User login

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

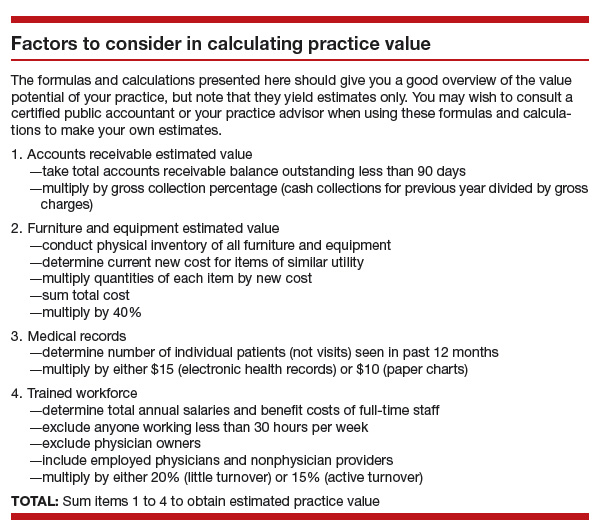

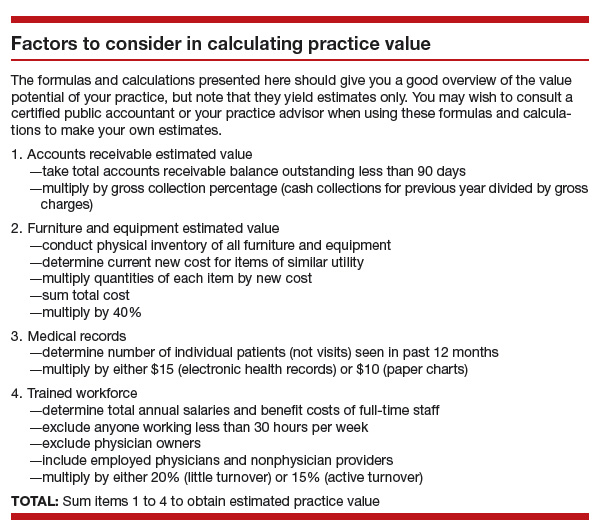

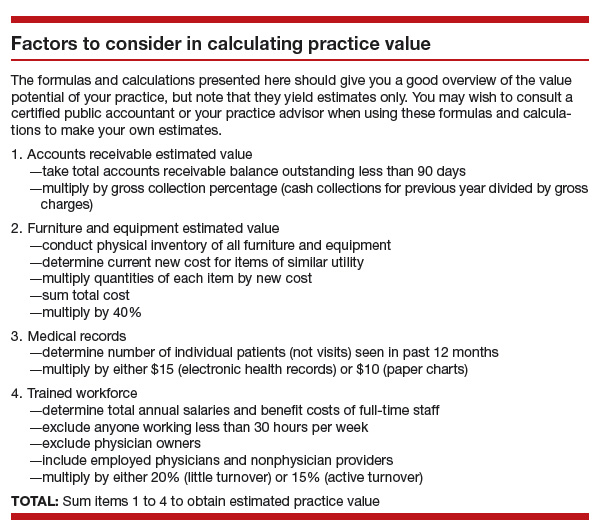

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to rbarbieri@frontlinemedcom.com. Please include your name and the city and state in which you practice.

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to rbarbieri@frontlinemedcom.com. Please include your name and the city and state in which you practice.

For ObGyns, 2 intensely stressful career milestones are the day you start your practice and the day you decide to put it up for sale.

One of us, Dr. Baum, started a practice in 1976. At that time, many clinicians seemed to work right up until the day they died—in mid-examination or with scalpel in hand! Today, clinicians seriously contemplate leaving an active practice at age 55, 60, or, more traditionally, 65.

ObGyns in group practice, even those with only 1 or 2 partners, presumably have in place a well-thought-out and properly drafted contract with buyout and phase-down provisions. For members of a group practice, it is imperative to critically review and discuss contractual arrangements periodically and decide if they make sense as much now as they did at the start. ObGyns who continually revisit their contracts probably have an exit strategy that is fairly self-executing and effective and that will provide the seller with a seamless transition to retirement.

A solo ObGyn who is selling a practice has 3 basic options: find a successor physician, sell to a hospital or to a larger group, or close the practice.

Related article:

ObGyns’ choice of practice environment is a big deal

Preparing your practice for sale

Regardless of who will take over your practice, you need to prepare for its transition.

The most important aspect of selling your practice is knowing its finances and ensuring that they are in order. Any serious buyer will ask to examine your books, see how you are running the business, and assess its vitality and potential growth. Simply, a buyer will want to know where your revenue comes from and where it goes.

Your practice will be attractive to a buyer if it shows a stable or growing revenue base, an attractive payer mix, reasonable overhead, and personal income that is steady if not increasing. If your earning capacity is low or declining, you will need to explain why.

Timing is key

We strongly recommend beginning the process 3 to 5 years before your intended exit.

By starting early, up to 5 years in advance, you can maximize the likelihood that your practice will retain all or most of its value. Moreover, you can use the long lead time to thoroughly explore all available options and find a committed buyer.

Selling a practice can be a complicated affair, and many ObGyns do not have the requisite skills. So much of the success in selling depends on the specifics of the practice, the physician, and the market (the hospital and physician environment).

Identifying potential buyers

Other ObGyns. Recruiting an ObGyn to take over your practice seems to be the best option but can prove very difficult in today’s environment. Many younger clinicians are either joining large groups or becoming hospital employees.

Other physician groups. While working your way down your list of potential buyers, you should also be quietly, subtly, and tactfully assessing other practices, even your competitors, to see if any are candidates for merging with and/or acquiring yours and all your charts, records, and referring physicians.

Hospitals. In today’s health care environment, in which more than half of clinicians are becoming hospital employees, selling to your associated hospital may be a viable option.

Your practice is probably contributing millions of dollars in income to that hospital each year, and of course the hospital would like to maintain this revenue stream. You should consider talking to the hospital’s CEO or medical director.

Hospitals also know that, if you leave and the market cannot absorb the resulting increase in demand for care, patients may go elsewhere, to a competing hospital or outside the community. Rather than lose your market share, a hospital may consider the obvious solution: recruit a replacement ObGyn for your practice.

Your goal here is to negotiate an agreement in which your hospital will recruit a replacement ObGyn, provide financial support, and transition your practice to that ObGyn over a specified period.

The hospital could acquire your practice and either employ you during the transition or provide recruiting support and an income guarantee to help your practice pay the new physician’s salary. Whether to sell or remain independent is often driven by the needs and desires of the recruit. As the vast majority of clinicians coming out of training are seeking employment, in most cases the agreement will require a sale.

Selling to a hospital a few years before your retirement can be a plus. You might find employment a welcome respite from the daunting responsibility of managing your own practice. Life can become much less stressful as you introduce and transition your patients to the new ObGyn. You will be working less, taking fewer calls, and maintaining or even increasing your income, all without the burden of managing the practice.

Read about determining your practice’s value

Putting a monetary value on your practice

After deciding to sell your practice, you need to determine its value. Buying a practice may be the largest financial transaction a young ObGyn will ever make. For a retiring physician, valuation of a practice may reflect a career’s worth of “sweat equity.”

What is your practice worth?

All ObGyns believe their practice is worth far more than any young ObGyn or hospital is willing to pay for it. After all, you have spent a medical lifetime creating, building, and nurturing your practice. You have cared for several thousand patients, who have been loyal and may want to stay with the practice under its new ObGyn. So, how does a retiring physician put a value on his or her practice and then “cast the net” to the marketplace? How do you find a buyer who will pay the asking price and then help the practice make the transition from seller to buyer and continue to serve their patients?

The buyer’s perspective on value. In a pure sense, the value of any asset is what a potential buyer is willing to pay. From a value standpoint, the price that potential buyers are willing to pay varies by the specifics of the situation, regardless of what a valuation or practice appraisal might indicate.

For example, once your plan to retire becomes known, why would a young ObGyn agree to pay X dollars for all your medical records? After all, the potential buyer knows that your existing patients and your referral base will need to seek care from another ObGyn after you leave, and they will likely stay with the practice if they feel they will be treated well by the new clinician.

A hospital may take a similar tack but more often will be willing to pay fair market value for your practice. Hospitals, however, cannot legally pay more than fair market value as determined by an independent appraiser.

Related article:

Four pillars of a successful practice: 1. Keep your current patients happy

Valuation methods

The valuation of any business generally is approached in terms of market, assets, and income.

The market approach usually is taken only with regard to office real estate. Given the lack of reliable and comparable sales information, this approach is seldom used in the valuation of medical practices. If you own your office real estate, a real estate appraiser will establish its fair market value.

In the assets approach, the individual assets of a medical practice are valued on the basis of their current market values. These assets are either tangible or intangible.

Tangible assets can be seen and touched. Furniture, equipment, and office real estate are examples.

The fair market value of used furniture and equipment is most often determined by replacement cost. The value of these items is limited. Usually it starts at 50% of the cost of buying new furniture or equipment of the same utility. From there, the value is lowered on the basis of the age and condition of the items.

Often, the market value of major ObGyn office equipment, such as a DXA (dual-energy x-ray absorptiometry) scanner, is based on similar items for sale or recently sold in the used secondary equipment market.

Tangible assets may include accounts receivable (A/R). A/R represents uncollected payment for work performed. Most buyers want to avoid paying for A/R and assuming the risk of collections. Generally, you should expect to retain your A/R and pay a small or nominal fee to have the buyer handle the collections after you have retired.

Intangible assets are not physical. Examples include the physician’s name, phone number, reputation, referral base, trained staff, and medical records—in other words, what gets patients to keep coming back. Most physicians value these goodwill or “blue-sky” assets highly. Today, unfortunately, most sellers are unable to reap any financial benefit from their intangible assets.

The income approach is based on the premise that the value of any business is in the income it generates for its owner. In simple terms, value in the income approach is a multiple of the cash the business generates after expenses.

Read important keys to transitioning the practice

Transitioning the practice: Role of the seller and the buyer

First and very important is the contract agreement regarding the overlap period, when both the exiting ObGyn and the new ObGyn are at the practice. We suggest making the overlap a minimum of 6 months and a maximum of 1 year. During this period, the exiting physician can introduce the incoming physician to the patients. A face-to-face introduction can amount to an endorsement, which can ease a patient’s mind and help her decide to take on the new ObGyn and philosophy rather than search elsewhere for obstetric and gynecologic care. The new ObGyn also can use the overlap period to become familiar and comfortable with the staff and learn the process for physician and staff management of case flow, from scheduling and examination to insurance and patient follow-up.

We suggest that the exiting ObGyn send a farewell/welcome letter to patients and referring physicians. The letter should state the exiting ObGyn’s intention to leave (or retire from) the practice and should introduce the ObGyn who will be taking over.

The exiting ObGyn should also take the new ObGyn to meet the physicians who have been providing referrals over the years. We suggest visiting each referring physician’s office to make the introduction. Another good way to introduce a new ObGyn to referring physicians and other professionals—endocrinologists, cardiologists, nurses, pharmaceutical representatives—is to host an open house at your practice. Invite the staff members of the referring physicians as well, since they can be invaluable in making referrals.

We recommend that the exiting ObGyn spend the money to update all the practice’s stationery, brochures, and print materials and ensure they look professional. Note that it is not acceptable to place the new ObGyn’s name under the exiting ObGyn’s name. If the practice has a website, introduce the new physician there and make any necessary updates regarding office hours and accepted insurance plans.

If the exiting ObGyn’s practice lacks a robust Internet and social media presence, the new ObGyn should establish one. We recommend setting up an interactive website that patients can use to make appointments and pay bills. The website should have an email component that can be used to ask questions, raise concerns, and get answers. We also recommend opening Facebook, YouTube, and Twitter accounts for the practice and being active on these social media.

In our experience, smoothly transitioning practices can achieve patient retention rates as high as 90% to 95%. For practices without a plan, however, these rates may be as low as 50%, or worse. Therefore, work out a plan in advance, and include the steps described here, so that on arrival the new ObGyn can hit the ground running.

Acquiring a successful medical practice is doable and offers many advantages, such as autonomy and the ability to make business decisions affecting the practice. Despite all the changes happening in health care, we still think this is the best way to go.

Related article:

Four pillars of a successful practice: 4. Motivate your staff

Bottom line

Selling an ObGyn practice can be a daunting process. However, deciding to sell your practice, performing the valuation, and ensuring a smooth transition are part and parcel of making the transfer a success, equitable for both the buyer and the seller.

Share your thoughts! Send your Letter to the Editor to rbarbieri@frontlinemedcom.com. Please include your name and the city and state in which you practice.

IN THIS ARTICLE