement.

Nursing Expansion Called For

Nurses' roles and responsibilities should change significantly to meet the increased demand for care created by health care reform, according to an Institute of Medicine report that immediately drew criticism from the American Medical Association. The report urged removal of regulatory and institutional obstacles to nurses taking on additional patient-care duties. To handle these new responsibilities, nurses should receive higher levels of training through an improved education system, including a new residency program and additional opportunities for lifelong learning, the institute report said. The AMA took issue with the report's call to expand nurses' scope of practice, saying that nurse practitioners don't have nearly the amount of training and clinical experience that doctors do. “With a shortage of both nurses and physicians, increasing the responsibility of nurses is not the answer to the physician shortage,” AMA board member Dr. Rebecca J. Patchin said in a statement.

Mortality Trends Diverge

While pregnancy-related deaths dropped around the world, the official number increased early in this decade among U.S. women, according to two reports. Worldwide pregnancy-related deaths dropped by a third during 1990–2008, from 546,000 to 358,000, according to the latest maternal mortality report from the United Nations and the World Bank. “Countries where women are facing a high risk of death during pregnancy or childbirth are taking measures that are proving effective; they are training more midwives, and strengthening hospitals and health [centers] to assist pregnant women,” Dr. Margaret Chan, Director-General of the U.N.'s World Health Organization, said in a statement. In the United States, increased reporting of pregnancy deaths put the number of women dying of maternal causes at 495 in 2003 and 540 in 2004, the Centers for Disease Control and Prevention reported. The U.S. figures translate to 12 deaths per 100,000 live births in 2003 and 13 deaths per 100,000 in 2004. In contrast, the worldwide report said that the 2008 rate of maternal death was 290 per 100,000 live births in developing parts of the world. The U.S. increase “largely reflects the use by an increasing number of states of a separate item on the death certificate indicating pregnancy status of the decedent,” according to the CDC report. It acknowledged that an increasing number of cesarean sections and maternal obesity could be partly to blame.

Pregnancy Prevention Funded

The Department of Health and Human Services has granted $155 million to states, nonprofit organizations, schools, and universities to support teen pregnancy prevention programs that have been tested and proved effective, the agency said. “This investment will help bring evidence-based initiatives to more communities across the country while also testing new approaches so we can expand our toolkit of effective interventions,” HHS Secretary Kathleen Sebelius said in a statement. About $100 million will come from the existing Teen Pregnancy Prevention program, and the rest is from the new Affordable Care Act and the Personal Responsibility Education Program it created.

Planned Parenthood Case Moves On

A criminal case against a Kansas City, Kan., Planned Parenthood clinic is moving forward, after the state's Supreme Court refused to dismiss charges that the clinic conducted illegal late-term abortions and falsified records. The criminal complaint, filed in 2007 by the state's district attorney, includes 23 felonies and 84 misdemeanors, the Kansas City Star reported. The clinic is alleged to have done late-term abortions without finding that they were medically necessary. Planned Parenthood has denied all charges. The district attorney at the time, Phill Kline, had earlier as the state's attorney general launched an investigation into Wichita abortion provider Dr. George Tiller as well as the Kansas City Planned Parenthood clinic. Dr. Tiller went on trial in March 2009 and was acquitted of all charges. He was shot to death 2 months later by an antiabortion activist.

Productivity, Ownership Linked

Billable work per patient appears to be increasing only at physician groups under the “private practice model,” but expenses have also grown, according to a Medical Group Management Association study. Over the past 5 years, relative value units per patient rose by 13% at private medical practices but declined nearly 18% at practices owned by hospitals or integrated delivery systems, analysts found. Meanwhile, operating costs for private practices increased by nearly 2% last year, in contrast to a slight decline for practices owned by the larger entities. MGMA attributed part of the increase in expenses for private practices to the cost of implementing electronic health record systems. “In the private practice model, EHR incentives have provided a catalyst for practices to purchase systems and deploy electronic health records, therefore increasing the practice's information technology expenditures,” Kenneth Hertz, a principal with MGMA Health Care Consulting Group, said in a statement.

Nursing Expansion Called For

Nurses' roles and responsibilities should change significantly to meet the increased demand for care created by health care reform, according to an Institute of Medicine report that immediately drew criticism from the American Medical Association. The report urged removal of regulatory and institutional obstacles to nurses taking on additional patient-care duties. To handle these new responsibilities, nurses should receive higher levels of training through an improved education system, including a new residency program and additional opportunities for lifelong learning, the institute report said. The AMA took issue with the report's call to expand nurses' scope of practice, saying that nurse practitioners don't have nearly the amount of training and clinical experience that doctors do. “With a shortage of both nurses and physicians, increasing the responsibility of nurses is not the answer to the physician shortage,” AMA board member Dr. Rebecca J. Patchin said in a statement.

Reports Shows Progress, Pitfalls in Women's Health Research

WASHINGTON — Over the past 2 decades, women's mortality from cardiovascular disease and breast and cervical cancer has declined, thanks to research focused on women's health; however, little progress has been made in addressing debilitating conditions such as autoimmune diseases, addiction, lung cancer, and dementia, according to an Institute of Medicine committee.

“We are pleased with how much progress has been made, but there are some caveats,” Nancy E. Adler, Ph.D., chair of the IOM Committee on Women's Health Research and director of the Center for Health and Community at the University of California, San Francisco, said at the press briefing.

Based on the report, “Women's Health Research: Progress, Pitfalls, and Promise,” the committee recommended:

▸ Undertaking initiatives that increase research in high-risk populations of women;

▸ Ensuring adequate participation of women in research and analysis of data by sex; and

▸ Creation of a task force to communicate health messages about research results to women and prevent them from receiving conflicting messages from various venues.

Communication is one area in which office-based physicians can play an important role, translating research into their practices, said committee member Alina Salganicoff, Ph.D., vice president and director of women's health policy at the Kaiser Family Foundation.

“Their recommendations hold a lot of weight” with their patients, Dr. Salganicoff said.

The report comes 20 years after the creation of the Office of Research on Women's Health at the National Institutes of Health and 25 years after a Public Health Service task force concluded that excluding women from medical research had compromised women's health care.

Before those landmark events, women were not included in research studies as often as men were because of concerns about fetal exposure to potentially harmful substances, the “flux” of hormones, and the assumption that research findings in men would translate to women, according to the report.

The committee found that requiring researchers to enroll women in clinical trials had resulted in advances, yet the benefit of increased participation by women has not yet reached its full potential because researchers usually don't separate the results by sex.

Committee members could not pinpoint why progress was made in some conditions and not others, according to the report, which offered possible explanations such as the extent of attention from government agencies, interest from researchers, understanding of the condition, and political and social barriers.

In addition to major progress in cardiovascular diseases and breast and cervical cancers, the report noted that some progress had been made in reducing the burden of conditions such as depression, HIV/AIDS, and osteoporosis in women.

However, there has been little progress having an impact on conditions such as unintended pregnancy, maternal morbidity and mortality, autoimmune diseases, addiction, lung cancer, gynecologic cancers other than cervical cancer, and Alzheimer's disease, according to the report.

“Knowledge about differences in manifestation of diseases is crucial for further studies to identify the underlying biology of disease in women vs. men and to develop appropriate prevention, diagnosis, and treatment strategies for women,” they wrote.

WASHINGTON — Over the past 2 decades, women's mortality from cardiovascular disease and breast and cervical cancer has declined, thanks to research focused on women's health; however, little progress has been made in addressing debilitating conditions such as autoimmune diseases, addiction, lung cancer, and dementia, according to an Institute of Medicine committee.

“We are pleased with how much progress has been made, but there are some caveats,” Nancy E. Adler, Ph.D., chair of the IOM Committee on Women's Health Research and director of the Center for Health and Community at the University of California, San Francisco, said at the press briefing.

Based on the report, “Women's Health Research: Progress, Pitfalls, and Promise,” the committee recommended:

▸ Undertaking initiatives that increase research in high-risk populations of women;

▸ Ensuring adequate participation of women in research and analysis of data by sex; and

▸ Creation of a task force to communicate health messages about research results to women and prevent them from receiving conflicting messages from various venues.

Communication is one area in which office-based physicians can play an important role, translating research into their practices, said committee member Alina Salganicoff, Ph.D., vice president and director of women's health policy at the Kaiser Family Foundation.

“Their recommendations hold a lot of weight” with their patients, Dr. Salganicoff said.

The report comes 20 years after the creation of the Office of Research on Women's Health at the National Institutes of Health and 25 years after a Public Health Service task force concluded that excluding women from medical research had compromised women's health care.

Before those landmark events, women were not included in research studies as often as men were because of concerns about fetal exposure to potentially harmful substances, the “flux” of hormones, and the assumption that research findings in men would translate to women, according to the report.

The committee found that requiring researchers to enroll women in clinical trials had resulted in advances, yet the benefit of increased participation by women has not yet reached its full potential because researchers usually don't separate the results by sex.

Committee members could not pinpoint why progress was made in some conditions and not others, according to the report, which offered possible explanations such as the extent of attention from government agencies, interest from researchers, understanding of the condition, and political and social barriers.

In addition to major progress in cardiovascular diseases and breast and cervical cancers, the report noted that some progress had been made in reducing the burden of conditions such as depression, HIV/AIDS, and osteoporosis in women.

However, there has been little progress having an impact on conditions such as unintended pregnancy, maternal morbidity and mortality, autoimmune diseases, addiction, lung cancer, gynecologic cancers other than cervical cancer, and Alzheimer's disease, according to the report.

“Knowledge about differences in manifestation of diseases is crucial for further studies to identify the underlying biology of disease in women vs. men and to develop appropriate prevention, diagnosis, and treatment strategies for women,” they wrote.

WASHINGTON — Over the past 2 decades, women's mortality from cardiovascular disease and breast and cervical cancer has declined, thanks to research focused on women's health; however, little progress has been made in addressing debilitating conditions such as autoimmune diseases, addiction, lung cancer, and dementia, according to an Institute of Medicine committee.

“We are pleased with how much progress has been made, but there are some caveats,” Nancy E. Adler, Ph.D., chair of the IOM Committee on Women's Health Research and director of the Center for Health and Community at the University of California, San Francisco, said at the press briefing.

Based on the report, “Women's Health Research: Progress, Pitfalls, and Promise,” the committee recommended:

▸ Undertaking initiatives that increase research in high-risk populations of women;

▸ Ensuring adequate participation of women in research and analysis of data by sex; and

▸ Creation of a task force to communicate health messages about research results to women and prevent them from receiving conflicting messages from various venues.

Communication is one area in which office-based physicians can play an important role, translating research into their practices, said committee member Alina Salganicoff, Ph.D., vice president and director of women's health policy at the Kaiser Family Foundation.

“Their recommendations hold a lot of weight” with their patients, Dr. Salganicoff said.

The report comes 20 years after the creation of the Office of Research on Women's Health at the National Institutes of Health and 25 years after a Public Health Service task force concluded that excluding women from medical research had compromised women's health care.

Before those landmark events, women were not included in research studies as often as men were because of concerns about fetal exposure to potentially harmful substances, the “flux” of hormones, and the assumption that research findings in men would translate to women, according to the report.

The committee found that requiring researchers to enroll women in clinical trials had resulted in advances, yet the benefit of increased participation by women has not yet reached its full potential because researchers usually don't separate the results by sex.

Committee members could not pinpoint why progress was made in some conditions and not others, according to the report, which offered possible explanations such as the extent of attention from government agencies, interest from researchers, understanding of the condition, and political and social barriers.

In addition to major progress in cardiovascular diseases and breast and cervical cancers, the report noted that some progress had been made in reducing the burden of conditions such as depression, HIV/AIDS, and osteoporosis in women.

However, there has been little progress having an impact on conditions such as unintended pregnancy, maternal morbidity and mortality, autoimmune diseases, addiction, lung cancer, gynecologic cancers other than cervical cancer, and Alzheimer's disease, according to the report.

“Knowledge about differences in manifestation of diseases is crucial for further studies to identify the underlying biology of disease in women vs. men and to develop appropriate prevention, diagnosis, and treatment strategies for women,” they wrote.

From a Press Briefing Held by the Institute of Medicine

Policy & Practice : Want more health reform news? Subscribe to our podcast – search 'Policy & Practice' in the iTunes store

VA Adds to Agent Orange List

The Department of Veterans Affairs has added Parkinson's disease to its list of disabilities presumed to be associated with exposure to Agent Orange, the blend of herbicides used by the U.S. military to remove jungle cover during the Vietnam War. VA Secretary Eric K. Shinseki announced that a new federal rule also added hairy cell and other chronic B-cell leukemia and ischemic heart disease to the list of about a dozen diseases with “presumption of service connection.” The action means that veterans no longer must prove an association between their illnesses and exposure to Agent Orange to get VA health care and other benefits.

In addition to accepting new claims for the three diseases, the VA will review about 90,000 previously denied claims from Vietnam vets, Mr. Shinseki said on the White House blog. “This rule is long overdue. It delivers justice to those who have suffered from Agent Orange's toxic effects for 40 years,” said Mr. Shinseki. Acute and subacute peripheral neuropathy was already on the list of presumed Agent Orange—linked conditions.

Bill Would Raise Alzheimer's Funds

Rep. Michael Burgess (R-Tex.) wants Americans to buy bonds for the war effort — the war on Alzheimer's disease, that is. Rep. Burgess, an ob.gyn., has introduced H.R. 6169, the Making Investments Now for Dementia (MIND) Act, which would create U.S. “Alzheimer's Bonds.” Proceeds of sales would go to the National Institutes of Health but would solely fund Alzheimer's research. The funds would be in addition to those appropriated normally, the bill states. In announcing his proposal, Rep. Burgess said that “Alzheimer's disease is one of the most burdensome diseases facing Americans today, taking an immense emotional, physical, and financial toll on those affected … yet research funding is not equivalent to other comparable illnesses.”

Two New Udall Centers Added

The National Institute of Neurological Disorders and Stroke has named Emory University in Atlanta and the Feinstein Institute for Medical Research, Manhasset, N.Y., as Morris K. Udall Centers of Excellence in Parkinson's Disease Research. The two centers will receive a total of more than $16 million over the next 5 years, bringing the number of Udall Centers to 11. With a component at Vanderbilt University, Nashville, Tenn., the Emory University program will focus on the mechanisms of existing and new Parkinson's treatments. The center at the Feinstein Institute will explore a new brain-imaging technique and the clinical side effects of levodopa, according to the announcement. Morris K. Udall was a Democratic representative from Arizona who died in 1998 after a battle with Parkinson's disease.

Botox Maker Fined $600 Million

Pharmaceutical manufacturer Allergan pleaded guilty to marketing Botox for the unapproved uses “headache, pain, spasticity, and juvenile cerebral palsy in children” from 2000 to 2005, the company announced. Although it pleaded guilty only to a single misdemeanor charge — “misbranding” — Allergan will pay a $375 million criminal fine. Another $225 million will settle a civil claim under the False Claims Act. Allergan admitted that it marketed Botox for the off-label uses. On the other hand, it said, “Allergan denies liability” associated with the civil claim but settled it for the good of stockholders.

As part of the settlement — still subject to approval by a federal court — Allergan agreed to withdraw a pending lawsuit claiming a First Amendment right to “proactively share truthful scientific and medical information with the medical community to assist physicians” in how to use Botox. The company also pointed out that as of last March, Botox has been approved for treating muscle stiffness in adults with upper limb spasticity.

Proposed New Rules Target Fraud

The Department of Health and Human Services has proposed new rules to fight waste, fraud, and abuse in Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). The rules are authorized by the Affordable Care Act and would tighten screening of providers wishing to bill the government programs for services, for example, by using broader criminal background checks and even fingerprinting. The rules also require states to terminate from their Medicaid and CHIP programs any provider who has been thrown out of Medicare or another state's health programs. The proposed rule asked for advice on how best to ensure provider compliance.

VA Adds to Agent Orange List

The Department of Veterans Affairs has added Parkinson's disease to its list of disabilities presumed to be associated with exposure to Agent Orange, the blend of herbicides used by the U.S. military to remove jungle cover during the Vietnam War. VA Secretary Eric K. Shinseki announced that a new federal rule also added hairy cell and other chronic B-cell leukemia and ischemic heart disease to the list of about a dozen diseases with “presumption of service connection.” The action means that veterans no longer must prove an association between their illnesses and exposure to Agent Orange to get VA health care and other benefits.

In addition to accepting new claims for the three diseases, the VA will review about 90,000 previously denied claims from Vietnam vets, Mr. Shinseki said on the White House blog. “This rule is long overdue. It delivers justice to those who have suffered from Agent Orange's toxic effects for 40 years,” said Mr. Shinseki. Acute and subacute peripheral neuropathy was already on the list of presumed Agent Orange—linked conditions.

Bill Would Raise Alzheimer's Funds

Rep. Michael Burgess (R-Tex.) wants Americans to buy bonds for the war effort — the war on Alzheimer's disease, that is. Rep. Burgess, an ob.gyn., has introduced H.R. 6169, the Making Investments Now for Dementia (MIND) Act, which would create U.S. “Alzheimer's Bonds.” Proceeds of sales would go to the National Institutes of Health but would solely fund Alzheimer's research. The funds would be in addition to those appropriated normally, the bill states. In announcing his proposal, Rep. Burgess said that “Alzheimer's disease is one of the most burdensome diseases facing Americans today, taking an immense emotional, physical, and financial toll on those affected … yet research funding is not equivalent to other comparable illnesses.”

Two New Udall Centers Added

The National Institute of Neurological Disorders and Stroke has named Emory University in Atlanta and the Feinstein Institute for Medical Research, Manhasset, N.Y., as Morris K. Udall Centers of Excellence in Parkinson's Disease Research. The two centers will receive a total of more than $16 million over the next 5 years, bringing the number of Udall Centers to 11. With a component at Vanderbilt University, Nashville, Tenn., the Emory University program will focus on the mechanisms of existing and new Parkinson's treatments. The center at the Feinstein Institute will explore a new brain-imaging technique and the clinical side effects of levodopa, according to the announcement. Morris K. Udall was a Democratic representative from Arizona who died in 1998 after a battle with Parkinson's disease.

Botox Maker Fined $600 Million

Pharmaceutical manufacturer Allergan pleaded guilty to marketing Botox for the unapproved uses “headache, pain, spasticity, and juvenile cerebral palsy in children” from 2000 to 2005, the company announced. Although it pleaded guilty only to a single misdemeanor charge — “misbranding” — Allergan will pay a $375 million criminal fine. Another $225 million will settle a civil claim under the False Claims Act. Allergan admitted that it marketed Botox for the off-label uses. On the other hand, it said, “Allergan denies liability” associated with the civil claim but settled it for the good of stockholders.

As part of the settlement — still subject to approval by a federal court — Allergan agreed to withdraw a pending lawsuit claiming a First Amendment right to “proactively share truthful scientific and medical information with the medical community to assist physicians” in how to use Botox. The company also pointed out that as of last March, Botox has been approved for treating muscle stiffness in adults with upper limb spasticity.

Proposed New Rules Target Fraud

The Department of Health and Human Services has proposed new rules to fight waste, fraud, and abuse in Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). The rules are authorized by the Affordable Care Act and would tighten screening of providers wishing to bill the government programs for services, for example, by using broader criminal background checks and even fingerprinting. The rules also require states to terminate from their Medicaid and CHIP programs any provider who has been thrown out of Medicare or another state's health programs. The proposed rule asked for advice on how best to ensure provider compliance.

VA Adds to Agent Orange List

The Department of Veterans Affairs has added Parkinson's disease to its list of disabilities presumed to be associated with exposure to Agent Orange, the blend of herbicides used by the U.S. military to remove jungle cover during the Vietnam War. VA Secretary Eric K. Shinseki announced that a new federal rule also added hairy cell and other chronic B-cell leukemia and ischemic heart disease to the list of about a dozen diseases with “presumption of service connection.” The action means that veterans no longer must prove an association between their illnesses and exposure to Agent Orange to get VA health care and other benefits.

In addition to accepting new claims for the three diseases, the VA will review about 90,000 previously denied claims from Vietnam vets, Mr. Shinseki said on the White House blog. “This rule is long overdue. It delivers justice to those who have suffered from Agent Orange's toxic effects for 40 years,” said Mr. Shinseki. Acute and subacute peripheral neuropathy was already on the list of presumed Agent Orange—linked conditions.

Bill Would Raise Alzheimer's Funds

Rep. Michael Burgess (R-Tex.) wants Americans to buy bonds for the war effort — the war on Alzheimer's disease, that is. Rep. Burgess, an ob.gyn., has introduced H.R. 6169, the Making Investments Now for Dementia (MIND) Act, which would create U.S. “Alzheimer's Bonds.” Proceeds of sales would go to the National Institutes of Health but would solely fund Alzheimer's research. The funds would be in addition to those appropriated normally, the bill states. In announcing his proposal, Rep. Burgess said that “Alzheimer's disease is one of the most burdensome diseases facing Americans today, taking an immense emotional, physical, and financial toll on those affected … yet research funding is not equivalent to other comparable illnesses.”

Two New Udall Centers Added

The National Institute of Neurological Disorders and Stroke has named Emory University in Atlanta and the Feinstein Institute for Medical Research, Manhasset, N.Y., as Morris K. Udall Centers of Excellence in Parkinson's Disease Research. The two centers will receive a total of more than $16 million over the next 5 years, bringing the number of Udall Centers to 11. With a component at Vanderbilt University, Nashville, Tenn., the Emory University program will focus on the mechanisms of existing and new Parkinson's treatments. The center at the Feinstein Institute will explore a new brain-imaging technique and the clinical side effects of levodopa, according to the announcement. Morris K. Udall was a Democratic representative from Arizona who died in 1998 after a battle with Parkinson's disease.

Botox Maker Fined $600 Million

Pharmaceutical manufacturer Allergan pleaded guilty to marketing Botox for the unapproved uses “headache, pain, spasticity, and juvenile cerebral palsy in children” from 2000 to 2005, the company announced. Although it pleaded guilty only to a single misdemeanor charge — “misbranding” — Allergan will pay a $375 million criminal fine. Another $225 million will settle a civil claim under the False Claims Act. Allergan admitted that it marketed Botox for the off-label uses. On the other hand, it said, “Allergan denies liability” associated with the civil claim but settled it for the good of stockholders.

As part of the settlement — still subject to approval by a federal court — Allergan agreed to withdraw a pending lawsuit claiming a First Amendment right to “proactively share truthful scientific and medical information with the medical community to assist physicians” in how to use Botox. The company also pointed out that as of last March, Botox has been approved for treating muscle stiffness in adults with upper limb spasticity.

Proposed New Rules Target Fraud

The Department of Health and Human Services has proposed new rules to fight waste, fraud, and abuse in Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). The rules are authorized by the Affordable Care Act and would tighten screening of providers wishing to bill the government programs for services, for example, by using broader criminal background checks and even fingerprinting. The rules also require states to terminate from their Medicaid and CHIP programs any provider who has been thrown out of Medicare or another state's health programs. The proposed rule asked for advice on how best to ensure provider compliance.

Health Spending Expected to Reach $4.6 Trillion by 2019

Major Finding: U.S. health care spending is projected to rise to about $4.6 trillion by 2019, growing at an average rate of 6.3% a year.

Data Source: Centers for Medicare and Medicaid Services, Office of the Actuary.

Disclosures: The authors had no relevant financial disclosures.

WASHINGTON — By 2019, nearly 93% of U.S. residents will be covered by health insurance, with nearly 20% of the gross domestic product being consumed in the process, federal actuaries announced at a press briefing.

U.S. health spending is expected to grow on an average annual rate of 6.3% over the next 10 years, 0.2% faster than was projected before passage of the Affordable Care Act (ACA), and reach an estimated $4.6 trillion by 2019, according to an analysis by officials in Office the Actuary at the Centers for Medicare and Medicaid Services (Health Affairs 2010 Sept. 9 [doi:10.1377/hlthaff.2010.0788]).

The projections update an analysis done in February. This time, they take into account the impact of the ACA as well as changes to COBRA premium subsidies and Medicare physician fee schedule.

With those changes, the average annual growth rate for health care spending will increase from 6.1% before reform to 6.3% after, according to the authors.

“While the estimated net impact of the Affordable Care Act and other legislative and regulatory changes on national health spending are moderate, the underlying effects of these changes on coverage and financing are more pronounced,” Andrea Sisko, lead author of the analysis and a CMS economist, said during the press briefing.

Meanwhile, the implementation of ACA provisions including the Pre-Existing Condition Insurance Plan and the extension of coverage of dependents under age 26 years are estimated to increase national health spending by $10.2 billion through 2013, according to the analysis.

Nancy-Ann DeParle, director of the White House Office of Health Reform, wrote in a blog post that the “report by the Office of the Actuary confirms a central point of the Affordable Care Act passed by Congress and signed by President Obama: The Act will make health care more affordable for all Americans with insurance.”

She added that by 2019, per capita health spending will average $14,720 instead of the $16,120 projected by the Actuary before the Act was enacted into law. “A close look at this report's data suggest that for average Americans, the Affordable Care Act will live up to its promise,” she wrote.

This year, health spending is projected to reach $2.6 trillion −17.5% of the gross domestic product – a 0.2% increase from the pre-reform projections. Authors noted the increase is driven largely by postponement of physician payment cuts under the Medicare sustainable growth rate (SGR) formula and changes to the COBRA legislations.

The major spike in health spending will be in 2014 when an additional 30 million Americans are expected to gain coverage. Overall spending is projected to increase 9.2% that year, compared with the 6.6% that was estimated in February.

Major Finding: U.S. health care spending is projected to rise to about $4.6 trillion by 2019, growing at an average rate of 6.3% a year.

Data Source: Centers for Medicare and Medicaid Services, Office of the Actuary.

Disclosures: The authors had no relevant financial disclosures.

WASHINGTON — By 2019, nearly 93% of U.S. residents will be covered by health insurance, with nearly 20% of the gross domestic product being consumed in the process, federal actuaries announced at a press briefing.

U.S. health spending is expected to grow on an average annual rate of 6.3% over the next 10 years, 0.2% faster than was projected before passage of the Affordable Care Act (ACA), and reach an estimated $4.6 trillion by 2019, according to an analysis by officials in Office the Actuary at the Centers for Medicare and Medicaid Services (Health Affairs 2010 Sept. 9 [doi:10.1377/hlthaff.2010.0788]).

The projections update an analysis done in February. This time, they take into account the impact of the ACA as well as changes to COBRA premium subsidies and Medicare physician fee schedule.

With those changes, the average annual growth rate for health care spending will increase from 6.1% before reform to 6.3% after, according to the authors.

“While the estimated net impact of the Affordable Care Act and other legislative and regulatory changes on national health spending are moderate, the underlying effects of these changes on coverage and financing are more pronounced,” Andrea Sisko, lead author of the analysis and a CMS economist, said during the press briefing.

Meanwhile, the implementation of ACA provisions including the Pre-Existing Condition Insurance Plan and the extension of coverage of dependents under age 26 years are estimated to increase national health spending by $10.2 billion through 2013, according to the analysis.

Nancy-Ann DeParle, director of the White House Office of Health Reform, wrote in a blog post that the “report by the Office of the Actuary confirms a central point of the Affordable Care Act passed by Congress and signed by President Obama: The Act will make health care more affordable for all Americans with insurance.”

She added that by 2019, per capita health spending will average $14,720 instead of the $16,120 projected by the Actuary before the Act was enacted into law. “A close look at this report's data suggest that for average Americans, the Affordable Care Act will live up to its promise,” she wrote.

This year, health spending is projected to reach $2.6 trillion −17.5% of the gross domestic product – a 0.2% increase from the pre-reform projections. Authors noted the increase is driven largely by postponement of physician payment cuts under the Medicare sustainable growth rate (SGR) formula and changes to the COBRA legislations.

The major spike in health spending will be in 2014 when an additional 30 million Americans are expected to gain coverage. Overall spending is projected to increase 9.2% that year, compared with the 6.6% that was estimated in February.

Major Finding: U.S. health care spending is projected to rise to about $4.6 trillion by 2019, growing at an average rate of 6.3% a year.

Data Source: Centers for Medicare and Medicaid Services, Office of the Actuary.

Disclosures: The authors had no relevant financial disclosures.

WASHINGTON — By 2019, nearly 93% of U.S. residents will be covered by health insurance, with nearly 20% of the gross domestic product being consumed in the process, federal actuaries announced at a press briefing.

U.S. health spending is expected to grow on an average annual rate of 6.3% over the next 10 years, 0.2% faster than was projected before passage of the Affordable Care Act (ACA), and reach an estimated $4.6 trillion by 2019, according to an analysis by officials in Office the Actuary at the Centers for Medicare and Medicaid Services (Health Affairs 2010 Sept. 9 [doi:10.1377/hlthaff.2010.0788]).

The projections update an analysis done in February. This time, they take into account the impact of the ACA as well as changes to COBRA premium subsidies and Medicare physician fee schedule.

With those changes, the average annual growth rate for health care spending will increase from 6.1% before reform to 6.3% after, according to the authors.

“While the estimated net impact of the Affordable Care Act and other legislative and regulatory changes on national health spending are moderate, the underlying effects of these changes on coverage and financing are more pronounced,” Andrea Sisko, lead author of the analysis and a CMS economist, said during the press briefing.

Meanwhile, the implementation of ACA provisions including the Pre-Existing Condition Insurance Plan and the extension of coverage of dependents under age 26 years are estimated to increase national health spending by $10.2 billion through 2013, according to the analysis.

Nancy-Ann DeParle, director of the White House Office of Health Reform, wrote in a blog post that the “report by the Office of the Actuary confirms a central point of the Affordable Care Act passed by Congress and signed by President Obama: The Act will make health care more affordable for all Americans with insurance.”

She added that by 2019, per capita health spending will average $14,720 instead of the $16,120 projected by the Actuary before the Act was enacted into law. “A close look at this report's data suggest that for average Americans, the Affordable Care Act will live up to its promise,” she wrote.

This year, health spending is projected to reach $2.6 trillion −17.5% of the gross domestic product – a 0.2% increase from the pre-reform projections. Authors noted the increase is driven largely by postponement of physician payment cuts under the Medicare sustainable growth rate (SGR) formula and changes to the COBRA legislations.

The major spike in health spending will be in 2014 when an additional 30 million Americans are expected to gain coverage. Overall spending is projected to increase 9.2% that year, compared with the 6.6% that was estimated in February.

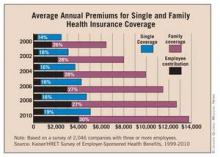

Rising Premium Costs Outpace Wage Increases

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance. According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research & Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said. “So the insurance that workers get just looks less and less like the more comprehensive coverage that their parents got.”

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of Health Research & Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care, or reexamining how they can best care for their families.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those withthree to nine employees – offer health insurance as a benefit.

Why the increase occurred was unclear, they noted. One possible explanation was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

More than 150 million nonelderly Americans have employer-sponsored health insurance, making it the leading source of coverage.

Elsevier Global Medical News

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance. According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research & Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said. “So the insurance that workers get just looks less and less like the more comprehensive coverage that their parents got.”

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of Health Research & Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care, or reexamining how they can best care for their families.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those withthree to nine employees – offer health insurance as a benefit.

Why the increase occurred was unclear, they noted. One possible explanation was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

More than 150 million nonelderly Americans have employer-sponsored health insurance, making it the leading source of coverage.

Elsevier Global Medical News

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance. According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research & Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said. “So the insurance that workers get just looks less and less like the more comprehensive coverage that their parents got.”

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of Health Research & Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care, or reexamining how they can best care for their families.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those withthree to nine employees – offer health insurance as a benefit.

Why the increase occurred was unclear, they noted. One possible explanation was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

More than 150 million nonelderly Americans have employer-sponsored health insurance, making it the leading source of coverage.

Elsevier Global Medical News

Rising Premium Costs Outpace Wage Increases

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance.

According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research and Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers, and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer-term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said.

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care office visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist office visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of the Health Research and Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those with three to nine employees – offer health insurance as a benefit.

One possible explanation for the increase was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

Meanwhile, the percentage of workers enrolled in health savings accounts or health reimbursement arrangements rose from 8% in 2009 to 13% in 2010.

Over 150 million nonelderly Americans have employer-sponsored health insurance, the leading source of coverage.

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance.

According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research and Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers, and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer-term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said.

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care office visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist office visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of the Health Research and Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those with three to nine employees – offer health insurance as a benefit.

One possible explanation for the increase was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

Meanwhile, the percentage of workers enrolled in health savings accounts or health reimbursement arrangements rose from 8% in 2009 to 13% in 2010.

Over 150 million nonelderly Americans have employer-sponsored health insurance, the leading source of coverage.

For the first time in several years, U.S. workers are footing nearly the whole bill for the premium increases associated with their employer-provided health insurance.

According to a nationwide survey, employers are declining to take more than a tiny share of the load.

The Employer Health Benefits 2010 Annual Survey shows that the average annual premium for employer-provided family health insurance is $13,770 this year. Of that, employees are paying an average of $3,997, an increase of $482, or 14%, from 2009, according to the survey, which was conducted by the Kaiser Family Foundation and the Health Research and Educational Trust.

“It's the first time that I can remember seeing employers cope with rising health care cost by shifting virtually all of the cost to the workers, and it just speaks to the depths of recession and the pressure that employers have been under to hold the line on cost while trying as best as they can to avoid layoffs,” Drew Altman, Ph.D., president and CEO of the Kaiser Family Foundation, said during a press briefing. “It also of course means added economic pressure and insecurity and burdens for working people in an already tough economy.”

The survey authors note that employer-provided health insurance is one piece that has not received enough attention in the health reform debate. They predicted that the increased out-of-pocket cost for employees is not going to stop in the next few years, despite implementation of the Affordable Care Act.

“The longer-term trend is that what workers pay for health insurance continues to go up much faster than their wages, while at the same time their insurance continues to get less comprehensive,” Dr. Altman said.

The survey was conducted between January and May 2010. The findings are based on a telephone survey of benefit managers for 2,046 randomly selected, nonfederal public and private companies with three or more employees.

The survey findings show a modest increase in premiums from last year: The average annual cost of premiums for single coverage was $5,049 in 2010, up 5% from 2009. The average premium for family coverage rose 3% to $13,770.

The average primary care office visit copayment increased from $20 in 2009 to $22 in 2010, and from $28 to $31 for a specialist office visit, according to the findings.

“High out-of-pocket expenses and premiums affect health care decisions for patients,” Maulik Joshi, Dr.P.H., president of the Health Research and Educational Trust, said in a statement. “If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care.”

Among the surprising findings of the survey was a significant increase in the percentage of companies offering health benefits in 2010 (69%) compared with 2009 (60%). The researchers attributed the increase to the fact that a greater percentage of very small companies – those with three to nine employees – offer health insurance as a benefit.

One possible explanation for the increase was that more very small companies that previously did not offer health insurance as a benefit have failed, shrinking the pool of companies to measure.

The survey also showed the impact on mental health coverage since passage of the Mental Health Parity and Addiction Equity Act of 2008. The law applies to firms with more than 50 workers; 31% of such firms reported that they had changed their mental health coverage because of the law. Two-thirds of the 31% reported that they had eliminated limits on mental health coverage, 16% reported increased utilization management for mental health benefits, and 5% said they had dropped coverage.

Meanwhile, the percentage of workers enrolled in health savings accounts or health reimbursement arrangements rose from 8% in 2009 to 13% in 2010.

Over 150 million nonelderly Americans have employer-sponsored health insurance, the leading source of coverage.

Underinsured Children Outnumber Uninsured

Children who are underinsured outnumber uninsured children and are almost as likely as uninsured children to have problems with health care access and quality.

Nearly a quarter of children with continuous health care coverage in 2007 did not have coverage adequate enough to provide access to appropriate services and providers, according to lead author Michael Kogan, Ph.D., of the Health Resources and Services Administration's Maternal and Child Health Bureau, and his colleagues.

Dr. Kogan and his colleagues analyzed data collected from the 2007 National Survey of Children's Health, which was conducted by random-digital-dial interviews with the parents or guardians of 91,642 children. They found that in 2007, 19% (14.1 million) of all U.S. children were underinsured (continuous but inadequate coverage), while 5% (3.4 million) were uninsured, and 10% (7.6 million) were sometimes insured. In contrast, 66% (48.2 million) were fully insured.

Children with private insurance were twice as likely to be underinsured as those with public insurance, for example coverage under either Medicaid or a State Children's Health Insurance Program (SCHIP), they wrote. Inadequate coverage of charges was the most common source of underinsurance, accounting for 12.1 million children.

Certain groups of insured children were more likely to be underinsured: those older than 6 years, Hispanic and black children, those in the Midwest, and those who had special health care needs.

Underinsured children had no access to a medical home on the same scale as their sometimes insured peers – 55% and 58% respectively. Dr. Kogan and colleagues found a similar situation regarding access to specialty care: 26% of underinsured children had difficulty obtaining specialist care, compared with 29% of sometimes insured children and 25% of uninsured children.

While attention has been focused on the woes of adult underinsurance, less has been paid to childhood underinsurance, according to Dr. Kogan, who added that it is not clear whether the number of uninsured children has been on the rise over the years, because there are no similar studies for comparison.

As implementation of the Affordable Care Act continues, “it may be worthwhile to consider not only the number of uninsured children in the United States but also the adequacy of coverage for those with current insurance,” wrote Dr. Kogan and colleagues.

The study is limited in several ways, the authors wrote. Because the study design was cross-sectional, it is difficult to establish the direction of causality. In addition, the data exclude children in institutions. And, because the study is based on data collected in a phone survey, it is subject to biases, “including the exclusion of household without landlines.”

“What I would hope from policymakers is that they would be aware that this problem is more prevalent than the number of uninsured kids and to take that into account in the future policy considerations,” Dr. Kogan wrote, noting that HRSA plans on repeating the study within the next few years.

The study authors that they have no relevant conflicts of interest.

Children who are underinsured outnumber uninsured children and are almost as likely as uninsured children to have problems with health care access and quality.

Nearly a quarter of children with continuous health care coverage in 2007 did not have coverage adequate enough to provide access to appropriate services and providers, according to lead author Michael Kogan, Ph.D., of the Health Resources and Services Administration's Maternal and Child Health Bureau, and his colleagues.

Dr. Kogan and his colleagues analyzed data collected from the 2007 National Survey of Children's Health, which was conducted by random-digital-dial interviews with the parents or guardians of 91,642 children. They found that in 2007, 19% (14.1 million) of all U.S. children were underinsured (continuous but inadequate coverage), while 5% (3.4 million) were uninsured, and 10% (7.6 million) were sometimes insured. In contrast, 66% (48.2 million) were fully insured.

Children with private insurance were twice as likely to be underinsured as those with public insurance, for example coverage under either Medicaid or a State Children's Health Insurance Program (SCHIP), they wrote. Inadequate coverage of charges was the most common source of underinsurance, accounting for 12.1 million children.

Certain groups of insured children were more likely to be underinsured: those older than 6 years, Hispanic and black children, those in the Midwest, and those who had special health care needs.

Underinsured children had no access to a medical home on the same scale as their sometimes insured peers – 55% and 58% respectively. Dr. Kogan and colleagues found a similar situation regarding access to specialty care: 26% of underinsured children had difficulty obtaining specialist care, compared with 29% of sometimes insured children and 25% of uninsured children.

While attention has been focused on the woes of adult underinsurance, less has been paid to childhood underinsurance, according to Dr. Kogan, who added that it is not clear whether the number of uninsured children has been on the rise over the years, because there are no similar studies for comparison.

As implementation of the Affordable Care Act continues, “it may be worthwhile to consider not only the number of uninsured children in the United States but also the adequacy of coverage for those with current insurance,” wrote Dr. Kogan and colleagues.

The study is limited in several ways, the authors wrote. Because the study design was cross-sectional, it is difficult to establish the direction of causality. In addition, the data exclude children in institutions. And, because the study is based on data collected in a phone survey, it is subject to biases, “including the exclusion of household without landlines.”

“What I would hope from policymakers is that they would be aware that this problem is more prevalent than the number of uninsured kids and to take that into account in the future policy considerations,” Dr. Kogan wrote, noting that HRSA plans on repeating the study within the next few years.

The study authors that they have no relevant conflicts of interest.