User login

Five personal finance questions for the young GI

While this article will get you started, these are complex topics, and each could warrant several standalone articles. I strongly encourage you to develop some basic understanding of personal finance through books, websites, and podcasts. If you can manage Barrett’s esophagus, Crohn’s, and cirrhosis, you can understand the basics of personal finance.

1. What should I do about my student loans? Go for public service loan forgiveness or pay them off?

The first step is knowing your debt burden, knowing your options, and developing a plan to pay off student loans. Public service loan forgiveness (PSLF) can be a good option in many situations. For borrowers staying in academic or other 501(c)(3) positions, PSLF is often an obvious move. Importantly, a fall 2022 statement by the U.S. Department of Education clarified that physicians working as contractors for nonprofit hospitals in California and Texas may now qualify for PSLF.1,2

For trainees debating an academic/501(c)(3) position vs. private practice, I would generally not advise making a career choice based purely on PSLF eligibility. However, borrowers with very high federal student loan burdens (e.g., debt to income ratio of > 2:1), or who are very close to the PSLF 10-year requirement may want to consider choosing a qualifying position for a few years to receive PSLF student loan forgiveness. Please see TNG’s 2020 article3 for a deeper discussion. Consultation with a company specializing in student loan advice for physicians may be well worth the upfront cost.

2. Do I need disability insurance? What should I look for?

I would strongly advise getting disability insurance as soon as possible (including while in training). While disability insurance is not cheap, it is one of the first steps you should take and one of the most important ways to protect your financial future. It is essential to look for a specialty-specific own occupation policy. Such a policy will provide disability payments if you are no longer able to work as a gastroenterologist/hepatologist (including an injury which prevents you from doing endoscopies).

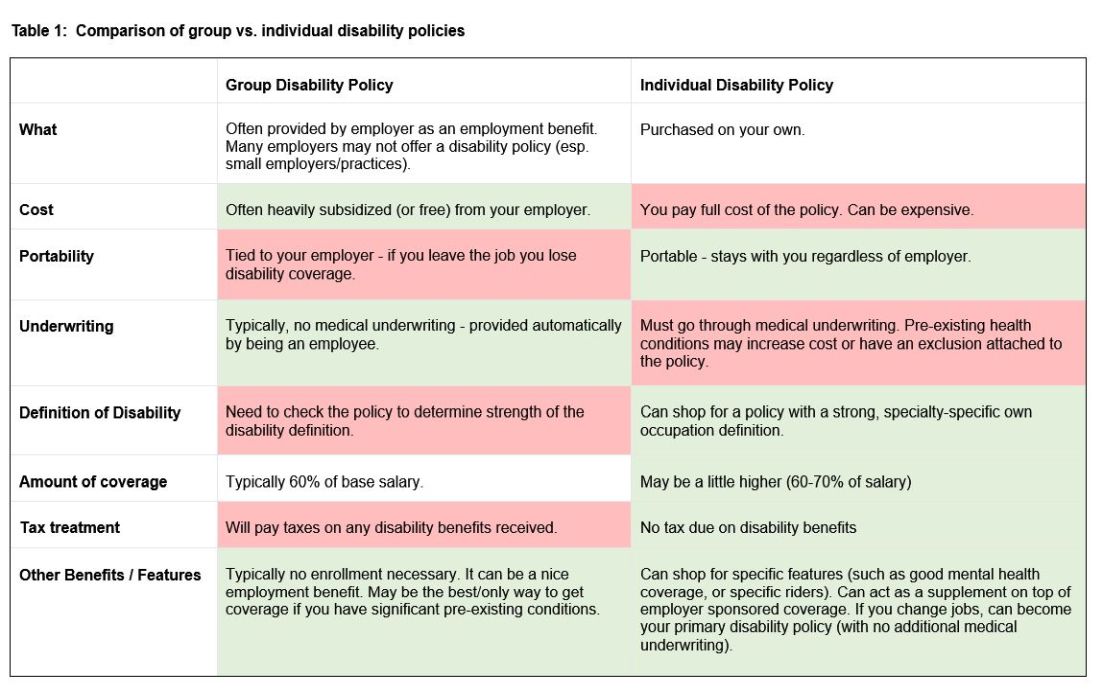

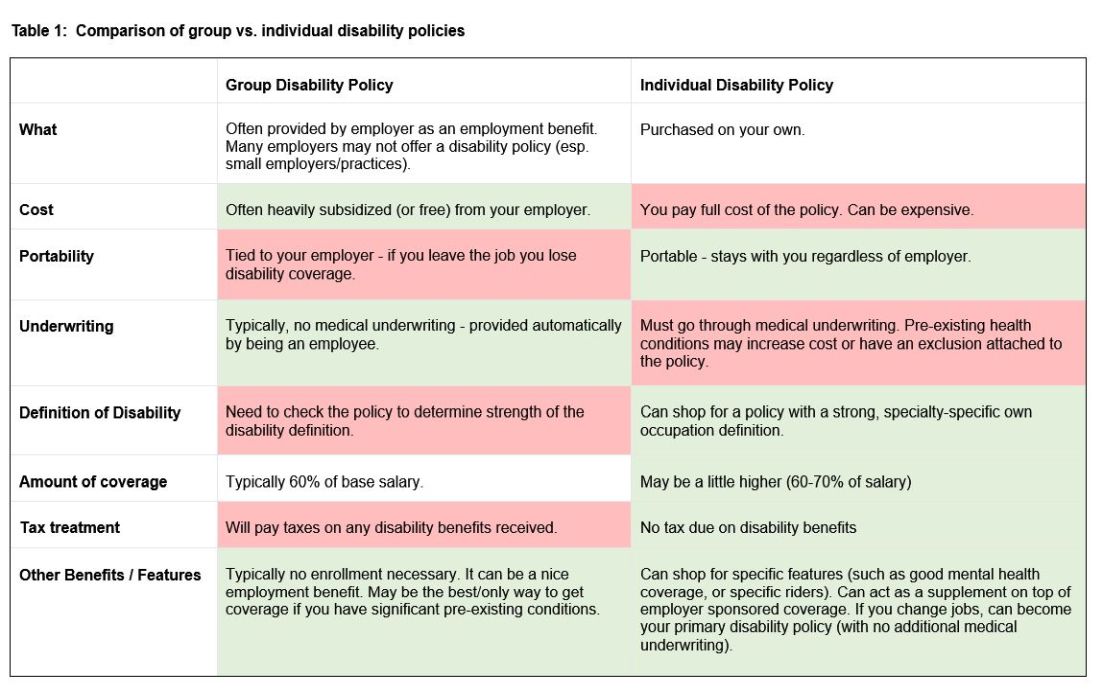

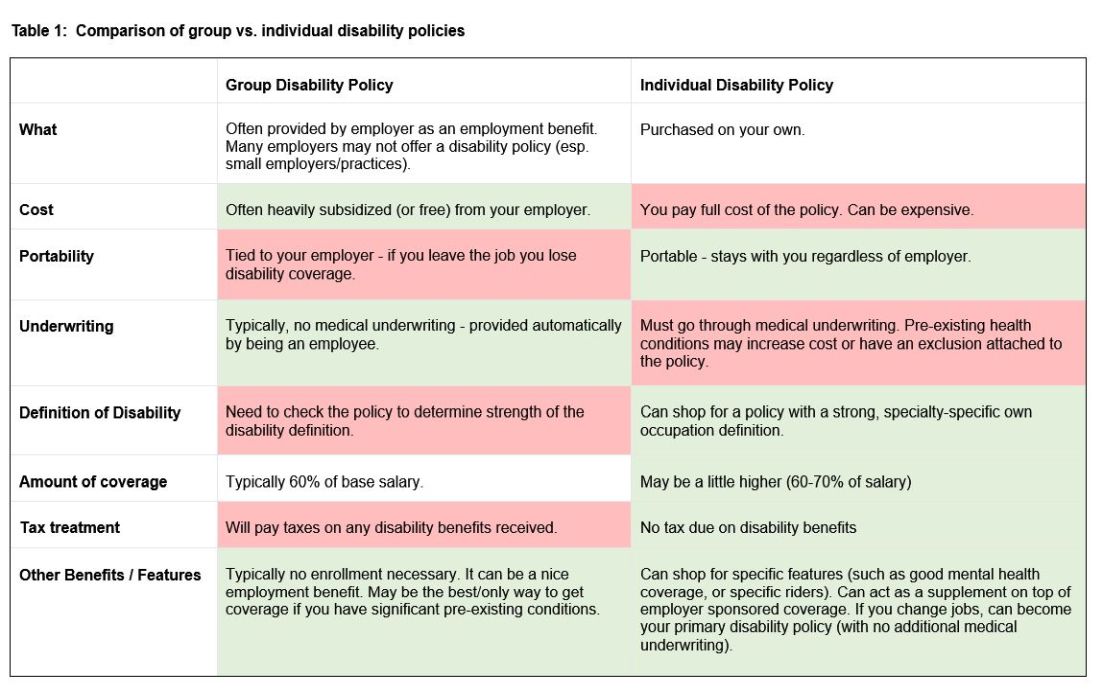

There are two major types of disability policies: group policies and individual policies. See table 1 for a detailed comparison.

Your hospital/employer may provide a group policy at a heavily subsidized rate. Alternatively, you can purchase an individual disability policy, which is independent of your employer and will stay with you even if you change jobs. Currently, the only companies providing high quality own-occupation policies for physicians are Mass Mutual, Principal, Guardian, The Standard, and Ameritas. Because disability insurance is complicated, it is highly advisable to work with an agent experienced in physician disability policies.

Importantly, even if you have a group disability policy, you can purchase an individual policy as a supplement to provide extra coverage. If you leave employers, the individual policy can then become your primary disability policy without any additional medical underwriting.

3. Do I need life insurance? What type should I get?

If anyone is dependent on your income (partner, child, etc.), you should have life insurance. Moreover, if you expect to have dependents in the near future (e.g., children), you could consider getting life insurance now while you are younger and healthier. For a young GI with multiple financial obligations, term life insurance is generally the right product. Term life insurance is a straightforward, affordable product that can be purchased from multiple high-quality insurance carriers. There are two major considerations: The amount of coverage ($2 million, $3 million, etc.) and the length of coverage (20 years, 30 years, etc.). To estimate the appropriate amount of coverage, start with your expected annual household living expenses, and multiply by 25-30. While this is a rule of thumb, it will get you in the ballpark. For many young physicians, a $2-$5 million policy with 20- to 30-year coverage is reasonable.

Many financial advisers may suggest whole life insurance policies. These are typically not the ideal policy for young GIs who are just starting their careers. While whole life insurance may be the right choice in select cases, term life insurance will be the best product for most of TNG’s audience. As an example, a $3 million, 25-year term policy for a healthy, nonsmoking 35-year-old male would cost approximately $175 per month. A similar $3 million whole life policy could cost $2,000 per month or more.

4. What do I need to know about retirement accounts and investing?

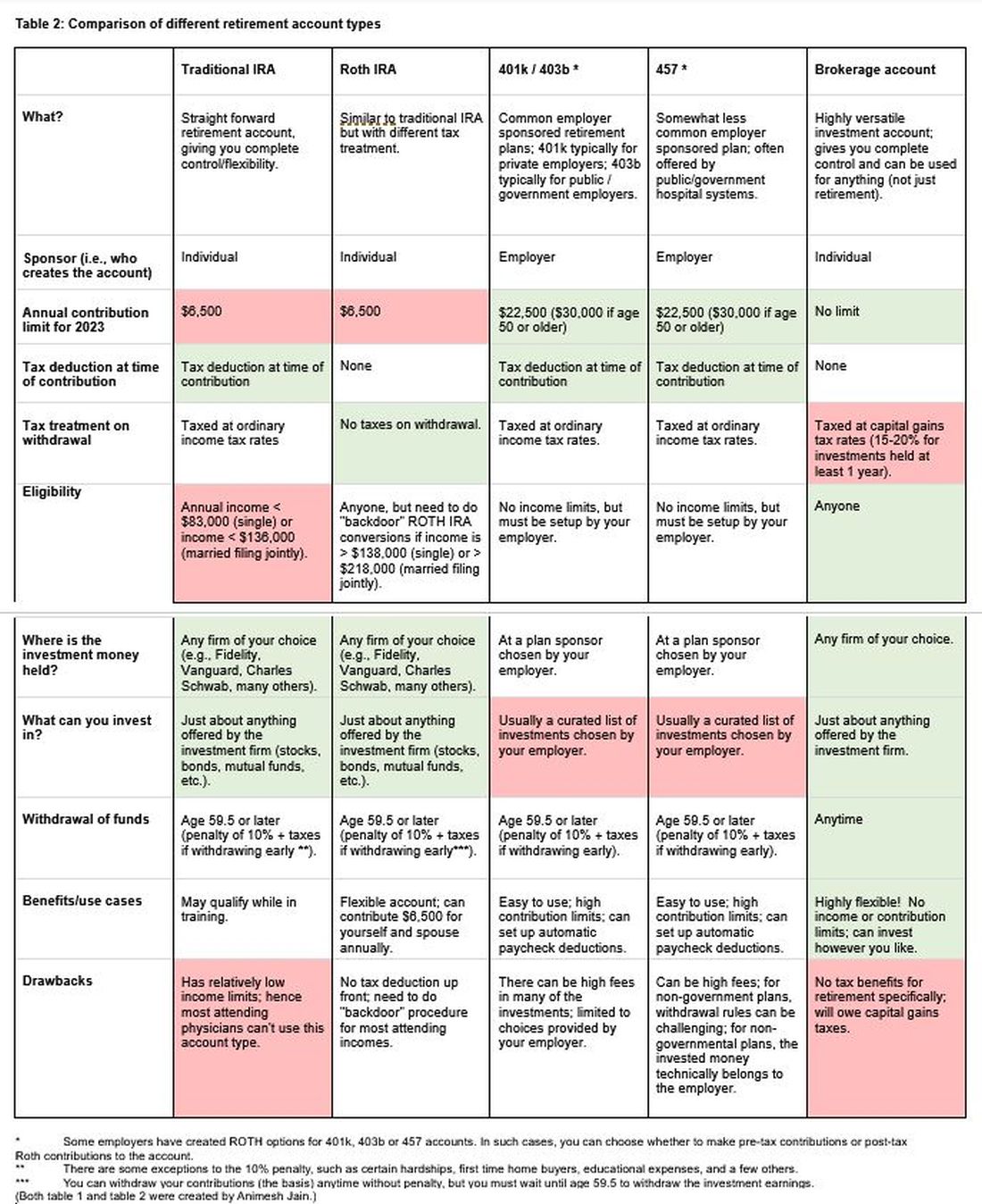

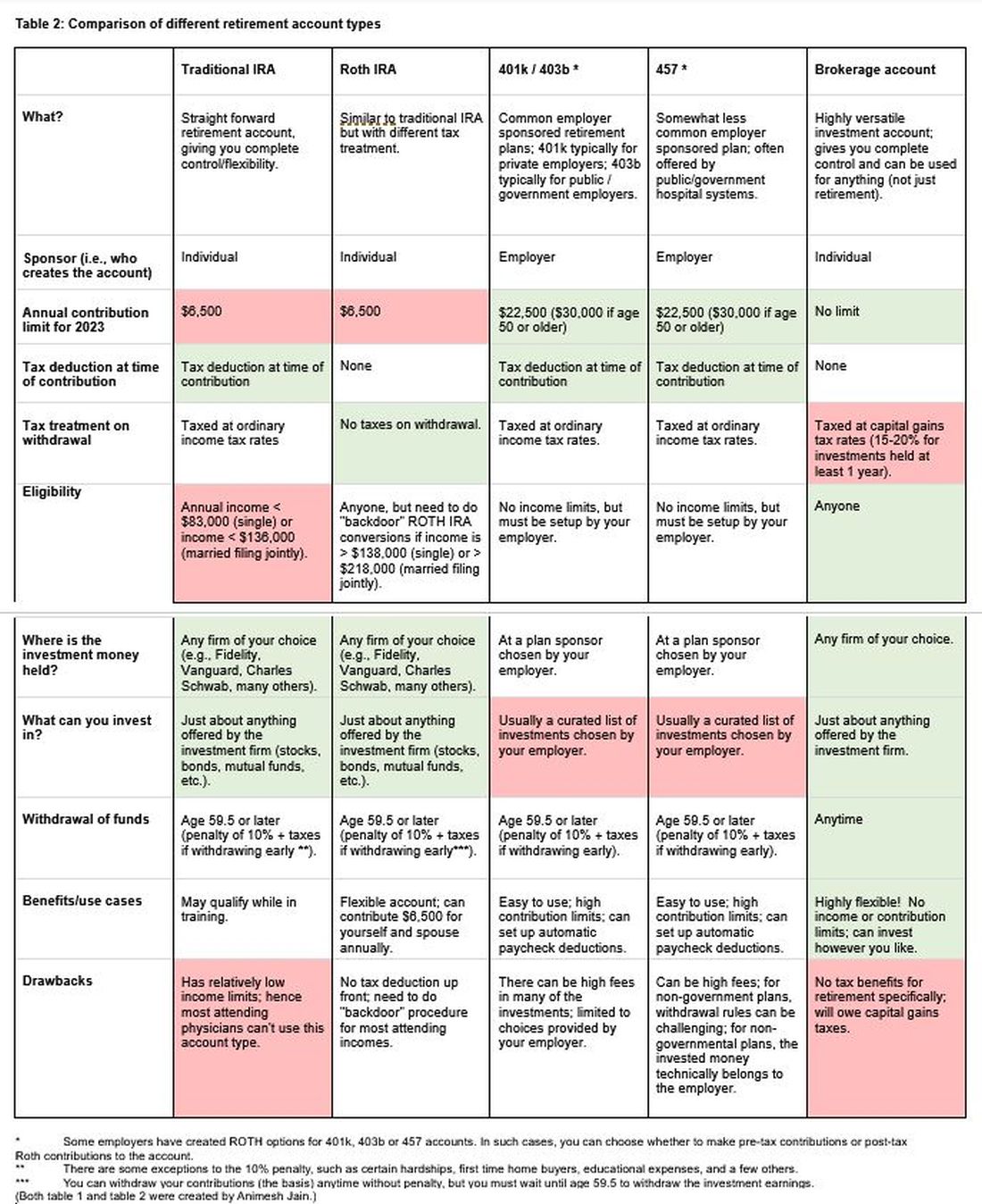

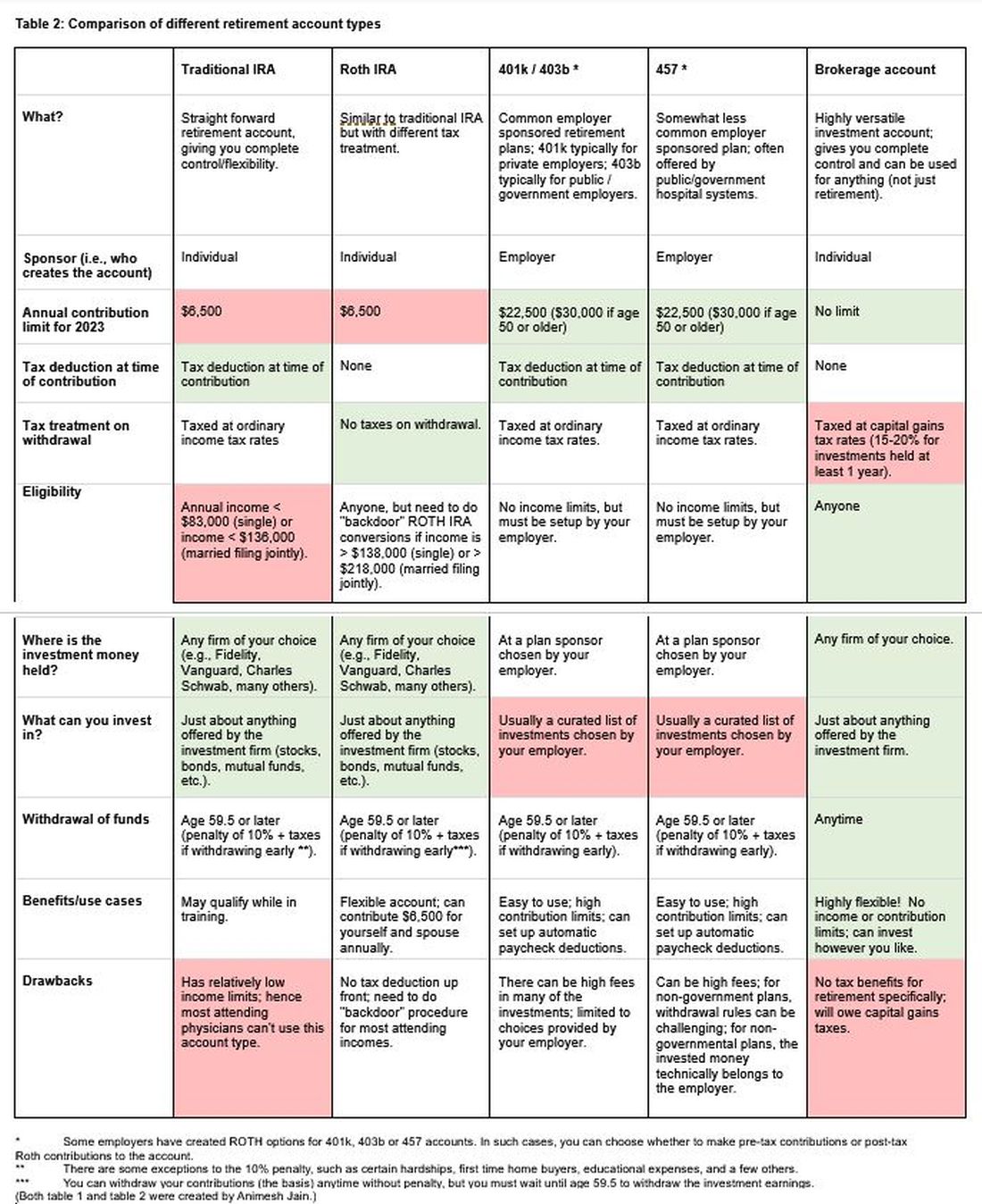

The alphabet soup of retirement accounts can be confusing – IRA, 401k, 457. Retirement accounts provide a tax break to incentivize saving for retirement. Traditional (“non-Roth”) accounts provide a tax break today, but you will pay taxes when withdrawing the money in retirement. Roth accounts provide no tax break now but provide tax-free growth for decades, and no taxes are due when withdrawing money. See table 2 for a detailed comparison of retirement accounts.

Once you place money into a retirement account, you will need to choose specific investments to grow your money. The two most common asset classes are stocks and bonds, though there are many other reasonable assets, such as real estate, commodities, and alternative currencies. It is generally recommended to have a higher proportion of stock-based investments early on (60%-90%) and then increase the ratio of bonds closer to retirement. Using low cost, passive index funds (or exchange traded funds) is a good way to get stock exposure. Target date retirement funds can be a nice tool for beginning investors since they will automatically adjust the stock/bond ratio for you.

Calculating the amount needed for retirement is beyond the scope of this article. However, saving at least 20% of your gross income specifically for retirement is a good starting point and should set you up for a reasonable retirement in about 30 years. For the average GI physician, this would mean saving $4,000 or more per month for retirement. If you aim to retire earlier, consider investing a higher percentage.

5. What do I need to know about buying a house?

The first question to ask is whether it makes sense to rent or buy a house. This is a personal and lifestyle decision, not just a financial decision. Today’s market is difficult with both high home prices and high rent costs. If there is a reasonable chance that you will be moving within 3-5 years, I would consider not buying until your long-term plans are more stable. Moreover, a high proportion of physicians change jobs.4,5,6 If you are just starting a new job, it is often wise to wait at least 6-12 months before buying a house to ensure the new job is a good fit. If you are in a stable long-term situation, it may be reasonable to buy a house. While it is commonly believed that buying a house is a “good financial move,” there are many hidden costs to home ownership, including big ticket repairs, property taxes, and real estate fees when selling a home.

First-time physician home buyers can often secure a physician mortgage with competitive interest rates and a low down payment of 0%-10% instead of the traditional 20% down payment. Moreover, a good physician mortgage should not have private mortgage insurance (PMI). Given the variation between mortgage companies, my most important piece of advice is to shop around for a good mortgage. An independent mortgage broker can be very valuable.

Dr. Jain is associate professor of medicine in the division of gastroenterology and hepatology, University of North Carolina School of Medicine, Chapel Hill. He has no conflicts of interest. The information in this article is meant for general educational purposes only. For individualized personal finance advice, please seek your own financial advisor, tax accountant, insurance broker, attorney, or other financial professional. Follow Dr. Jain @AJainMD on X.

References

1. Future of PSLF Fact Sheet

2. The Loophole That Can Get Thousands of Doctors into PSLF

3. Student loan management: An introduction for the young gastroenterologist

4. Study Shows First Job after Medical Residency Often Doesn’t Last

5. More physicians want to leave their jobs as pay rates fall, survey finds

6. Physician turnover rates are climbing as they clamor for better work-life balance

While this article will get you started, these are complex topics, and each could warrant several standalone articles. I strongly encourage you to develop some basic understanding of personal finance through books, websites, and podcasts. If you can manage Barrett’s esophagus, Crohn’s, and cirrhosis, you can understand the basics of personal finance.

1. What should I do about my student loans? Go for public service loan forgiveness or pay them off?

The first step is knowing your debt burden, knowing your options, and developing a plan to pay off student loans. Public service loan forgiveness (PSLF) can be a good option in many situations. For borrowers staying in academic or other 501(c)(3) positions, PSLF is often an obvious move. Importantly, a fall 2022 statement by the U.S. Department of Education clarified that physicians working as contractors for nonprofit hospitals in California and Texas may now qualify for PSLF.1,2

For trainees debating an academic/501(c)(3) position vs. private practice, I would generally not advise making a career choice based purely on PSLF eligibility. However, borrowers with very high federal student loan burdens (e.g., debt to income ratio of > 2:1), or who are very close to the PSLF 10-year requirement may want to consider choosing a qualifying position for a few years to receive PSLF student loan forgiveness. Please see TNG’s 2020 article3 for a deeper discussion. Consultation with a company specializing in student loan advice for physicians may be well worth the upfront cost.

2. Do I need disability insurance? What should I look for?

I would strongly advise getting disability insurance as soon as possible (including while in training). While disability insurance is not cheap, it is one of the first steps you should take and one of the most important ways to protect your financial future. It is essential to look for a specialty-specific own occupation policy. Such a policy will provide disability payments if you are no longer able to work as a gastroenterologist/hepatologist (including an injury which prevents you from doing endoscopies).

There are two major types of disability policies: group policies and individual policies. See table 1 for a detailed comparison.

Your hospital/employer may provide a group policy at a heavily subsidized rate. Alternatively, you can purchase an individual disability policy, which is independent of your employer and will stay with you even if you change jobs. Currently, the only companies providing high quality own-occupation policies for physicians are Mass Mutual, Principal, Guardian, The Standard, and Ameritas. Because disability insurance is complicated, it is highly advisable to work with an agent experienced in physician disability policies.

Importantly, even if you have a group disability policy, you can purchase an individual policy as a supplement to provide extra coverage. If you leave employers, the individual policy can then become your primary disability policy without any additional medical underwriting.

3. Do I need life insurance? What type should I get?

If anyone is dependent on your income (partner, child, etc.), you should have life insurance. Moreover, if you expect to have dependents in the near future (e.g., children), you could consider getting life insurance now while you are younger and healthier. For a young GI with multiple financial obligations, term life insurance is generally the right product. Term life insurance is a straightforward, affordable product that can be purchased from multiple high-quality insurance carriers. There are two major considerations: The amount of coverage ($2 million, $3 million, etc.) and the length of coverage (20 years, 30 years, etc.). To estimate the appropriate amount of coverage, start with your expected annual household living expenses, and multiply by 25-30. While this is a rule of thumb, it will get you in the ballpark. For many young physicians, a $2-$5 million policy with 20- to 30-year coverage is reasonable.

Many financial advisers may suggest whole life insurance policies. These are typically not the ideal policy for young GIs who are just starting their careers. While whole life insurance may be the right choice in select cases, term life insurance will be the best product for most of TNG’s audience. As an example, a $3 million, 25-year term policy for a healthy, nonsmoking 35-year-old male would cost approximately $175 per month. A similar $3 million whole life policy could cost $2,000 per month or more.

4. What do I need to know about retirement accounts and investing?

The alphabet soup of retirement accounts can be confusing – IRA, 401k, 457. Retirement accounts provide a tax break to incentivize saving for retirement. Traditional (“non-Roth”) accounts provide a tax break today, but you will pay taxes when withdrawing the money in retirement. Roth accounts provide no tax break now but provide tax-free growth for decades, and no taxes are due when withdrawing money. See table 2 for a detailed comparison of retirement accounts.

Once you place money into a retirement account, you will need to choose specific investments to grow your money. The two most common asset classes are stocks and bonds, though there are many other reasonable assets, such as real estate, commodities, and alternative currencies. It is generally recommended to have a higher proportion of stock-based investments early on (60%-90%) and then increase the ratio of bonds closer to retirement. Using low cost, passive index funds (or exchange traded funds) is a good way to get stock exposure. Target date retirement funds can be a nice tool for beginning investors since they will automatically adjust the stock/bond ratio for you.

Calculating the amount needed for retirement is beyond the scope of this article. However, saving at least 20% of your gross income specifically for retirement is a good starting point and should set you up for a reasonable retirement in about 30 years. For the average GI physician, this would mean saving $4,000 or more per month for retirement. If you aim to retire earlier, consider investing a higher percentage.

5. What do I need to know about buying a house?

The first question to ask is whether it makes sense to rent or buy a house. This is a personal and lifestyle decision, not just a financial decision. Today’s market is difficult with both high home prices and high rent costs. If there is a reasonable chance that you will be moving within 3-5 years, I would consider not buying until your long-term plans are more stable. Moreover, a high proportion of physicians change jobs.4,5,6 If you are just starting a new job, it is often wise to wait at least 6-12 months before buying a house to ensure the new job is a good fit. If you are in a stable long-term situation, it may be reasonable to buy a house. While it is commonly believed that buying a house is a “good financial move,” there are many hidden costs to home ownership, including big ticket repairs, property taxes, and real estate fees when selling a home.

First-time physician home buyers can often secure a physician mortgage with competitive interest rates and a low down payment of 0%-10% instead of the traditional 20% down payment. Moreover, a good physician mortgage should not have private mortgage insurance (PMI). Given the variation between mortgage companies, my most important piece of advice is to shop around for a good mortgage. An independent mortgage broker can be very valuable.

Dr. Jain is associate professor of medicine in the division of gastroenterology and hepatology, University of North Carolina School of Medicine, Chapel Hill. He has no conflicts of interest. The information in this article is meant for general educational purposes only. For individualized personal finance advice, please seek your own financial advisor, tax accountant, insurance broker, attorney, or other financial professional. Follow Dr. Jain @AJainMD on X.

References

1. Future of PSLF Fact Sheet

2. The Loophole That Can Get Thousands of Doctors into PSLF

3. Student loan management: An introduction for the young gastroenterologist

4. Study Shows First Job after Medical Residency Often Doesn’t Last

5. More physicians want to leave their jobs as pay rates fall, survey finds

6. Physician turnover rates are climbing as they clamor for better work-life balance

While this article will get you started, these are complex topics, and each could warrant several standalone articles. I strongly encourage you to develop some basic understanding of personal finance through books, websites, and podcasts. If you can manage Barrett’s esophagus, Crohn’s, and cirrhosis, you can understand the basics of personal finance.

1. What should I do about my student loans? Go for public service loan forgiveness or pay them off?

The first step is knowing your debt burden, knowing your options, and developing a plan to pay off student loans. Public service loan forgiveness (PSLF) can be a good option in many situations. For borrowers staying in academic or other 501(c)(3) positions, PSLF is often an obvious move. Importantly, a fall 2022 statement by the U.S. Department of Education clarified that physicians working as contractors for nonprofit hospitals in California and Texas may now qualify for PSLF.1,2

For trainees debating an academic/501(c)(3) position vs. private practice, I would generally not advise making a career choice based purely on PSLF eligibility. However, borrowers with very high federal student loan burdens (e.g., debt to income ratio of > 2:1), or who are very close to the PSLF 10-year requirement may want to consider choosing a qualifying position for a few years to receive PSLF student loan forgiveness. Please see TNG’s 2020 article3 for a deeper discussion. Consultation with a company specializing in student loan advice for physicians may be well worth the upfront cost.

2. Do I need disability insurance? What should I look for?

I would strongly advise getting disability insurance as soon as possible (including while in training). While disability insurance is not cheap, it is one of the first steps you should take and one of the most important ways to protect your financial future. It is essential to look for a specialty-specific own occupation policy. Such a policy will provide disability payments if you are no longer able to work as a gastroenterologist/hepatologist (including an injury which prevents you from doing endoscopies).

There are two major types of disability policies: group policies and individual policies. See table 1 for a detailed comparison.

Your hospital/employer may provide a group policy at a heavily subsidized rate. Alternatively, you can purchase an individual disability policy, which is independent of your employer and will stay with you even if you change jobs. Currently, the only companies providing high quality own-occupation policies for physicians are Mass Mutual, Principal, Guardian, The Standard, and Ameritas. Because disability insurance is complicated, it is highly advisable to work with an agent experienced in physician disability policies.

Importantly, even if you have a group disability policy, you can purchase an individual policy as a supplement to provide extra coverage. If you leave employers, the individual policy can then become your primary disability policy without any additional medical underwriting.

3. Do I need life insurance? What type should I get?

If anyone is dependent on your income (partner, child, etc.), you should have life insurance. Moreover, if you expect to have dependents in the near future (e.g., children), you could consider getting life insurance now while you are younger and healthier. For a young GI with multiple financial obligations, term life insurance is generally the right product. Term life insurance is a straightforward, affordable product that can be purchased from multiple high-quality insurance carriers. There are two major considerations: The amount of coverage ($2 million, $3 million, etc.) and the length of coverage (20 years, 30 years, etc.). To estimate the appropriate amount of coverage, start with your expected annual household living expenses, and multiply by 25-30. While this is a rule of thumb, it will get you in the ballpark. For many young physicians, a $2-$5 million policy with 20- to 30-year coverage is reasonable.

Many financial advisers may suggest whole life insurance policies. These are typically not the ideal policy for young GIs who are just starting their careers. While whole life insurance may be the right choice in select cases, term life insurance will be the best product for most of TNG’s audience. As an example, a $3 million, 25-year term policy for a healthy, nonsmoking 35-year-old male would cost approximately $175 per month. A similar $3 million whole life policy could cost $2,000 per month or more.

4. What do I need to know about retirement accounts and investing?

The alphabet soup of retirement accounts can be confusing – IRA, 401k, 457. Retirement accounts provide a tax break to incentivize saving for retirement. Traditional (“non-Roth”) accounts provide a tax break today, but you will pay taxes when withdrawing the money in retirement. Roth accounts provide no tax break now but provide tax-free growth for decades, and no taxes are due when withdrawing money. See table 2 for a detailed comparison of retirement accounts.

Once you place money into a retirement account, you will need to choose specific investments to grow your money. The two most common asset classes are stocks and bonds, though there are many other reasonable assets, such as real estate, commodities, and alternative currencies. It is generally recommended to have a higher proportion of stock-based investments early on (60%-90%) and then increase the ratio of bonds closer to retirement. Using low cost, passive index funds (or exchange traded funds) is a good way to get stock exposure. Target date retirement funds can be a nice tool for beginning investors since they will automatically adjust the stock/bond ratio for you.

Calculating the amount needed for retirement is beyond the scope of this article. However, saving at least 20% of your gross income specifically for retirement is a good starting point and should set you up for a reasonable retirement in about 30 years. For the average GI physician, this would mean saving $4,000 or more per month for retirement. If you aim to retire earlier, consider investing a higher percentage.

5. What do I need to know about buying a house?

The first question to ask is whether it makes sense to rent or buy a house. This is a personal and lifestyle decision, not just a financial decision. Today’s market is difficult with both high home prices and high rent costs. If there is a reasonable chance that you will be moving within 3-5 years, I would consider not buying until your long-term plans are more stable. Moreover, a high proportion of physicians change jobs.4,5,6 If you are just starting a new job, it is often wise to wait at least 6-12 months before buying a house to ensure the new job is a good fit. If you are in a stable long-term situation, it may be reasonable to buy a house. While it is commonly believed that buying a house is a “good financial move,” there are many hidden costs to home ownership, including big ticket repairs, property taxes, and real estate fees when selling a home.

First-time physician home buyers can often secure a physician mortgage with competitive interest rates and a low down payment of 0%-10% instead of the traditional 20% down payment. Moreover, a good physician mortgage should not have private mortgage insurance (PMI). Given the variation between mortgage companies, my most important piece of advice is to shop around for a good mortgage. An independent mortgage broker can be very valuable.

Dr. Jain is associate professor of medicine in the division of gastroenterology and hepatology, University of North Carolina School of Medicine, Chapel Hill. He has no conflicts of interest. The information in this article is meant for general educational purposes only. For individualized personal finance advice, please seek your own financial advisor, tax accountant, insurance broker, attorney, or other financial professional. Follow Dr. Jain @AJainMD on X.

References

1. Future of PSLF Fact Sheet

2. The Loophole That Can Get Thousands of Doctors into PSLF

3. Student loan management: An introduction for the young gastroenterologist

4. Study Shows First Job after Medical Residency Often Doesn’t Last

5. More physicians want to leave their jobs as pay rates fall, survey finds

6. Physician turnover rates are climbing as they clamor for better work-life balance

Student loan management: An introduction for the young gastroenterologist

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

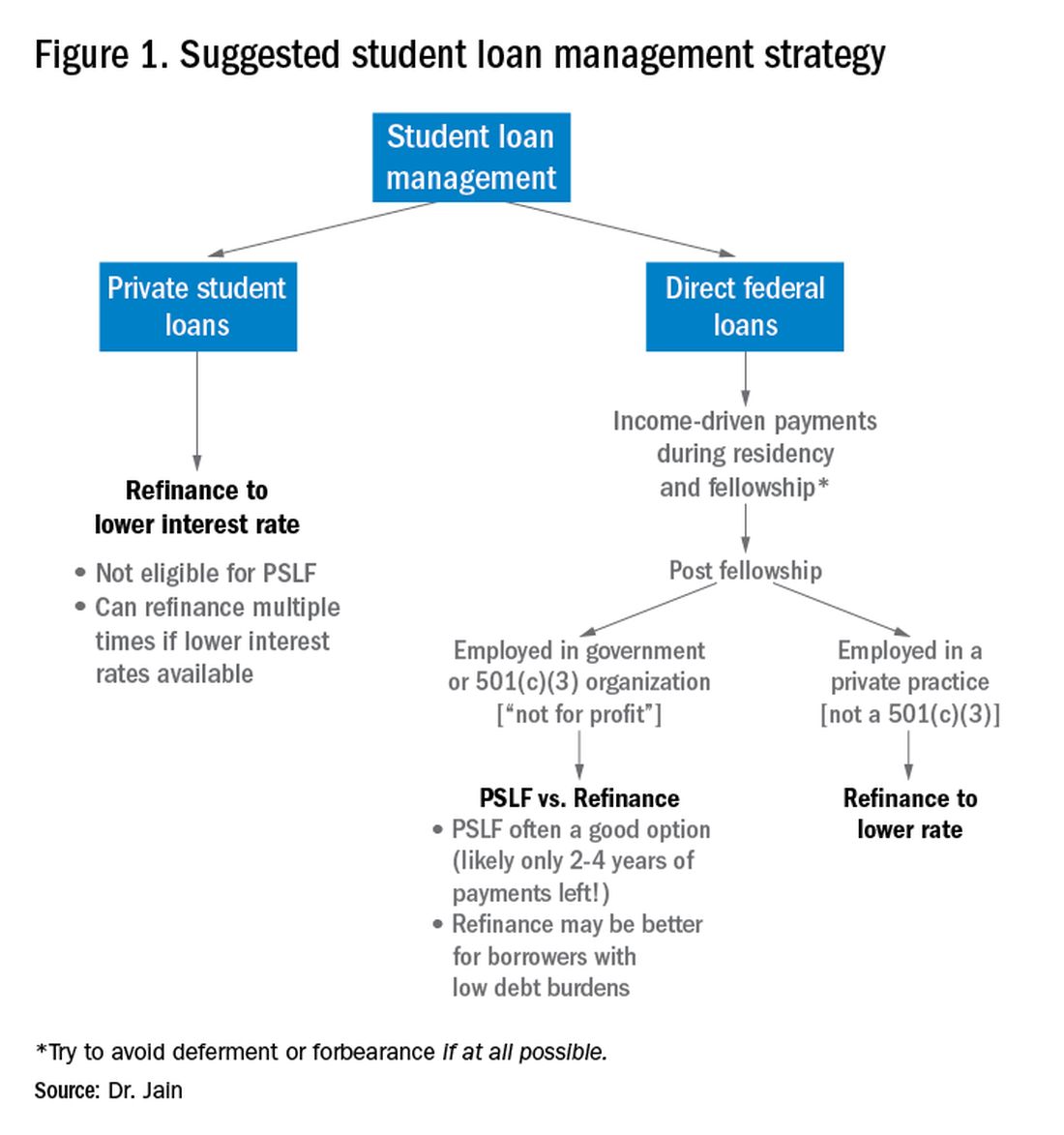

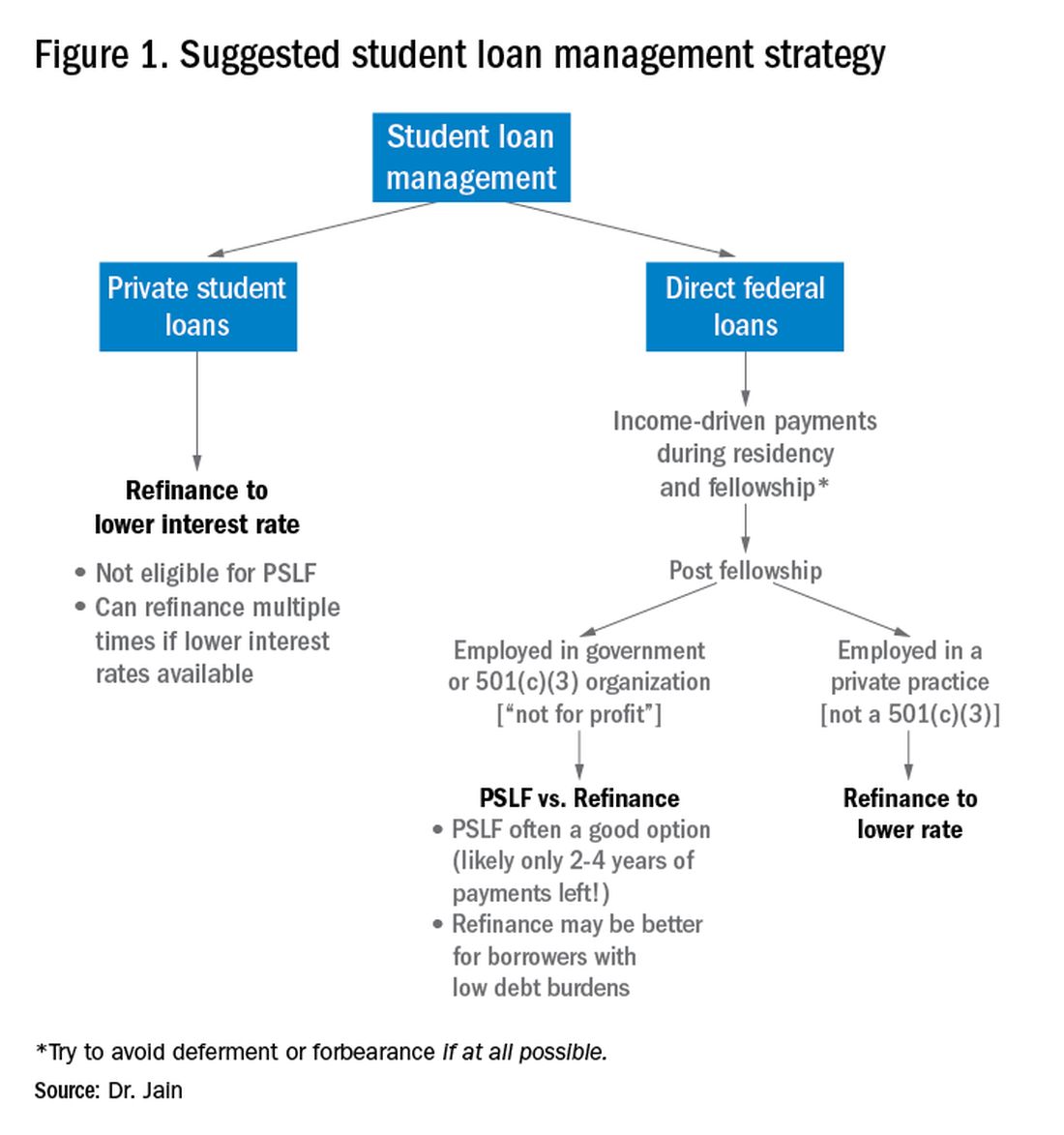

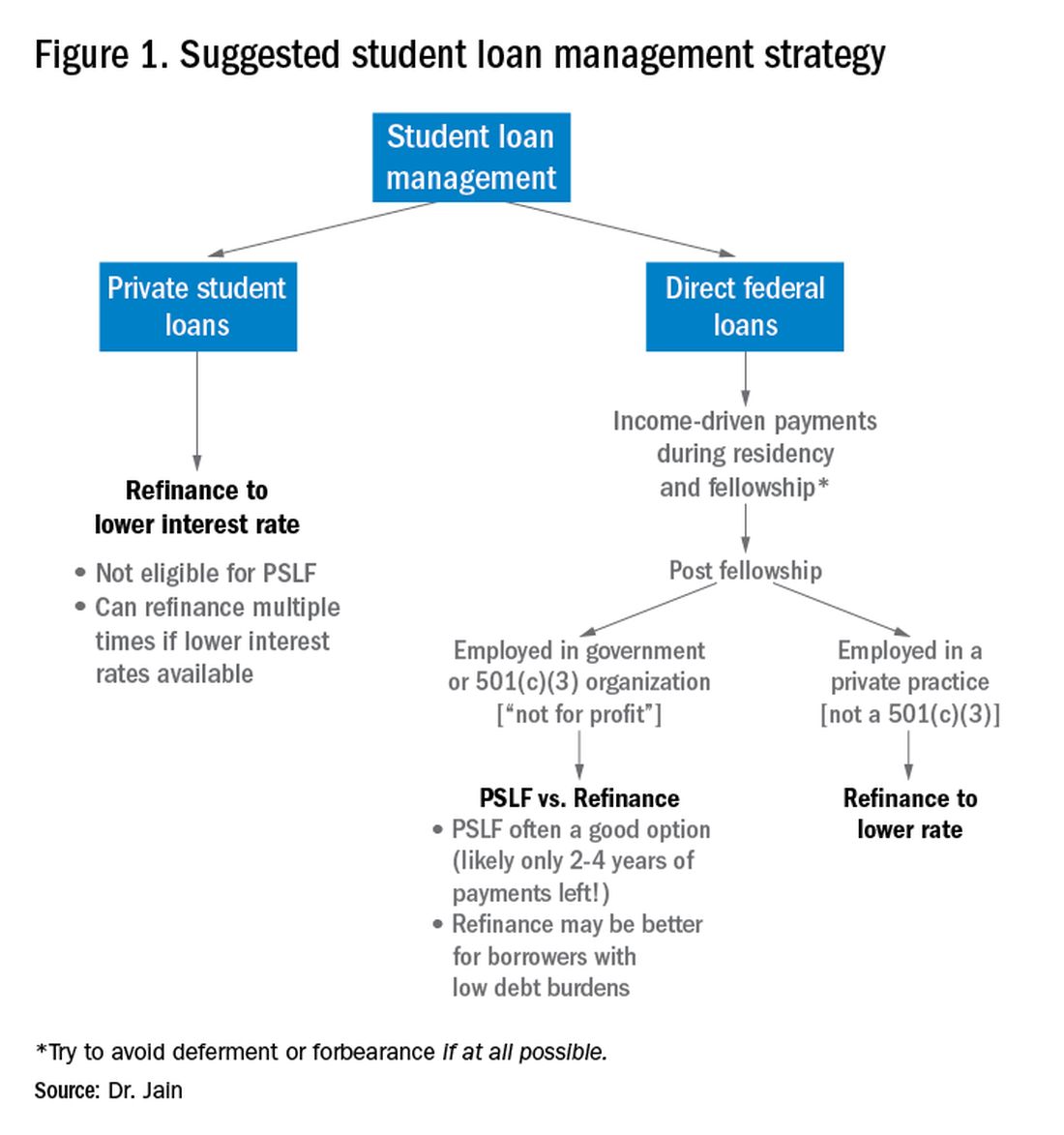

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

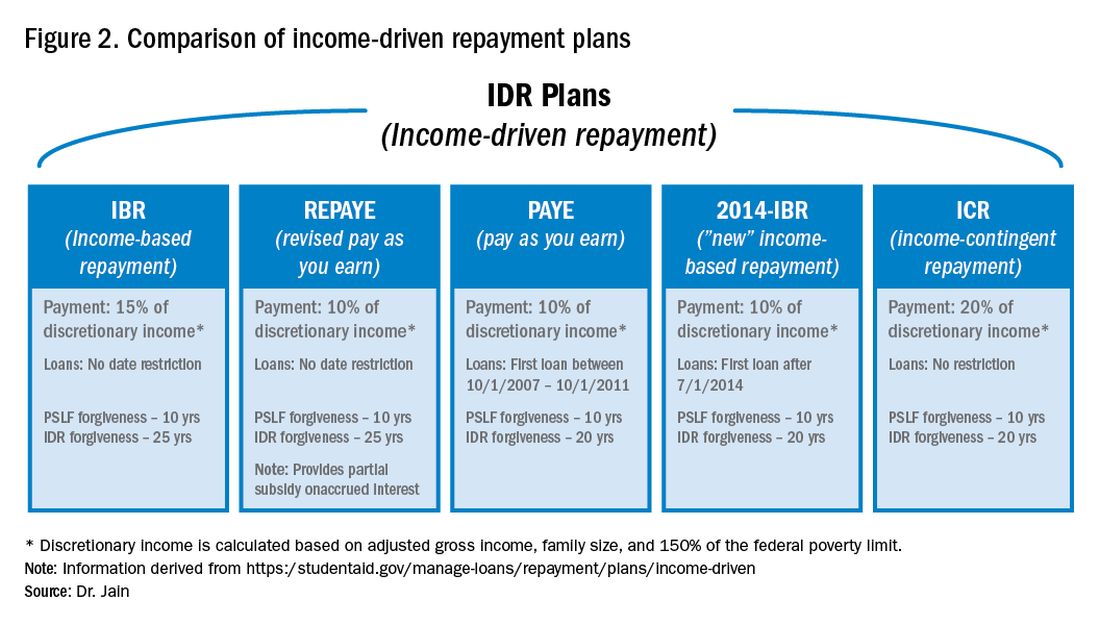

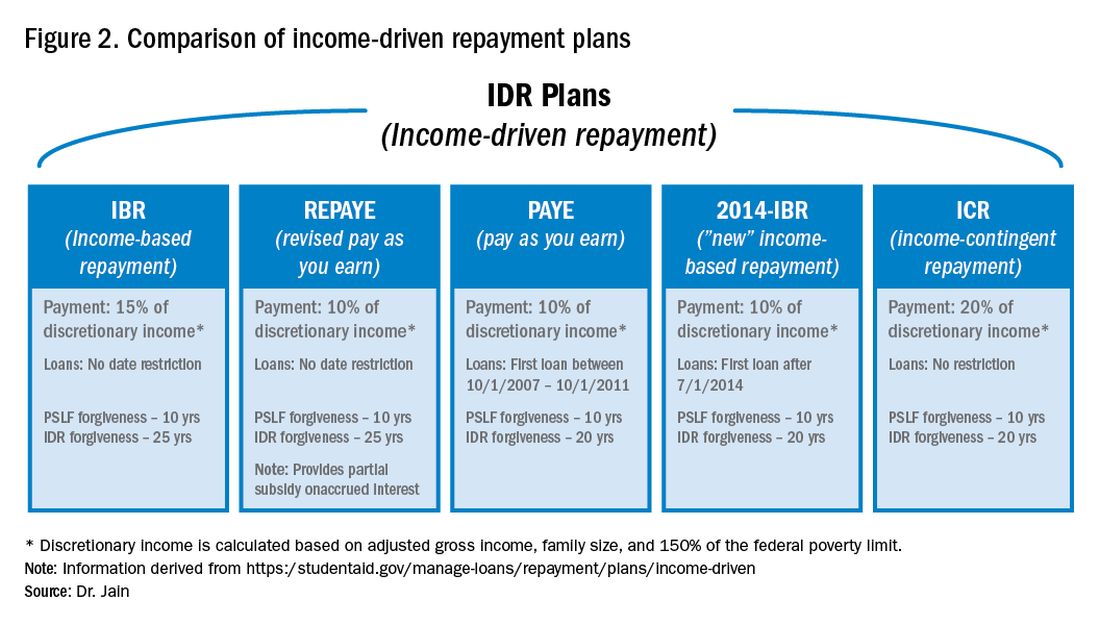

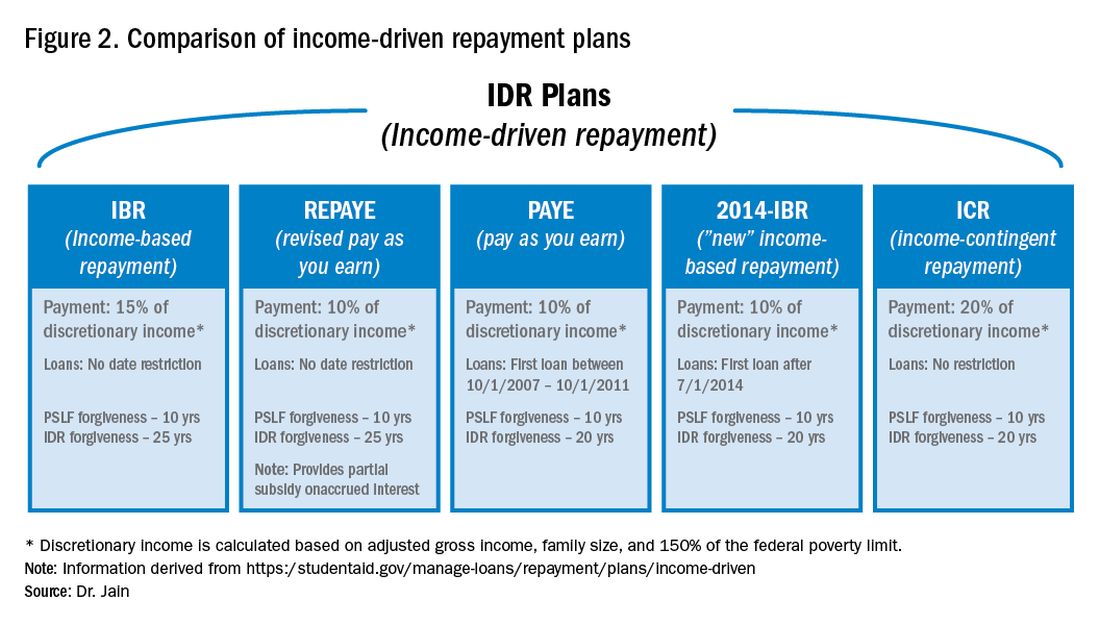

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs

The young gastroenterologist has no shortage of personal finance topics to juggle, ranging from investments, to life and disability coverage, and planning for retirement. But the elephant in the room is student loan management. Average medical student debt today is approximately $240,000, and debt burdens greater than $300,000 are becoming common.1,2 With this staggering amount of debt, it is understandable why student loans are a major source of anxiety. Here, I will provide a brief introduction to student loan management for gastroenterologists.

Student loans: Basic strategy

It is important to distinguish between two major types of loans: private student loans and direct federal loans. With private student loans the best strategy in most cases is to refinance to a lower interest rate. For direct federal loans, however, the decision making is more complex. There are two major approaches to these federal loans – either 1) refinance, or 2) go for public service loan forgiveness (PSLF). See Figure 1 for a flowchart summarizing my general approach to student loan management.

Refinance basics

One potential approach is to refinance your federal loans. Most federal loans today are at a relatively high interest rate of 6%-8%.3 Private refinancing can yield rates in the 3%-5% range, depending on the type of loan and other factors. For a loan balance of $200,000, the savings by refinancing could be approximately $2,000-$10,000 per year in interest alone. However, refinancing your loans with a private company eliminates the possibility of PSLF. Hence, you should only refinance federal loans once you are sure that you will not be pursuing PSLF. You may refinance your private loans anytime since they do not qualify for PSLF. There are multiple companies that provide student loan refinancing. The process can be done online, sometimes in as little as 30 minutes. There is generally little or no cost to refinancing, and many companies even provide a small cash-back incentive to refinance.

PSLF basics

The PSLF program allows borrowers to have the remainder of their direct loans forgiven after 10 years (120 monthly payments) under a qualifying income-driven repayment (IDR) plan.4 Figure 2 shows an overview of the various IDR plans. During the 120 payments, the borrower must work full time for a qualifying employer, which includes a government employer or a not-for-profit 501(c)(3) organization. Loan forgiveness with PSLF is completely tax free. Importantly, the PSLF program only applies to direct federal loans. You can see your federal loan types and balances by visiting https://studentaid.gov/.

To PSLF or not to PSLF?

With direct federal loans, the decision to refinance or go for PSLF is a major fork in the road. PSLF can be a good option for borrowers with long training programs and with high student loan burdens (e.g., loan-to-income ratios of 1:1, 2:1 or higher). By contrast, borrowers with short training programs or relatively small loan burdens may be better off refinancing to a low interest rate and paying off loans quickly. Virtually all institutions that train residents and fellows are qualified government or 501(c)(3) organizations. Hence, a gastroenterology graduate generally will have completed at least 6 out of 10 years of payments by the end of training. Trainees who did a chief resident year or gastroenterology research track may have completed 7 or 8 years of qualifying payments already.

For trainees who are already planning an academic career, PSLF is often a good option. While PSLF can be a nice benefit, I would not advise making a career decision purely based on PSLF. Private practice jobs generally come with substantially higher salaries than academic and government jobs. This salary differential typically more than compensates for the loss of access to PSLF. Hence, I advise trainees to choose the practice setting that is best for their personal and career satisfaction, and then build a student loan management plan around that. The exception may be the trainee who has a very large student loan burden (e.g., loan-to-income ratio of 2:1 or 3:1).

Caveats with PSLF

There have been well publicized concerns about the future of PSLF, including proposals to eliminate or cap the program.5,6 However, most proposed legislation has only recommended changes to PSLF for new borrowers. If you currently have existing federal loans, you would very likely be grandfathered into the existing PSLF terms. All federal master promissory notes since 2007 have cited PSLF as a loan repayment option.7 Hence, eliminating PSLF for existing borrowers seems unlikely since it would be changing the terms of an executed contract.8

There have also been widespread reports of high numbers of borrowers being denied applications for PSLF.9,10 However, the majority of these applicants did not have correct types of loans, had not worked full time for qualifying employers or had not made the full 120 payments.11 Yet some denials have apparently resulted from errors in tracking qualifying payments by FedLoan servicing.12 Therefore it would be prudent to keep your own careful records of all qualifying payments towards PSLF.

The nuclear option: 20- to 25-year IDR-based forgiveness

An additional option allows borrowers to make IDRs for 20-25 years (details in Figure 2) and then having their remaining loan balance forgiven.13 This option is completely independent of PSLF. Borrowers can work full time or part time and can work for any employer, including private employers.

One additional option: NIH loan repayment programs

One additional solution to consider are the NIH Loan Repayment Programs (LRPs). These programs can provide substantial loan repayment (up to $50,000 annually) for trainees and attendings engaged in research that aligns with NIH priorities, including clinical research or health disparities research.14 Notably, the applicant’s research does not have to be NIH sponsored research.

Getting more information

The approach above is a general overview of student loan concepts for gastroenterologists. However, there are countless nuances and tactics that are beyond the scope of this introductory article. I encourage everyone to get additional information and advice when making your own loan management plan. There are many helpful online resources, podcasts, and books discussing the topic. Several companies provide detailed consultation on managing student loans. Such services may cost a few hundred dollars but could potentially save tens of thousands of dollars on student loan costs.

Dr. Jain is assistant professor of medicine, division of gastroenterology & hepatology, department of medicine, University of North Carolina School of Medicine, Chapel Hill. Dr. Jain has no conflicts of interest and no funding source.

References

1. https://nces.ed.gov/programs/digest/d18/tables/dt18_332.45.asp

2. https://www.credible.com/blog/statistics/average-medical-school-debt/

3. https://studentaid.gov/understand-aid/types/loans/interest-rates

4. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

5. https://www.forbes.com/sites/robertfarrington/2019/09/24/how-to-get-your-public-service-loan-forgiveness-qualifying-payments-recounted/#18567f061f5d

6. https://www.cbo.gov/budget-options/2018/54721

7. https://static.studentloans.gov/images/ApplicationAndPromissoryNote.pdf

8. https://www.biglawinvestor.com/pslf-promissory-note/

9. https://bostonstudentloanlawyer.com/scary-stats-for-public-service-loan-forgiveness/

10. https://www.marketwatch.com/story/this-government-loan-forgiveness-program-has-rejected-99-of-borrowers-so-far-2018-09-20

11. https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data

12. https://www.nytimes.com/2019/04/12/your-money/public-service-loan-forgiveness.html

13. https://studentaid.gov/manage-loans/repayment/plans/income-driven

14. https://www.lrp.nih.gov/eligibility-programs