User login

Hospitalists often are involved in the care of a surgical patient. Reimbursement for surgical procedures includes payment for pre-, intra-, and post-operative care.

Knowing the billing and coding responsibilities apart from those of the surgeon is imperative for the hospitalist’s accurate charge capture. There are several critical misconceptions in this regard:

- Hospitalists cannot bill for services when involved in a surgical case;

- Surgeons are not responsible for inpatient care if the patient is stable and does not require additional inpatient post-op visits; and

- Modifiers are not required for hospitalist claims unless the hospitalist reports under the same tax identification number as the surgeon.

Determine Global Period

Procedures are categorized as major or minor surgery. A global period is assigned to each procedure code, designating post-operative periods of zero, 10, or 90 days. Physician services during this global period are considered part of the packaged payment and not separately reimbursed.

The global period for any given CPT code can be identified in the Medicare Physician Fee Schedule and accessed at www.cms.hhs.gov/PfsLookup. In addition to zero, 10, and 90 days, services can be noted with:

- XXX, indicating the global period concept does not apply; or

- ZZZ, indicating an “add-on” procedure that must always be reported with the relevant primary procedure code; “add-on” procedures assume the global period of the primary procedure.

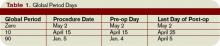

Major surgery routinely is allotted 90-day global periods. Therefore, the surgeon is responsible for the patient and must provide all related care one day prior to the surgery forward thru 90 postoperative days at no additional charge. Minor surgery, including endoscopy, has zero or 10-day postoperative periods, bundling all services on the surgical day only, or the surgical day and the subsequent 10 days, respectively (see Table 1, p. above).

The Surgeon Defined

Any qualified physician able to perform “surgical” services within his scope of practice is considered a “surgeon” for billing purposes. For example, a pulmonologist, or primary care physician, must meet the surgical billing and documentation requirements when performing bronchoscopies or uncomplicated incision-and-drainage services, respectively.

Surgical services easily are identified as any code included in range 20000-69999. This code series includes major, minor, and endoscopic procedures. The “surgeon” and all physicians in the same group practice (i.e., reporting services under the same tax identification number) with the same specialty designation must adhere to the global period billing rules.

Alternately, physicians with different specialty designations in the same group practice (e.g., multispecialty group that reports services under the same tax identification number) or different group practices can perform and separately report medically necessary services during the surgeon’s global period, as long as a formal (mutually agreed upon) transfer of care did not occur. Information on physician specialty designations is available at www.highmarkmedicareservices.com/partb/refman/appendix-d.html.

Package Components

The following services are included in the surgeon’s packaged payment:

- Preoperative visits after the decision for surgery is made beginning one day prior to surgery;

- All additional post-operative medical or surgical services provided by the surgeon related to complications, but not require additional trips to the operating room;

- Post-operative visits by the surgeon related to recovery from surgery, including but not limited to dressing changes; local incisional care; removal of cutaneous sutures and staples; line removals; changes and removal of tracheostomy tubes; and discharge services; and

- Post-operative pain management provided by the surgeon.

Services not included are:

- The initial consultation or evaluation of the problem by the surgeon to determine the need for surgery. Append modifier 57 to this visit if provided the day before or day of major surgery to alert the payer that the service resulted in the decision for surgery. Append modifier 25 to this visit if provided the day of minor surgery;

- Services of other physicians except where the other physicians are providing coverage for the surgeon or agree on a transfer of care. This agreement may be in the form of a letter or an annotation in the discharge summary, hospital record, or ASC record;

- Post-operative visits by the surgeon unrelated to the diagnosis for which the surgical procedure is performed, unless the visits occur due to complications of the surgery. These services only are payable after the patient has been discharged from the hospitalization in which the surgery occurred. Append modifier 24 to these unrelated post-op visits;

- Diagnostic tests and procedures, including diagnostic radiological procedures;

- Clearly distinct surgical procedures during the post-operative period that do not result in repeat operations or treatment for complications;

- Treatment for post-operative complications that require a return trip to the operating room, catheterization lab, or endoscopy suite;

- Immunosuppressive therapy for organ transplants; and

- Critical care services (CPT codes 99291 and 99292) unrelated to the surgery in which a seriously injured or burned patient is critically ill and requires constant attendance of the surgeon. Append modifier 24 to these unrelated critical care services (see Table 2, above).

Payer Variations

While Medicare does not require modifier usage by hospitalists providing medically necessary services on surgical cases, some private payers do. Their electronic claim systems may not differentiate services by non-surgical specialists, requiring all physicians to append the appropriate modifier depending on the reason and timing of the service (see “Key Modifiers” below). TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is on the faculty of SHM’s inpatient coding course.

Hospitalists often are involved in the care of a surgical patient. Reimbursement for surgical procedures includes payment for pre-, intra-, and post-operative care.

Knowing the billing and coding responsibilities apart from those of the surgeon is imperative for the hospitalist’s accurate charge capture. There are several critical misconceptions in this regard:

- Hospitalists cannot bill for services when involved in a surgical case;

- Surgeons are not responsible for inpatient care if the patient is stable and does not require additional inpatient post-op visits; and

- Modifiers are not required for hospitalist claims unless the hospitalist reports under the same tax identification number as the surgeon.

Determine Global Period

Procedures are categorized as major or minor surgery. A global period is assigned to each procedure code, designating post-operative periods of zero, 10, or 90 days. Physician services during this global period are considered part of the packaged payment and not separately reimbursed.

The global period for any given CPT code can be identified in the Medicare Physician Fee Schedule and accessed at www.cms.hhs.gov/PfsLookup. In addition to zero, 10, and 90 days, services can be noted with:

- XXX, indicating the global period concept does not apply; or

- ZZZ, indicating an “add-on” procedure that must always be reported with the relevant primary procedure code; “add-on” procedures assume the global period of the primary procedure.

Major surgery routinely is allotted 90-day global periods. Therefore, the surgeon is responsible for the patient and must provide all related care one day prior to the surgery forward thru 90 postoperative days at no additional charge. Minor surgery, including endoscopy, has zero or 10-day postoperative periods, bundling all services on the surgical day only, or the surgical day and the subsequent 10 days, respectively (see Table 1, p. above).

The Surgeon Defined

Any qualified physician able to perform “surgical” services within his scope of practice is considered a “surgeon” for billing purposes. For example, a pulmonologist, or primary care physician, must meet the surgical billing and documentation requirements when performing bronchoscopies or uncomplicated incision-and-drainage services, respectively.

Surgical services easily are identified as any code included in range 20000-69999. This code series includes major, minor, and endoscopic procedures. The “surgeon” and all physicians in the same group practice (i.e., reporting services under the same tax identification number) with the same specialty designation must adhere to the global period billing rules.

Alternately, physicians with different specialty designations in the same group practice (e.g., multispecialty group that reports services under the same tax identification number) or different group practices can perform and separately report medically necessary services during the surgeon’s global period, as long as a formal (mutually agreed upon) transfer of care did not occur. Information on physician specialty designations is available at www.highmarkmedicareservices.com/partb/refman/appendix-d.html.

Package Components

The following services are included in the surgeon’s packaged payment:

- Preoperative visits after the decision for surgery is made beginning one day prior to surgery;

- All additional post-operative medical or surgical services provided by the surgeon related to complications, but not require additional trips to the operating room;

- Post-operative visits by the surgeon related to recovery from surgery, including but not limited to dressing changes; local incisional care; removal of cutaneous sutures and staples; line removals; changes and removal of tracheostomy tubes; and discharge services; and

- Post-operative pain management provided by the surgeon.

Services not included are:

- The initial consultation or evaluation of the problem by the surgeon to determine the need for surgery. Append modifier 57 to this visit if provided the day before or day of major surgery to alert the payer that the service resulted in the decision for surgery. Append modifier 25 to this visit if provided the day of minor surgery;

- Services of other physicians except where the other physicians are providing coverage for the surgeon or agree on a transfer of care. This agreement may be in the form of a letter or an annotation in the discharge summary, hospital record, or ASC record;

- Post-operative visits by the surgeon unrelated to the diagnosis for which the surgical procedure is performed, unless the visits occur due to complications of the surgery. These services only are payable after the patient has been discharged from the hospitalization in which the surgery occurred. Append modifier 24 to these unrelated post-op visits;

- Diagnostic tests and procedures, including diagnostic radiological procedures;

- Clearly distinct surgical procedures during the post-operative period that do not result in repeat operations or treatment for complications;

- Treatment for post-operative complications that require a return trip to the operating room, catheterization lab, or endoscopy suite;

- Immunosuppressive therapy for organ transplants; and

- Critical care services (CPT codes 99291 and 99292) unrelated to the surgery in which a seriously injured or burned patient is critically ill and requires constant attendance of the surgeon. Append modifier 24 to these unrelated critical care services (see Table 2, above).

Payer Variations

While Medicare does not require modifier usage by hospitalists providing medically necessary services on surgical cases, some private payers do. Their electronic claim systems may not differentiate services by non-surgical specialists, requiring all physicians to append the appropriate modifier depending on the reason and timing of the service (see “Key Modifiers” below). TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is on the faculty of SHM’s inpatient coding course.

Hospitalists often are involved in the care of a surgical patient. Reimbursement for surgical procedures includes payment for pre-, intra-, and post-operative care.

Knowing the billing and coding responsibilities apart from those of the surgeon is imperative for the hospitalist’s accurate charge capture. There are several critical misconceptions in this regard:

- Hospitalists cannot bill for services when involved in a surgical case;

- Surgeons are not responsible for inpatient care if the patient is stable and does not require additional inpatient post-op visits; and

- Modifiers are not required for hospitalist claims unless the hospitalist reports under the same tax identification number as the surgeon.

Determine Global Period

Procedures are categorized as major or minor surgery. A global period is assigned to each procedure code, designating post-operative periods of zero, 10, or 90 days. Physician services during this global period are considered part of the packaged payment and not separately reimbursed.

The global period for any given CPT code can be identified in the Medicare Physician Fee Schedule and accessed at www.cms.hhs.gov/PfsLookup. In addition to zero, 10, and 90 days, services can be noted with:

- XXX, indicating the global period concept does not apply; or

- ZZZ, indicating an “add-on” procedure that must always be reported with the relevant primary procedure code; “add-on” procedures assume the global period of the primary procedure.

Major surgery routinely is allotted 90-day global periods. Therefore, the surgeon is responsible for the patient and must provide all related care one day prior to the surgery forward thru 90 postoperative days at no additional charge. Minor surgery, including endoscopy, has zero or 10-day postoperative periods, bundling all services on the surgical day only, or the surgical day and the subsequent 10 days, respectively (see Table 1, p. above).

The Surgeon Defined

Any qualified physician able to perform “surgical” services within his scope of practice is considered a “surgeon” for billing purposes. For example, a pulmonologist, or primary care physician, must meet the surgical billing and documentation requirements when performing bronchoscopies or uncomplicated incision-and-drainage services, respectively.

Surgical services easily are identified as any code included in range 20000-69999. This code series includes major, minor, and endoscopic procedures. The “surgeon” and all physicians in the same group practice (i.e., reporting services under the same tax identification number) with the same specialty designation must adhere to the global period billing rules.

Alternately, physicians with different specialty designations in the same group practice (e.g., multispecialty group that reports services under the same tax identification number) or different group practices can perform and separately report medically necessary services during the surgeon’s global period, as long as a formal (mutually agreed upon) transfer of care did not occur. Information on physician specialty designations is available at www.highmarkmedicareservices.com/partb/refman/appendix-d.html.

Package Components

The following services are included in the surgeon’s packaged payment:

- Preoperative visits after the decision for surgery is made beginning one day prior to surgery;

- All additional post-operative medical or surgical services provided by the surgeon related to complications, but not require additional trips to the operating room;

- Post-operative visits by the surgeon related to recovery from surgery, including but not limited to dressing changes; local incisional care; removal of cutaneous sutures and staples; line removals; changes and removal of tracheostomy tubes; and discharge services; and

- Post-operative pain management provided by the surgeon.

Services not included are:

- The initial consultation or evaluation of the problem by the surgeon to determine the need for surgery. Append modifier 57 to this visit if provided the day before or day of major surgery to alert the payer that the service resulted in the decision for surgery. Append modifier 25 to this visit if provided the day of minor surgery;

- Services of other physicians except where the other physicians are providing coverage for the surgeon or agree on a transfer of care. This agreement may be in the form of a letter or an annotation in the discharge summary, hospital record, or ASC record;

- Post-operative visits by the surgeon unrelated to the diagnosis for which the surgical procedure is performed, unless the visits occur due to complications of the surgery. These services only are payable after the patient has been discharged from the hospitalization in which the surgery occurred. Append modifier 24 to these unrelated post-op visits;

- Diagnostic tests and procedures, including diagnostic radiological procedures;

- Clearly distinct surgical procedures during the post-operative period that do not result in repeat operations or treatment for complications;

- Treatment for post-operative complications that require a return trip to the operating room, catheterization lab, or endoscopy suite;

- Immunosuppressive therapy for organ transplants; and

- Critical care services (CPT codes 99291 and 99292) unrelated to the surgery in which a seriously injured or burned patient is critically ill and requires constant attendance of the surgeon. Append modifier 24 to these unrelated critical care services (see Table 2, above).

Payer Variations

While Medicare does not require modifier usage by hospitalists providing medically necessary services on surgical cases, some private payers do. Their electronic claim systems may not differentiate services by non-surgical specialists, requiring all physicians to append the appropriate modifier depending on the reason and timing of the service (see “Key Modifiers” below). TH

Carol Pohlig is a billing and coding expert with the University of Pennsylvania Medical Center, Philadelphia. She also is on the faculty of SHM’s inpatient coding course.